UK Steel Market 2025: Importers Poised for Growth Amid Domestic Decline

The UK steel industry is undergoing a profound transformation, creating both challenges and golden opportunities for international suppliers. As domestic production shrinks and demand begins to recover, importers are set to play an even bigger role in shaping the British steel market.

Britain’s Steel Supply Gap: A Growing Opportunity for Importers

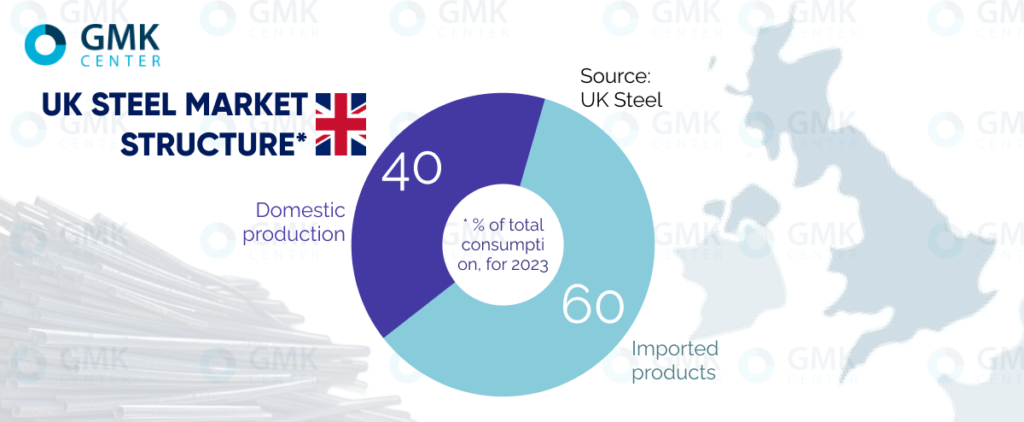

The UK’s reliance on steel imports is no secret. In 2023, the country produced 5.6 million tons of steel but consumed 7.6 million tons, leaving a supply gap of 4.46 million tons filled by foreign suppliers—chiefly India’s Tata Steel and China’s Jingye Group.

This gap isn’t solely the result of British steel being exported. The UK’s domestic steel mills offer a narrow product range, creating significant supply shortfalls, particularly in specialized segments like cold-rolled flat-rolled steel used in automotive and appliance manufacturing. These constraints have driven the UK’s Trade Remedies Authority (TRA) to lift import quotas on key products to avoid consumer price hikes—a move even supported by domestic producers like Tata Steel.

Domestic Production Decline Accelerates

The British steel sector hit a major turning point in 2024 when Tata Steel permanently shut down its blast furnaces at Port Talbot, the country’s largest steel plant. This move slashed national steel production by 29% to just 4 million tons, driving steel imports up by 25.8% year-on-year to 6.2 million tons.

The Port Talbot closure is part of a broader government-backed strategy to decarbonize the industry and shift towards electric arc furnace (EAF) technology using domestically sourced scrap metal. With the UK generating around 11 million tons of scrap annually but consuming just 2.6 million tons locally, there’s significant untapped potential to grow green, self-sufficient steel production.

A £1.35 billion electric arc furnace facility is scheduled to replace the Port Talbot blast furnaces, set for completion by the end of 2027. The UK government is investing £500 million into this project as part of its green transformation push.

Uncertainty Looms Over British Steel’s Future

Meanwhile, the future of British Steel’s Scunthorpe plant remains in limbo. Chinese owner Jingye Group rejected a £500 million UK government offer to co-finance the EAF conversion, arguing the £2 billion cost requires greater state support.

Three options are now on the table:

- Immediate Closure: Shutting down blast furnaces without building a replacement.

- Conditional Conversion: Shutting down pig iron production and constructing an EAF if the government matches Jingye’s investment.

- Prolonged Operations: Continuing blast furnace operations indefinitely while delaying closure.

Prime Minister Keir Starmer has hinted at possible nationalization if no funding compromise is reached, but this scenario seems unlikely due to the UK’s strict decarbonization commitments.

Either way, Scunthorpe’s blast furnaces are expected to cease operations this year, tightening the domestic steel supply even further as consumption begins to rebound.

