📐 What Is a Square Billet?

A square billet is a semi-finished steel product with a square cross-section, typically ranging from 100 mm to 150 mm in size and several meters in length. It’s produced during the initial stages of steel processing, either through continuous casting or rolling.

Unlike slabs (which are flat) and blooms (which are thicker and larger), billets are designed for rolling into long products, such as bars, rods, and wires. Their uniform geometry, consistent composition, and mechanical strength make them ideal for further processing.

Steel Billet Described

Steel billets are semi-finished steel products manufactured from molten steel, typically in a square or rectangular form. Before they are usable in manufacturing or construction, they must be further processed — forged, rolled, or formed into the final shapes required.

Square Steel Billet

As the name suggests, square billets have a uniform width and thickness (e.g., 100 x 100 mm to 150 x 150 mm) and are typically 6 to 12 meters in length. They are solid, durable, and ideal for heat processing, rolling, and fabrication, making them popular across many industrial sectors.

✅ Advantages of Square Billets

Square billets offer multiple advantages that make them a preferred choice in various sectors of the steel industry:

1. High Strength & Durability

Steel billets are known for their high tensile strength and toughness, ensuring that products made from them can endure significant mechanical stress and environmental conditions.

2. Dimensional Consistency

Their standardized dimensions ensure easy integration into automated rolling mills and fabrication processes, reducing time and production errors.

3. Versatility

Square billets can be transformed into a wide variety of steel products, including rebars, flat bars, square bars, angles, and channels.

4. Cost Efficiency

Billets are relatively economical as raw materials since they can be produced in large volumes and stored or transported efficiently.

5. Recyclability

Billets can be made from recycled scrap steel, promoting sustainable steel production and reducing the carbon footprint of manufacturing.

🏗️ Common Applications of Square Billets

Because of their mechanical properties and dimensional adaptability, square billets are used as a precursor to many downstream steel products, such as:

- Reinforcement bars (rebars) used in construction

- Wire rods for manufacturing mesh, cables, and fencing

- Square and round bars for fabrication industries

- Steel angles and channels for structural frameworks

- Machinery parts in automotive, shipbuilding, and heavy equipment

These applications highlight the critical role billets play in infrastructure, energy, automotive, and industrial development.

⚙️ How Square Billets Are Made: The Production Process

The production of square billets follows a well-controlled metallurgical process to ensure consistency, quality, and performance. Below is a breakdown of the stages involved:

1. Melting of Raw Materials

Steel is produced by melting raw materials such as scrap metal, iron ore, or direct reduced iron (DRI) in blast furnaces or electric arc furnaces (EAFs). Alloying elements such as manganese, silicon, and carbon are added to achieve the desired composition.

2. Continuous Casting

Once the steel is in molten form, it’s cast into billets using a continuous casting machine. The molten steel is poured into a water-cooled mold where it begins to solidify into a square cross-section.

This process ensures homogeneity and structural integrity in the billets and is more efficient than traditional ingot casting.

3. Cooling and Cutting

After exiting the mold, the semi-solid billet is rapidly cooled with water sprays to enhance its structural properties. It is then cut into desired lengths using mechanical shears.

4. Inspection and Storage

Finished billets undergo non-destructive testing and quality inspections before being bundled and stored for shipping or downstream processing (like hot rolling into bars or rods).

The Most Common Square Steel Billet Applications

Square steel billets are widely used in:

- Rolling mills to produce rebars, angles, channels, and flat bars

- Metal casting and forging applications

- Automotive and aerospace components

- Machining parts like fasteners, turned and milled parts

- Tool and die manufacturing

- Infrastructure and civil engineering

They serve as a base material for structural and mechanical engineering, making them a foundational item in metal fabrication.

Aluminum Square Billet vs Steel Square Billet – What’s the Difference?

| Aspect | Steel Billet | Aluminum Billet |

|---|---|---|

| Strength | Higher tensile strength | Lower but sufficient strength |

| Weight | Heavier | Lightweight |

| Cost | Often lower upfront | Higher material cost |

| Corrosion Resistance | Good (with proper treatment) | Excellent (naturally) |

| Applications | Heavy-duty, industrial | Aerospace, interior, automotive |

Billet steel is suitable for demanding environments, while aluminum billets are chosen when weight reduction is critical.

What Is the Weight of a Square Billet?

Weight depends on dimensions and density:

Formula:

📏 Weight = Length × Width × Height × Steel Density (7,850 kg/m³)

Example:

1m × 0.1m × 0.5m × 7,850 = 393.75 kg

Standard Specifications

- Sizes: 120×120 mm, 150×150 mm

- Length: 6m to 12m

- Weight range: 1,350 – 2,100 kg

Market Price Overview for Square Billets

Steel billet prices are dynamic and influenced by region, energy cost, raw material sources, and global demand.

📉 Regional Pricing (USD/ton, CFR):

- Southeast Asia: $540–$550

- Middle East/Japan/Taiwan/India: $545–$560

- Turkey: $510–$520

Note: Lux Metal keeps up-to-date with international billet pricing to offer clients competitive and transparent rates.

Customization & Heat Treatment in Billet Production (New)

At Lux Metal, we understand that one size doesn’t fit all. That’s why we offer:

✅ Custom Billet Sizes — Cut to length

✅ Alloy Composition Control — Additives for higher strength or corrosion resistance

✅ Heat Treatment Options — Annealing, quenching, tempering for enhanced properties

These steps improve machinability, ductility, hardness, and tensile strength, tailored to your application.

Quality Control & Surface Inspection (New)

High-quality billets ensure better performance and fewer rejections in downstream processes.

🔍 Our in-house QC protocols include:

- Ultrasonic Testing – To detect internal defects

- Surface Inspection – To ensure minimal scale or cracks

- Dimension & Tolerance Checks – To match engineering drawings

Lux Metal follows strict ISO standards to ensure your steel billets exceed expectations.

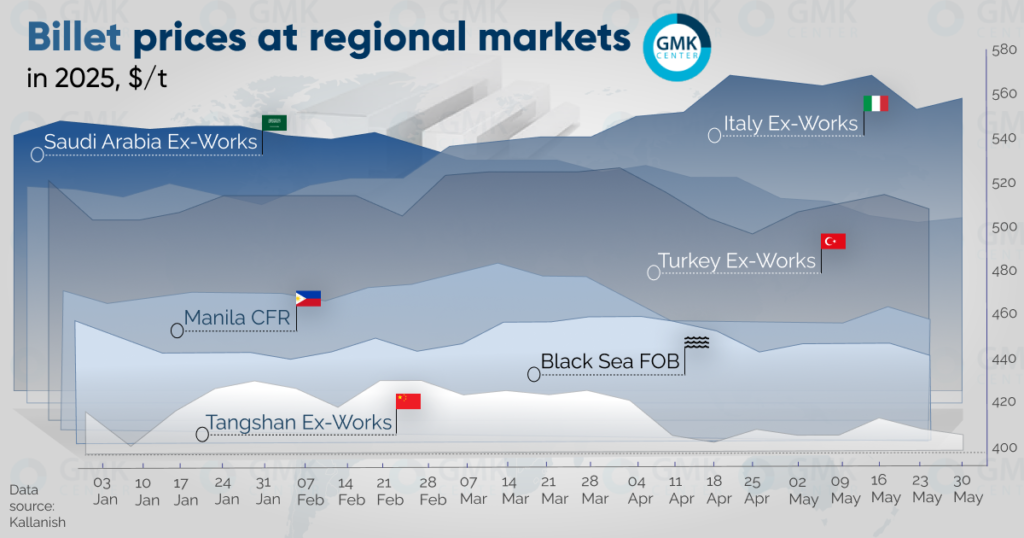

🌍 Global Square Billet Market Trends: Turkish Buyers Shift Focus Amid Stabilized Prices in May 2025

The global square billet market in May 2025 demonstrated relative price stability across most regional markets, with minimal volatility and minor downward corrections. As global demand remains tepid, purchasing strategies are shifting—particularly in Turkey, where buyers are showing growing interest in imported billets due to more competitive pricing compared to domestic offers.

📉 Price Overview: Stable with Slight Declines

In May 2025, square billet prices across many regions saw a mild downward adjustment of around $10 per tonne, largely driven by weak export demand and low trading momentum.

Some mid-month optimism did emerge as prices briefly rose by $5/t, but this was short-lived. By the end of May, rates had returned to early-month levels, reflecting market uncertainty and muted global steel activity.

⚓ Black Sea Market: Holding Steady

The Black Sea FOB market for square billets remained largely stable throughout the month. Prices fluctuated within a tight range of $433–437/t, signaling consistency amidst broader market softness.

This pricing is particularly attractive to Turkish rolling mills, which are increasingly opting for imported billets rather than domestic supply. For comparison:

- Kardemir, a major Turkish steelmaker, listed billet prices at $500–510/t in May.

- Chinese billets were offered at $460–465/t CFR Turkey, making them a more economical option for Turkish buyers.

This shift in purchasing strategy is expected to continue into June, especially if domestic producers maintain higher price points.

🇨🇳 China: Tangshan Mills Hold Off on Billet Sales

In Tangshan, China, billet prices stayed relatively stable, ranging between $405–407/t for most of May. A small bump to $411/t mid-month did little to change the overall market mood.

Due to the continued weakness in demand, many Chinese producers are now diverting billet production toward finished rolled products instead. This trend reflects a growing reluctance to sell billets at low margins and may lead to further supply constraints if continued into June.

🇸🇦 Saudi Arabia: Demand Cools Ahead of Eid al-Adha

In Saudi Arabia, square billet prices experienced a noticeable drop, falling from $523/t at the end of April to $501/t by the end of May.

The market is also anticipating a period of reduced trading activity due to the Eid al-Adha holidays (June 6–10). Seasonal slowdowns are common during major religious festivals in the region, and steel demand typically picks up again afterward.

🇮🇹 Italy: Prices Dip Amid Rising Energy Costs

Italy continues to be one of the highest-priced billet markets globally, but even here, a $4/t drop was recorded, bringing prices down to $557/t Ex-Works.

This decline is closely tied to rising electricity costs, which have significantly inflated steel production expenses. Unless energy prices stabilize, Italian producers may struggle to maintain their competitiveness in the European market.

🇹🇷 Turkey: Domestic Producers Slash Prices to Compete

In April, Turkish domestic billet producers lowered prices by $33/t, reaching an average of $497/t EXW. This move aimed to regain competitiveness amid growing pressure from more attractively priced imports, especially from the Black Sea and China.

While this price cut improved interest slightly, many Turkish buyers still prefer imports due to cost efficiency and logistical reliability.

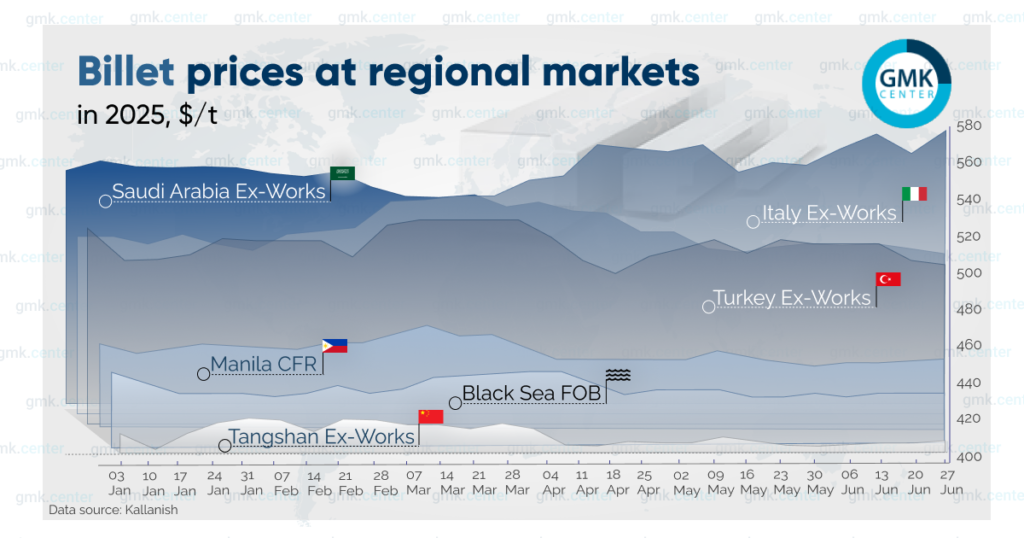

🧱 Global Billet Price Trends June 2025: Stabilization, Regional Highlights & Market Outlook

In June 2025, the global market for square billets has shown notable price stability after months of fluctuations. In most regional markets, price adjustments did not exceed $5 per tonne, signaling a calm in what has been a turbulent steel landscape. However, this stability comes not from a surge in demand but rather from weaker export activity and subdued consumption across key regions.

📊 Billet Prices Snapshot – June 2025

- Black Sea FOB: $433–$435/t

- Kardemir (Turkey): $485–$495/t (Excl. VAT, down by $15/t)

- Tangshan (China): $402–$406/t

- Saudi Arabia (Ex-Works): $500–$503/t

- Indonesia (CFR): $443–$445/t

- Italy (Ex-Works): $562/t (up $5/t in May)

🔍 Factors Behind the Stabilization

- Weak Global Export Demand: Many major steel-exporting countries have seen reduced orders from international markets, placing downward pressure on billet prices.

- Rising Inventories in China: Despite price reductions, demand remains stagnant, leading to oversupply and even temporary production halts.

- Attractive Black Sea Pricing: Turkish buyers are favoring imports from the Black Sea region due to more competitive prices versus local supply.

- CISA’s Concern in China: The China Iron and Steel Association is pushing for tighter controls on billet exports due to a spike in outbound shipments.

🌐 Regional Analysis & Market Reactions

🇹🇷 Turkey’s Strategic Purchasing Shift

Turkey is closely monitoring price changes in neighboring markets, and Black Sea-origin billets remain attractive. The $50+ price gap between local Kardemir’s billets and Black Sea FOB offerings is significant. If this price disparity continues, it may lead to increased import volumes and reduced domestic production reliance.

🇨🇳 China’s Quiet Market Amid Overcapacity

Even with low prices in Tangshan, China’s key billet-producing region, demand has not picked up. Inventory levels are rising, and mills are slowing down or pausing production altogether. China’s policy response—particularly around export restrictions—will be key to watch in Q3 2025.

🇮🇹 Italy Shows Strength

Italy remains the highest-priced regional billet market at $562/t. While modest, the $5 increase in May points to more resilient infrastructure and manufacturing demand across Europe, especially with government-backed construction programs accelerating.

📉 Forecasts: Billet Prices 2025–2027

According to the National Bank of Ukraine (NBU):

- 2025: Prices may fall by 5.2% to $478/t FOB Ukraine.

- 2026: Projected rebound of 2.9% to $492/t.

- 2027: Continued recovery with a 2.1% rise to $502.5/t.

This suggests the market is near the bottom in 2025, and producers are likely to focus on balancing capacity and demand while awaiting stronger macroeconomic growth.

🔧 Related Industry Trends Worth Watching

🏗️ Global Infrastructure Projects Driving Long-Term Demand

Governments across the world are investing in large-scale infrastructure projects that require billets for rebar, structural components, and more. Projects in India, Southeast Asia, and the EU are expected to increase billet consumption in late 2025 and 2026.

🌱 Green Steel & EAF Expansion

The push toward decarbonization means more steel producers are shifting toward Electric Arc Furnace (EAF) technologies that can use scrap and billets as feedstock. This evolution favors regions with better scrap collection networks and renewable electricity access.

🏭 Supply Chain Reconfiguration & Regionalization

With persistent geopolitical tensions, many buyers are re-evaluating sourcing strategies. Some are opting for local billets over imports to ensure consistent supply. This trend will influence regional billet pricing and availability going into 2026.

💼 Construction, Automotive & Energy Sectors

Square billets are key in construction and heavy manufacturing. As renewable energy and electric vehicle production grows, billet demand in downstream industries could see diversification and volume increases by late 2025.

🔚 Final Thoughts: Market Stability or Precursor to Change?

While billet prices appear calm on the surface, underlying supply chain and policy dynamics suggest the market could shift quickly. Inventory build-up in China, strong EU demand, and policy moves in Turkey and Indonesia will play crucial roles in shaping H2 2025.

🔧 About Lux Metal: Your Trusted Steel Fabrication Partner

At Lux Metal, we stay ahead of market trends to support your evolving steel needs. As a trusted metal manufacturer in Malaysia, we specialize in high-quality fabrication of custom steel and stainless steel components, including:

- CNC cutting, bending, and precision sheet metal works

- V-grooving, laser cutting, and welding services

- Tailor-made steel solutions for industrial, architectural, and structural applications

Our advanced facilities and experienced engineering team ensure accuracy, quality, and efficiency — whether for small batches or large-scale production.

🌐 Explore more at www.luxmetalgroup.com

Need a quote or project consultation? Contact us today to learn how we can support your next project with precision and speed.

📚 References

For additional insights and market data on square billet pricing, production trends, and global demand fluctuations, explore the following resources: