How America’s New Trade Policy is Reshaping the Global Economy

In his second term as President of the United States, Donald Trump has reignited global tensions by plunging headfirst into a new trade war that could potentially reshape the global economic landscape. What began as a targeted response to domestic issues like fentanyl trafficking and illegal immigration quickly evolved into an international clash of tariffs, protectionism, and retaliatory policies.

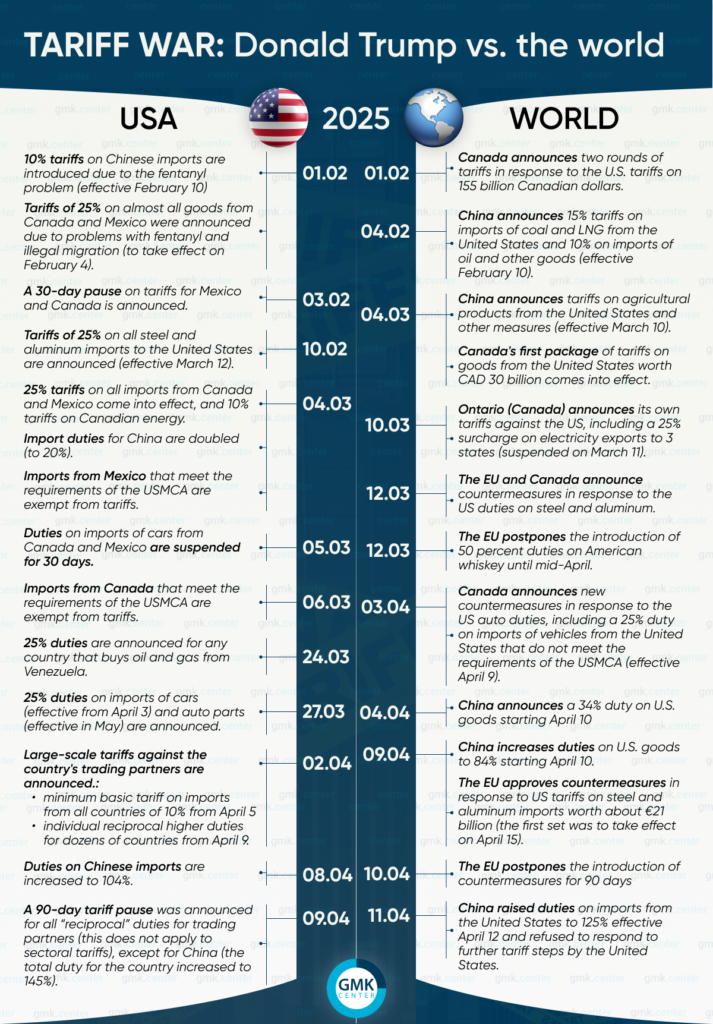

Since February 2025, the Trump administration has introduced a sweeping series of import tariffs—targeting not just China, but also key trading partners such as Canada, Mexico, the European Union, and more. As of April 9, the United States now faces a growing wave of backlash from around the world, with retaliatory duties and threats of economic countermeasures escalating at an unprecedented pace.

But what exactly triggered this explosive confrontation? And what does this mean for the future of international trade, economic stability, and the global balance of power?

Phase One: Triggering the Firestorm

On January 20, 2025, President Donald Trump began his second term with a clear mission: to address what his administration termed “unfair and unbalanced trade.” A White House memorandum outlined an aggressive agenda to overhaul America’s trade practices, emphasizing national security, domestic job creation, and economic independence.

By February 1, the first salvos of this economic war were launched:

- A 10% tariff was slapped on Chinese imports, officially linked to China’s alleged role in the fentanyl crisis.

- 25% tariffs were simultaneously announced on nearly all goods from Canada and Mexico, citing concerns over fentanyl and illegal border migration.

Although the initial tariffs were scheduled to take effect on February 4, the administration later issued a 30-day pause for Canada and Mexico. China, however, faced no such reprieve.

Phase Two: Steel, Aluminum, and the Domino Effect

On February 10, the Trump administration escalated the conflict dramatically, imposing 25% tariffs on all steel and aluminum imports into the United States. This measure signaled a broader protectionist shift, targeting global supply chains and challenging the existing rules of the World Trade Organization (WTO).

March brought another round of aggressive enforcement:

- March 4: 25% tariffs on all imports from Canada and Mexico took effect, along with a 10% tariff specifically on Canadian energy exports.

- China faced doubled import duties, increasing to 20%, further stoking tensions.

Although temporary exemptions were later granted for USMCA-compliant goods from Canada and Mexico, the message was clear: America’s trading relationships would now be conditional and transactional.

Phase Three: Escalating to Global Proportions

By late March and early April, Trump’s trade war had gone fully global. Key developments included:

- March 24: The U.S. imposed 25% duties on countries purchasing oil and gas from Venezuela, effectively weaponizing energy geopolitics.

- March 27: Duties on auto imports (25%) and auto parts (to follow in May) were announced, striking at the heart of transatlantic trade with Europe and Asia.

- April 2: The “Liberation Day” announcement introduced a minimum basic tariff of 10% on imports from all countries, to be effective from April 5. Dozens of nations faced even higher reciprocal tariffs, ranging from 10% to 34%.

- April 8: Tariffs on Chinese goods soared to 104%, and on April 9, these increased again, reaching 145%, making it nearly impossible for Chinese products to compete in the U.S. market.

However, in a surprise move on April 9, the administration also paused reciprocal tariffs for 90 days—excluding China. This partial retreat was seen as an olive branch to Europe, Japan, South Korea, and other allies who had entered trade negotiations without retaliating.

Global Responses: Retaliation, Resistance, and Realignment

The global community did not sit idly by. Countries across North America, Europe, and Asia took swift countermeasures.

Canada’s Two-Pronged Defense

- February 1: Canada announced a two-round countermeasure strategy, targeting U.S. exports worth CAD 155 billion.

- March 4: Canada’s first tariff package worth CAD 30 billion came into force, focusing on consumer goods and industrial imports.

- April 3: Canada retaliated against auto duties with a 25% tariff on U.S. vehicles that don’t comply with USMCA standards.

Even the province of Ontario joined the fray briefly by imposing a 25% electricity export tariff to three U.S. states—a measure later suspended under federal pressure.

China’s Relentless Counterattack

China’s response was sharp and unyielding:

- February 4: Beijing imposed a 15% tariff on U.S. coal and LNG, and 10% on crude oil and other goods.

- March 10: Agricultural products were added to the list.

- April 4: A 34% tariff was introduced.

- April 9: China raised tariffs to 84%.

- April 11: China brought duties up to 125% and announced a complete refusal to engage with future U.S. tariff negotiations.

Beijing made it clear that it intended to “fight to the end,” positioning itself as the standard-bearer for multilateral trade cooperation in contrast to American unilateralism.

The European Union: Holding Its Ground

Europe took a more calculated approach:

- March 12: The EU aligned with Canada in opposing U.S. steel and aluminum tariffs.

- April 9: The EU approved countermeasures on U.S. goods worth €21 billion, set for rollout on April 15.

- April 10: In response to the 90-day U.S. tariff pause, the EU reciprocated by delaying its own countermeasures for the same duration.

European Commission President Ursula von der Leyen welcomed the truce as a move toward economic stability but warned that Europe would not hesitate to resume action if negotiations fail.

Domestic Consequences in the United States

While President Trump touts the tariff war as a strategy for “economic liberation,” many sectors within the United States are feeling the heat:

- Manufacturers face higher input costs for steel, aluminum, and auto parts.

- Farmers are losing access to key export markets, especially in China.

- Consumers are seeing rising prices in electronics, vehicles, and home goods.

Nonetheless, Trump’s administration remains defiant, emphasizing the long-term goal of restoring industrial independence and reshaping trade policy around American interests.

China Urges End to Trade War Amid Escalating Tariffs

In April 2025, the Trump administration escalated the U.S.-China trade war by imposing tariffs of up to 245% on Chinese imports. This move, detailed in a White House fact sheet, combines several tariff measures: a 125% reciprocal tariff, a 20% tariff addressing the fentanyl crisis, and Section 301 tariffs ranging from 7.5% to 100% on specific goods .The White House

The administration justified these tariffs as a response to China’s export restrictions on critical materials like gallium, germanium, and rare earth elements, which are vital for industries such as defense and technology. China’s actions were seen as attempts to leverage their control over essential components in global supply chains.

China dismissed the U.S. tariffs as a “meaningless tariff numbers game,” indicating a reluctance to engage in tit-for-tat escalations . Despite calls for cooperation, Beijing warned it is prepared to retaliate if necessary .Hindustan Times+2Newsweek+2Reuters+2Reuters

The tariffs have significant implications for global markets. Analysts like John Stoltzfus of Oppenheimer have revised economic forecasts, citing market downturns fueled by the aggressive trade strategy . Business leaders express concerns over increased costs and supply chain disruptions, emphasizing the need for strategic planning in implementing such policies .Business InsiderBusiness Insider

While the tariffs aim to protect national security and promote economic resilience, their long-term effectiveness remains uncertain. The situation underscores the complexities of global trade and the challenges in balancing economic interests with strategic objectives.

Global Trade Realignment: Who Benefits?

While U.S. trade partners scramble to shield themselves, some countries stand to benefit from the chaos:

- India, Vietnam, and Brazil have seen increased interest as alternative suppliers of goods previously sourced from China.

- Turkey and Mexico are being considered for regional manufacturing relocations to bypass U.S. tariffs.

- Southeast Asia continues to gain favor as companies reconfigure supply chains toward ASEAN nations.

Even Malaysia, with its strategic position and industrial expertise, may find opportunities to attract new manufacturing investments and expand trade within the Asia-Pacific region.

What Comes Next?

With the U.S. temporarily suspending reciprocal tariffs for most partners (except China), a narrow window has opened for negotiations. Yet the broader trade environment remains unstable.

Some critical questions arise:

- Will China and the U.S. ever find common ground?

- Can the EU, Canada, and others strike long-term deals that preserve market access while defending their industries?

- Will the WTO intervene—or is the multilateral trade system losing relevance in the age of economic nationalism?

Conclusion: Trade in an Age of Uncertainty

The tariff war ignited by Donald Trump’s administration in early 2025 has far-reaching implications. It challenges long-standing trade alliances, disrupts supply chains, and fuels economic uncertainty at a time when global recovery from previous crises is still fragile.

While some may view these measures as bold acts of sovereignty and economic defense, others warn of a return to isolationism, inflation, and prolonged diplomatic strife.

As negotiations unfold over the next 90 days, the world watches closely. Whether this war ends in recalibrated trade deals or spirals into prolonged conflict depends on the ability of world leaders to balance national interests with global cooperation.

Supporting Fair Trade with Local Excellence – Introducing Lux Metal

At Lux Metal, we fully support fair trade practices and the protection of Malaysia’s local manufacturing industry. As a leading provider of customized metal fabrication services in Malaysia, Lux Metal is committed to:

✅ Precision stainless steel works

✅ Advanced CNC machining

✅ Customized structural and industrial metal solutions

✅ End-to-end service from design to delivery

Whether you’re in construction, manufacturing, or industrial sectors, we’re here to provide cost-effective, reliable, and high-quality fabrication — helping Malaysian businesses stay competitive in a globalized economy.

🔗 Explore our services at Lux Metal

📞 Contact us for tailored solutions to your project needs

References:

Al Jazeera. (2025, April 17). China says it will pay no attention to Trump’s tariff ‘numbers game’. Retrieved from: https://www.aljazeera.com/news/2025/4/17/china-says-it-will-pay-no-attention-to-trumps-tariff-numbers-game

GMK Center. (2025). Tariff War: Donald Trump vs. the World [Infographic]. Retrieved from: https://gmk.center/en/infographic/tariff-war-donald-trump-vs-the-world/

Hindustan Times. (2025, April 17). China to now pay up to 245% tariffs on imports to US: Trump’s latest move in trade war. Retrieved from: https://www.hindustantimes.com/world-news/us-news/china-to-now-pay-up-to-245-tariffs-on-imports-to-us-trumps-latest-move-trade-war-101744789093597.html