Steel Demand Recovery on the Horizon

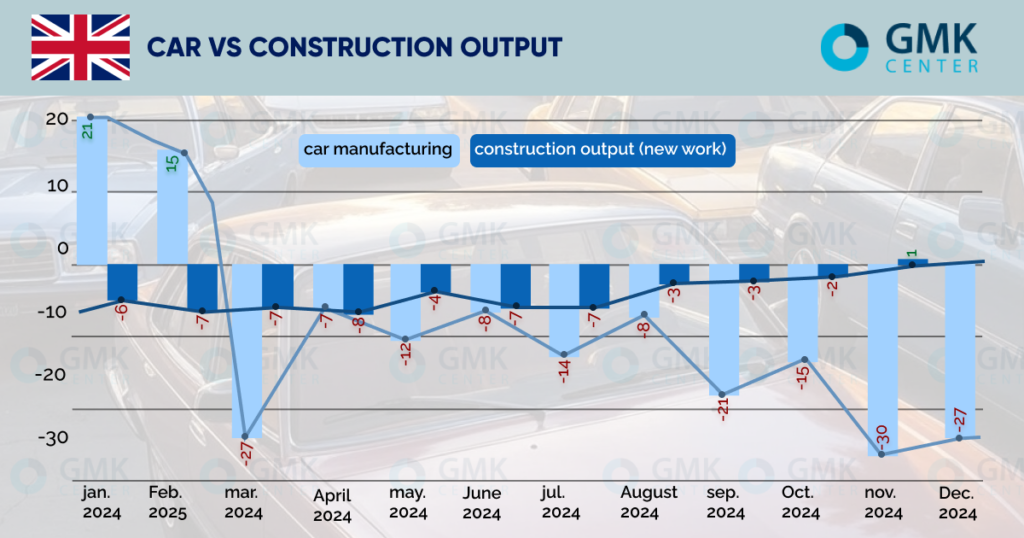

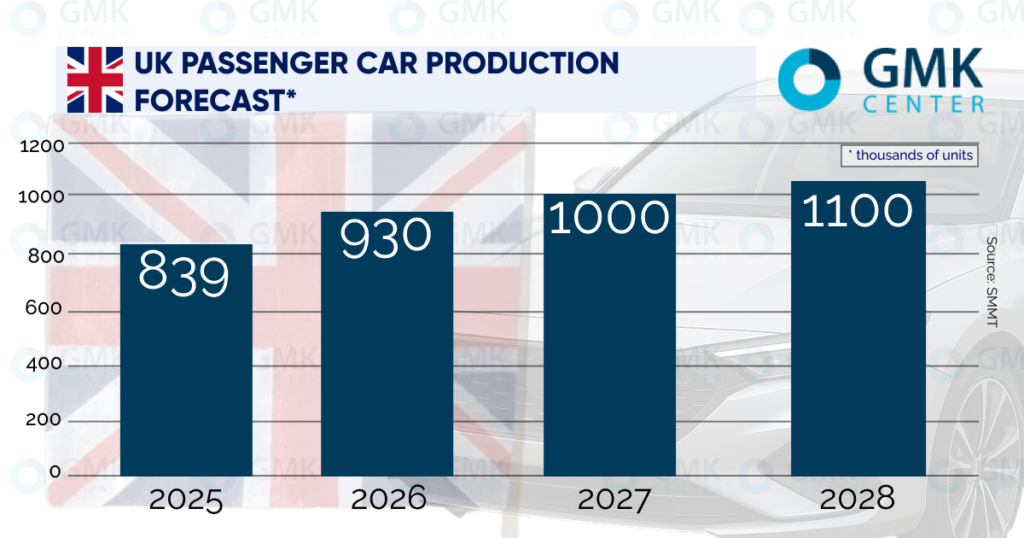

The outlook for UK steel demand is bright. According to the Society of Motor Manufacturers and Traders (SMMT), UK car production is forecast to grow 7.6% in 2025, with steady long-term growth expected. The Construction Products Association (CPA) predicts 2.1% growth in construction activity in 2025 and 4% in 2026, driven largely by private housing, which is expected to grow 6% in 2025 and 8% in 2026.

Additionally, the UK’s offshore wind energy expansion under the Clean Power Plan is set to require 25 million tons of steel by 2050, averaging 1 million tons per year. British mills currently produce only half of the required product range, leaving an annual import potential of 500,000 tons, valued at approximately £420 million per year.

Protectionism Remains, But Importers Have Space to Grow

Despite growth opportunities, the UK government continues to prioritize domestic suppliers for public sector projects. In 2024, 70% of government steel purchases were sourced locally, and Network Rail relies on domestic mills for 90% of its steel needs.

Further localization is expected under the UK’s Procurement Act and National Procurement Policy Statement (NPPS), which strengthen the role of domestic manufacturers in government contracts.

However, the private sector remains wide open for importers, and tariff protections on 15 categories of steel products will stay in place until July 2026. Yet, the British pound’s relative strength against the US dollar and a consistent gap between domestic supply and demand continue to provide a competitive edge for overseas suppliers.

Europe’s Electricity Prices Plunge: A Power Market in Transition

April 2025 has reshaped Europe’s energy landscape—plummeting electricity prices, record renewable generation, and a surprising blackout across Spain and Portugal have signaled that the continent’s energy system is entering a volatile yet opportunity-filled phase.

📉 Electricity Prices Dive Across Europe

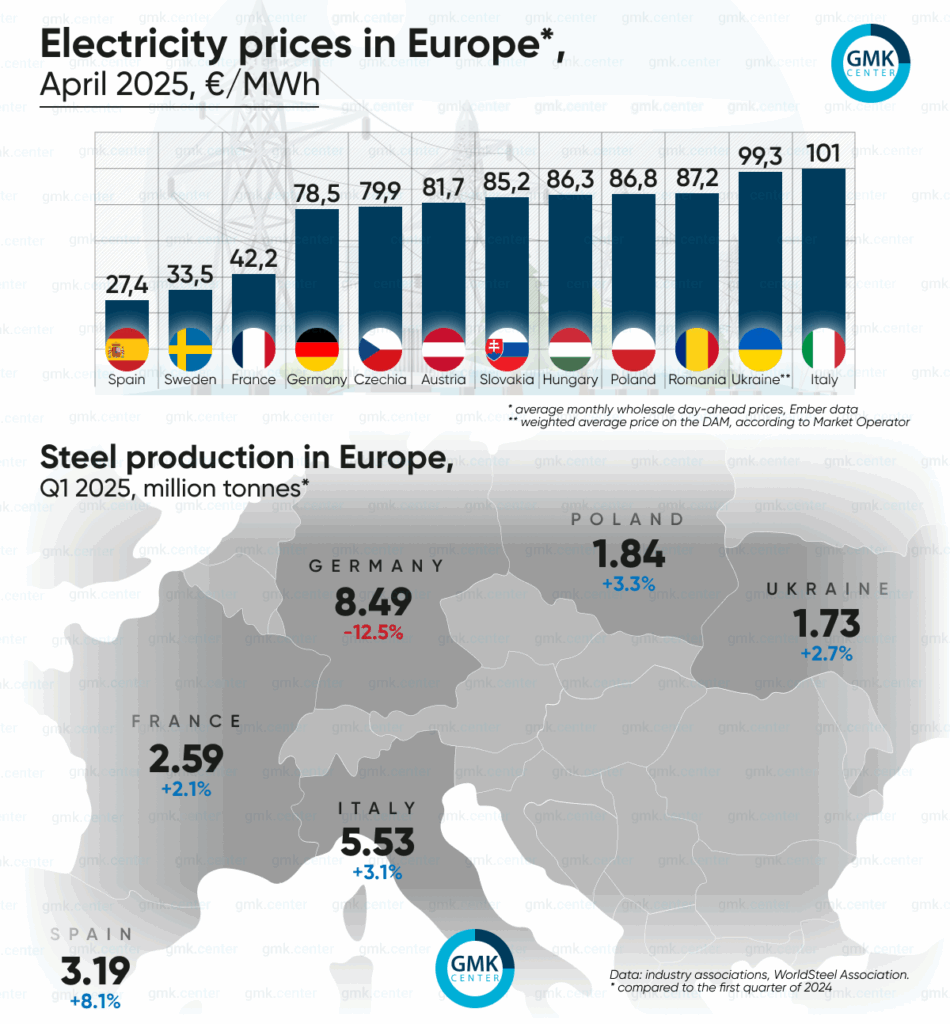

The latest data from Ember shows that average monthly wholesale day-ahead electricity prices in April saw significant declines across major European countries:

- 🇮🇹 Italy: €101.01/MWh (-16% month-on-month)

- 🇫🇷 France: €42.21/MWh (-45%)

- 🇩🇪 Germany: €78.51/MWh (-15%)

- 🇪🇸 Spain: €27.44/MWh (-48%)

- 🇸🇪 Sweden: €33.46/MWh (-18.4%)

Central and Eastern Europe followed the trend:

- 🇵🇱 Poland: €81.7/MWh

- 🇸🇰 Slovakia: €85.15/MWh

- 🇭🇺 Hungary: €86.35/MWh

The drop in prices is largely attributed to strong renewable energy production (particularly solar) and a significant reduction in electricity demand. During the first half of April, prices in most markets stayed below €75/MWh, with some countries like Portugal even recording hourly negative prices.

⚡ Renewable Boom: A Double-Edged Sword?

While renewables like solar and wind provided record-breaking generation, the reliance on variable sources has also exposed system vulnerabilities. The most striking incident was the April 28 blackout in Spain and Portugal, which paralyzed banking systems, communication networks, and critical infrastructure.

Although Spanish authorities ruled out a cyberattack, the exact cause is still under investigation. Experts believe that the rapid integration of renewables, paired with the closure of coal, gas, and nuclear plants, has significantly reduced grid balancing capabilities, making blackouts more likely unless grid infrastructure is quickly upgraded.

🔥 Gas Prices Tumble: A Silver Lining

Natural gas prices, which heavily influence European electricity markets, also fell sharply in April. Dutch TTF gas futures dropped from €42.65/MWh at the beginning of the month to €32.30/MWh by April 30.

Why the drop?

- The strengthening euro, boosted by financial market volatility and U.S. tariff policies.

- A slump in LNG demand from China, impacted by Trump-era tariffs.

- Germany’s decision to ease its natural gas storage targets, which relieved some supply pressures.

Despite this price relief, European gas storage levels remain low—at just 39.9% as of May 1, compared to 62.7% a year earlier. France has aggressively replenished its reserves, outpacing Germany and Italy, but storage remains a critical focus.

💣 The Russian Gas Exit Strategy

In a major policy move, the European Commission proposed the REPowerEU Roadmap, which sets a legal timeline to phase out all Russian gas and LNG imports.

- No new Russian gas contracts allowed after 2025.

- Existing long-term contracts must end by 2027.

The EU aims to pivot toward LNG supplies from the U.S., Qatar, Canada, and African nations, but this transition hinges on securing hundreds of additional LNG cargoes to maintain stable market conditions.

🌍 Ukraine’s Electricity Market: Exports Surge

Ukraine saw a 15.7% month-on-month drop in its day-ahead electricity prices, reaching €99.3/MWh. Electricity demand also shrank by over 10% in April, while exports nearly doubled compared to March.

Key export destinations:

- 🇭🇺 Hungary: 38%

- 🇲🇩 Moldova: 35%

With increased export capacity of up to 650 MW, Ukraine is becoming a more active player in the European power market, exporting to Slovakia, Romania, Hungary, Poland, and Moldova. As Energoatom carries out scheduled maintenance on nuclear units, Ukraine is smartly leveraging the seasonally higher springtime export potential.

🚨 What’s Next? Key Trends to Watch

Here are the critical developments shaping Europe’s energy future:

- Blackout Risk:

As coal and nuclear plants are phased out, grids must rapidly invest in storage and balancing capacity to handle renewable surges. - Renewables vs. Reliability:

Spain’s energy system is under the spotlight. With plans to shut down all nuclear reactors between 2027 and 2035, can the grid remain stable on renewables alone? - Gas Storage Race:

Europe’s gas storage levels are worryingly low compared to last year. This could create price volatility later in 2025, especially if the continent faces supply bottlenecks or an unexpectedly harsh winter. - The Russian Gas Divorce:

The EU’s decisive push to cut Russian energy ties will force deeper cooperation with LNG-exporting nations and possibly redefine Europe’s long-term energy security strategy. - The Ukraine Factor:

Ukraine’s growing role in cross-border electricity trade is becoming strategically important for both the EU and Ukraine’s economy, especially as the country continues to navigate energy infrastructure challenges amid conflict.

UK Steel Industry Faces Major Shock: New 50% US Tariff Threatens Exports

The UK steel industry is bracing for a significant blow as President Trump’s administration prepares to introduce a new 50% import tariff on all steel and aluminium entering the United States. This unexpected move is set to replace the existing 25% tariff imposed earlier this year and could have severe consequences for UK steelmakers.

The Rising Tension

Despite an agreement announced on 8 May between the UK Prime Minister and President Trump to remove the import tax on UK steel, the initial 25% tariff remains in place as the finer details are still being negotiated. With the sudden announcement of the tariff hike, UK steelmakers now fear immediate cancellation of orders—some of which may already be in transit to the US.

The US is the second largest export market for UK steel, valued at approximately £400 million annually and accounting for 9% of total UK steel exports by value. Losing access or facing harsher tariffs in this crucial market would deeply affect the sector.

Gareth Stace, Director-General of UK Steel, expressed serious concerns:

“The announcement that US steel tariffs could jump up to 50% on Wednesday is yet another body blow for all UK steelmakers in this torrid time. UK steel companies are this morning fearful that orders will now be cancelled, some of which are likely being shipped across the Atlantic as we speak.”

He emphasized the urgent need for the UK government to finalize the tariff elimination agreement and shield UK steelmakers from this disruptive escalation.

A Market Under Pressure

The global steel market is already battling excess capacity and shrinking demand, especially from China. In 2024, the global steel overcapacity stood at 602 million tonnes (Mt) and is expected to balloon to 721 Mt by 2027. Capacity expansions in Southeast Asia and the Middle East, often state-funded and reliant on high-emission blast furnaces, continue despite weak local demand.

Meanwhile, the UK’s steel imports are rapidly increasing, rising from 60% in 2022 to 65% in 2024, predominantly driven by non-EU countries like India, Vietnam, China, South Korea, Turkey, and Algeria. These markets are also absorbing large amounts of surplus steel from China, further flooding the international steel trade.

The UK’s domestic safeguards, inherited from the EU post-Brexit, are under strain. These safeguards, which expire in June 2026, were originally intended to protect the UK market from being overwhelmed by trade diversions triggered by the US tariffs. However, as these quotas have been liberalized over the years while UK demand has contracted, even a small portion of diverted steel could now swamp the UK market.

Industry Snapshot

The UK steel sector in 2024:

- Produced 4 million tonnes of crude steel, covering about 30% of national demand.

- Supported 36,800 direct jobs and another 46,000 in supply chains.

- Contributed £1.7 billion to the UK’s GVA and supported an additional £2.2 billion.

- Contributed £3.1 billion to the UK’s trade balance.

- Showcased high sustainability with 96% of steel used in UK construction and infrastructure being recovered and recycled.

Looking Ahead

The current situation underscores the fragile balance of international trade, especially for industries like steel that are highly exposed to global supply and demand shocks. The UK government now faces intense pressure to resolve the tariff negotiations swiftly and to reinforce domestic safeguards against a looming flood of cheap imports.

For UK steelmakers, the next few weeks will be pivotal in determining whether they can continue serving the US market or face a significant commercial setback.

✍️ Final Thoughts

As the UK steel industry transitions towards greener production methods and domestic mills temporarily cut capacity, importers are well-positioned to capture a larger share of the British market.

With demand recovery in automotive, construction, and renewable energy sectors, the UK is becoming an increasingly attractive destination for steel exporters. While protectionist measures remain, the opportunities for importers are clear—and now is the time to seize them.

April 2025 wasn’t just about falling electricity prices—it was a pivotal month highlighting the complex balancing act between affordability, sustainability, and reliability in Europe’s energy transformation.

The question remains: Can Europe build an energy system that’s green, resilient, and independent, all at the same time?

The next few years will provide the answer.

About LUX METAL

At LUX METAL, we specialize in customized metal solutions and precision steel fabrication to meet your project’s unique demands. Our advanced facilities offer:

- CNC Machining

- Laser Cutting

- Sheet Rolling

- Welding

- Stainless Steel Fabrication

- Customized Metal Products

Whether you are building large-scale infrastructure, developing industrial equipment, or creating bespoke metal designs, LUX METAL is your trusted partner for reliability, accuracy, and innovation.

👉 Visit us: www.luxmetalgroup.com

👉 Learn more: LUX METAL Services