A Brief History of US Tariffs on Steel and Aluminum

In 2018, the Trump administration imposed tariffs of 25% on steel and 10% on aluminum imports, citing national security concerns under Section 232 of the Trade Expansion Act of 1962. This move sparked outrage among key US allies, including the EU, Canada, and Mexico, who viewed the tariffs as unjustified and economically harmful. The EU responded with retaliatory tariffs on a range of American goods, escalating tensions and leading to a period of strained transatlantic trade relations.

While the Biden administration sought to ease these tensions by negotiating a temporary suspension of tariffs and pursuing a more cooperative approach, the specter of protectionism has not fully disappeared. With former President Donald Trump eyeing a potential return to the White House, fears are mounting that a resurgence of aggressive trade policies could reignite tariff conflicts, particularly in the steel and aluminum sectors.

The Current Landscape: US Protectionism on the Rise Again?

According to recent reports from Bloomberg and GMK Center, the EU is bracing for the possibility of renewed US tariffs on steel and aluminum. With Trump leading in Republican primaries and gaining momentum for a 2024 presidential run, the potential for a return to protectionist policies is high. Trump has long advocated for tariffs as a tool to protect American industries from foreign competition, and his administration’s previous actions set a precedent that could be revived if he returns to office.

The EU, aware of these risks, is proactively preparing countermeasures to protect its industries. This includes diplomatic negotiations aimed at averting a tariff war, as well as plans for targeted retaliatory tariffs if the US moves forward with new protectionist measures.

EU Prepares to Counter US Protectionism as Tariff Tensions Resurface

The longstanding issue of US tariffs on steel and aluminum is once again poised to become a major source of tension between the United States and the European Union (EU). With protectionist policies gaining momentum in the US and the EU bracing for potential retaliatory measures, the transatlantic trade relationship is entering a critical phase. Both parties are attempting to navigate a delicate balance of diplomacy and defense, aiming to avoid a full-scale trade war while safeguarding their economic interests. However, the stakes are high, and the outcome could have far-reaching implications for global trade, particularly in the steel and aluminum sectors.

The Current Scenario: Renewed Tensions and Diplomatic Maneuvering

With Donald Trump re-entering the political arena and leading the Republican primaries, there is growing concern within the EU about the resurgence of protectionist policies. Trump’s administration had previously embraced tariffs as a means to protect American industries, and his recent rhetoric suggests a return to such policies if he regains the presidency. This prospect has prompted the EU to prepare for a potential trade fight, while simultaneously seeking avenues for negotiation to prevent escalation.

1. The EU’s Strategy: A Mix of Diplomacy and Preparedness

According to Bloomberg, the EU sees opportunities for negotiation with the US despite the looming threat of tariffs. The decision by Trump to postpone tariffs on imports from Mexico and Canada has given the EU some confidence that a mutually acceptable outcome can be achieved. This development has influenced the European Commission’s strategy, prompting it to prepare a proportional response to any tariff threats from the US.

However, the EU faces significant challenges in establishing productive contacts with the new US administration. Several key trade positions remain unfilled, pending approval by the US Senate, which has complicated diplomatic efforts. Despite these hurdles, the EU remains committed to defusing potential disputes, particularly regarding steel and aluminum exports, which could reach a critical point by March 2025.

2. The Expiration of Tariff Suspensions: A Ticking Clock

At the end of March 2025, the suspension of EU tariffs on approximately $3 billion worth of American products is set to expire. These tariffs were initially introduced during Trump’s first presidency as a response to the US’s Section 232 duties on steel and aluminum. The EU extended the suspension of these duties in December 2023 to maintain positive diplomatic relations.

Similarly, the US extended the suspension of Section 232 tariffs for the EU, replacing them with a tariff quota system until December 31, 2025. Despite this temporary reprieve, the future remains uncertain. According to insiders, the EU is likely to extend the suspension of its duties beyond March to avoid provoking the US administration and to maintain a constructive dialogue.

3. Broader Trade Negotiations: LNG, Fertilizers, and Defense

In an effort to improve bilateral relations, the European Commission has proposed a comprehensive plan that includes increased imports of US liquefied natural gas (LNG), fertilizers, and weapons. This proposal aims to strengthen economic ties and create a foundation for resolving trade disputes.

Additionally, the EU and the US are exploring opportunities for policy harmonization, particularly regarding China. Both parties are interested in aligning their export controls, investment verification mechanisms, and strategies to address Chinese overcapacity in the steel industry. This collaborative approach could serve as a counterbalance to escalating tensions over tariffs.

The Impact of US Tariffs on Steel and Aluminum

The imposition of US tariffs on steel and aluminum has far-reaching consequences for both economies, affecting industries, consumers, and diplomatic relations.

1. Impact on the US Economy

In 2023, steel consumption in the United States totaled approximately 93 million tons, with 13% of this demand met through imports. Tariffs on steel and aluminum significantly increase the cost of these imports, leading to higher prices for American manufacturers and, ultimately, consumers. This can have a cascading effect on industries reliant on these materials, including construction, automotive, and aerospace sectors.

While tariffs are designed to protect domestic producers, they can also lead to unintended consequences, such as supply chain disruptions and reduced competitiveness in global markets. Additionally, retaliatory measures from the EU and other trading partners can harm US exporters, creating a ripple effect throughout the economy.

2. Impact on the EU Economy

The EU, as one of the US’s largest trading partners, is significantly affected by American tariffs on steel and aluminum. European producers face restricted access to the US market, leading to potential revenue losses and job cuts. Furthermore, retaliatory tariffs imposed by the EU on American goods can escalate tensions, affecting a wide range of industries on both sides of the Atlantic.

Despite these challenges, the EU remains a critical supplier of steel and aluminum to the US. The potential reintroduction of tariffs threatens to disrupt this dynamic, leading to economic uncertainty and increased costs for both parties.

The Role of Russian Steel in the EU Market

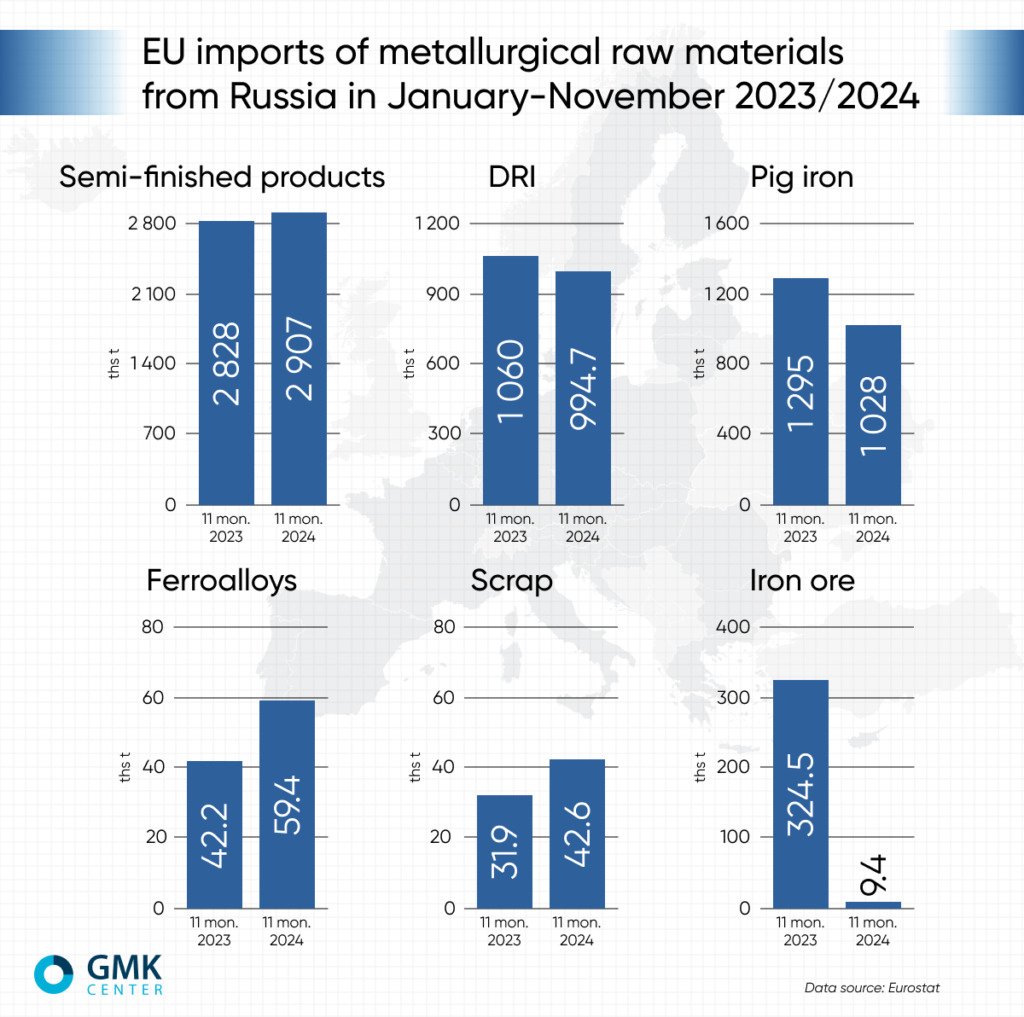

Complicating the EU’s trade strategy is its continued reliance on steel raw materials from Russia. According to GMK Center, the EU imported 5.04 million tons of steel raw materials from Russia between January and November 2024, with a total import value of €2.39 billion. This dependence raises questions about the EU’s ability to diversify its supply chain and reduce reliance on Russian imports amid ongoing geopolitical tensions.

1. Breakdown of Russian Steel Imports

- Semi-Finished Products:

The bulk of the EU’s steel imports from Russia consists of semi-finished products, such as slabs and billets. In the first 11 months of 2024, 2.91 million tons of these products were shipped to the EU, representing a 2.8% year-on-year increase. Major consumers include Belgium (1.15 million tons), Italy (666.91 thousand tons), Denmark (463.68 thousand tons), and the Czech Republic (437.77 thousand tons). - Pig Iron:

The EU imported 1.03 million tons of pig iron from Russia, with Italy and Latvia being the primary recipients. Revenues from these imports totaled €420.3 million. - Ferroalloys and Scrap:

Imports of Russian ferroalloys increased by 40.9% compared to the previous year, totaling 59.43 thousand tons. The Netherlands accounted for more than 77% of these imports. Additionally, the EU imported 42.61 thousand tons of scrap from Russia.

2. Geopolitical Implications and the Path Forward

The EU’s reliance on Russian steel presents both economic and political challenges. While Russian producers offer competitive pricing, ongoing sanctions and geopolitical tensions complicate this trade relationship. The EU has not implemented a complete ban on Russian steel imports, and in some cases, restrictions have been eased, particularly for slabs.

However, there is growing pressure within the EU to diversify its steel supply chain and reduce dependency on Russian imports. Ukraine, as a prospective EU member, presents a potential alternative, offering an opportunity to replace Russian products in the European market

Conclusion: Navigating a Complex Trade Landscape

The potential reintroduction of US tariffs on steel and aluminum poses significant challenges for the EU, both economically and diplomatically. As the EU prepares to counter US protectionism, it must navigate a complex landscape of trade negotiations, geopolitical tensions, and internal economic dependencies.

While diplomatic efforts are underway to prevent a full-scale trade conflict, the outcome remains uncertain. The expiration of tariff suspensions and the resurgence of protectionist rhetoric in the US could reignite tensions, affecting industries on both sides of the Atlantic.

At the same time, the EU must address its reliance on Russian steel imports, balancing economic needs with geopolitical considerations. Diversifying supply chains and strengthening internal production capabilities will be critical in ensuring the EU’s resilience in the face of global trade disruptions.

For more insights into the steel and aluminum industries and the latest developments in global trade, visit Lux Metal.

References: