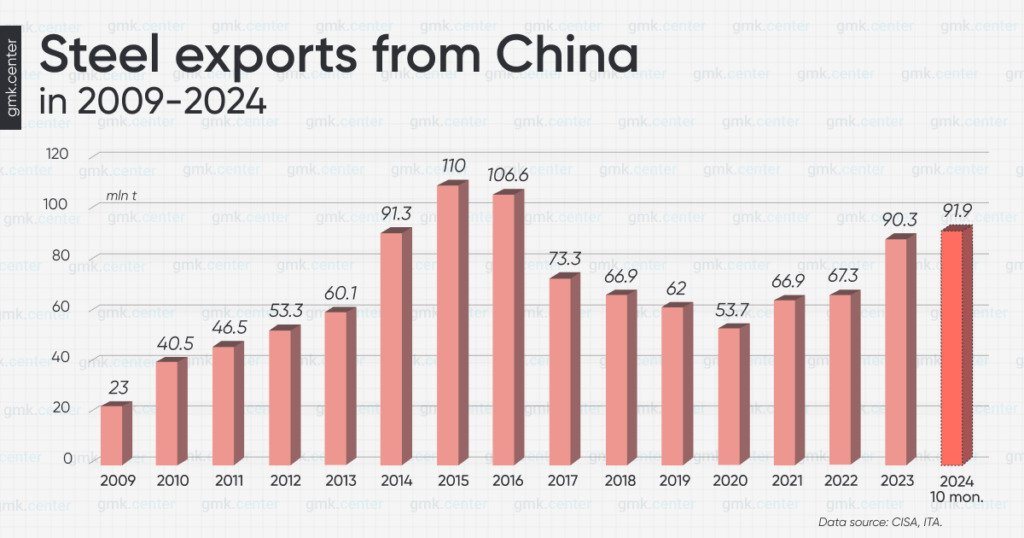

Record-High Steel Exports in October 2024

China’s steel exports reached 11.18 million tons in October 2024, the highest monthly figure in the last nine years. This number represents a 40.8% increase compared to October 2023 and a 10.2% rise from September 2024. Cumulatively, from January to October 2024, China exported 91.89 million tons, a significant 23.3% growth year-on-year (y/y). Analysts predict that the year-end total could surpass 110 million tons, a milestone not achieved since 2016.

This remarkable export growth was fueled by competitive pricing, improved global demand, and strategic trade measures. However, the surge in exports contrasts with a 10.1% decline in steel imports during the first ten months of 2024, amounting to just 5.72 million tons.

Iron Ore Prices and Imports

China’s demand for raw materials to fuel its booming steel production remains robust. In October 2024, iron ore prices rose significantly, with Australian iron ore (62% Fe content) reaching US$105.6/ton, marking a 7.4% increase since mid-October. This uptick was driven by:

- Recovery in China’s real estate sector.

- Economic stimulus measures promoting construction activities.

Iron ore imports in October totaled 103.84 million tons, a slight 0.2% month-on-month (m/m) dip but a 4.5% y/y increase. Over the first ten months of 2024, China imported 1.023 billion tons of iron ore, a 4.9% rise y/y.

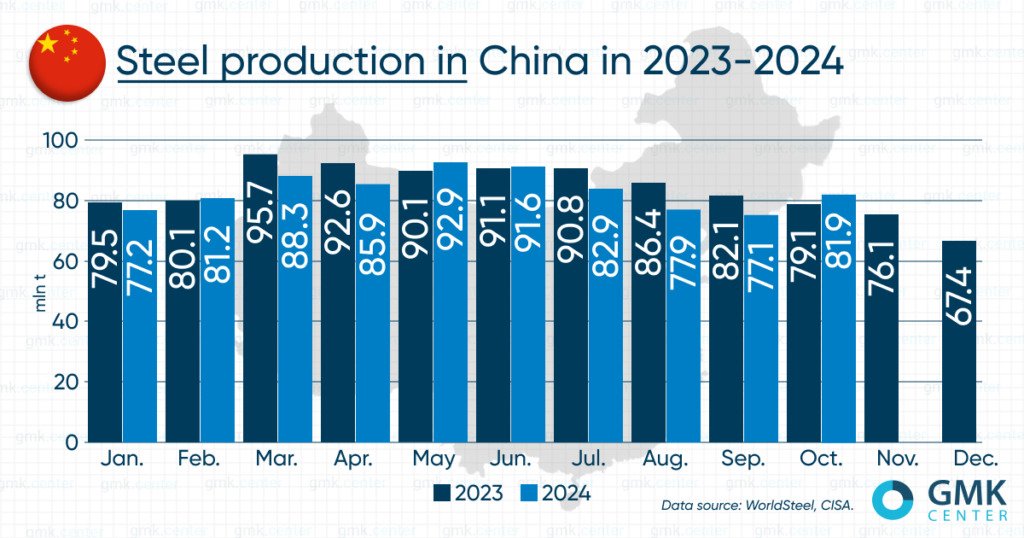

Steel Production: Growth and Challenges

In October 2024, Chinese steelmakers ramped up production, with output reaching 81.88 million tons, representing a 6.2% m/m increase and a 2.9% y/y increase. This marked a rebound after four months of decline, supported by renewed demand and economic optimism.

The average daily steel production in October stood at 2.64 million tons, up from 2.57 million tons in September. However, seasonal factors are expected to curb production in November, and for the January-October period, overall steel production declined 3% y/y to 850.73 million tons.

Economic Stimulus and Government Initiatives

China’s economic growth slowed to 4.6% in Q3 2024, casting doubt on the government’s 5% annual target. In response, Beijing announced a series of stimulus measures, including:

- Interest Rate Cuts: Lowering borrowing costs to boost investment in construction and real estate.

- Down Payment Reductions: Easing loan terms for homebuyers and developers.

- Debt Restructuring Program: A $1.4 trillion initiative to restructure local government debt and reduce financial risks.

These measures have driven increased demand for construction materials like steel and iron ore. However, structural challenges such as high debt levels and cooling market sentiment remain concerns for long-term economic stability.

US-China Trade Tensions and Export Opportunities

The lingering effects of trade tensions between the US and China continue to shape the global steel market. Tariffs imposed during the previous US administration made it more challenging for Chinese steelmakers to access American markets. Nevertheless, analysts see opportunities for China to diversify exports to other regions, leveraging competitive pricing and improved trade relationships.

Insights from 2023 Performance

Looking back at 2023, China’s steel exports surged by 36.2% y/y, reaching 90.3 million tons, while imports fell 27.6% y/y to 7.64 million tons. Iron ore imports grew by 6.6% y/y to 1.179 billion tons, highlighting the country’s reliance on raw material imports to sustain its steel production. Despite two consecutive years of declining output, China managed to produce 1.019 billion tons of steel in 2023, reflecting a 0.6% growth from 2022.

Challenges Ahead

Environmental Regulations

As the world’s largest steel producer, China faces growing pressure to reduce carbon emissions. Environmental production constraints could become more stringent, particularly during the winter season, affecting steel output and pricing.

Market Sentiment

While the government’s stimulus efforts have improved short-term market sentiment, structural issues like high debt levels and slowing economic growth may dampen investor confidence in the long term.

Seasonal Factors

The winter season traditionally leads to reduced construction activity, which could impact steel demand and production levels in the coming months.

Future Outlook for China’s Steel Industry

China’s steel industry remains a critical driver of the global market, with its record-breaking exports and resilient production capabilities. However, the path ahead is not without challenges. To sustain growth, the industry must:

- Adapt to environmental regulations and reduce carbon emissions.

- Focus on high-value steel products to enhance competitiveness.

- Explore new export markets to counter trade restrictions.

- Balance economic stimulus with structural reforms for long-term stability.

As 2024 unfolds, the industry’s performance will depend on how effectively it navigates these challenges while leveraging opportunities for growth.

Partner with Lux Metal for Premium Steel Solutions

For businesses seeking high-quality steel products and customized metal solutions, Lux Metal is your trusted partner. Visit our website to explore our wide range of services and see how we can help you meet your industrial needs with precision and excellence.