The Basics of Hot-Rolled Coil Steel

What Is Hot-Rolled Steel?

Hot-rolled steel is manufactured by rolling steel at high temperatures, typically over 1,700°F, which makes it easier to shape and form. The result is a durable and versatile steel product used in industries like construction, automotive, and machinery.

Read the article from Lux Metal website to have more understandings on Hot Rolled vs. Cold Rolled Stainless Steel.

Key Applications of Hot-Rolled Steel

Hot-rolled coil steel is widely used in:

- Construction: For structural components, beams, and reinforcements.

- Automotive: In manufacturing vehicle frames and parts.

- Industrial Equipment: For heavy machinery and equipment components.

Hot-Rolled Coil Market Trends and Pricing Factors

The HRC market is influenced by numerous variables, including production capacity, geopolitical dynamics, and raw material costs. Let’s delve into these factors:

- Global Steel Production

- Steel production levels directly impact the availability and pricing of HRC. Recent reports indicate a slowdown in production in several major steel-producing regions due to higher energy costs and stricter environmental regulations.

- Countries like China, which dominate the steel production landscape, have implemented measures to control excess capacity, influencing the global supply chain.

- Raw Material Costs

- The prices of iron ore, coking coal, and other raw materials have seen fluctuations in recent months. These changes cascade through the supply chain, affecting the cost of hot-rolled steel products.

- Geopolitical Instabilities

- Trade disputes, tariff adjustments, and sanctions have significantly influenced steel imports and exports. For instance, anti-dumping duties imposed by various countries, including Malaysia, have reshaped regional trade flows.

- Supply disruptions caused by geopolitical conflicts have also added to the market’s volatility.

- Shift in Consumer Markets

- There is a rising preference for greener, more sustainable steel products, pushing manufacturers to adopt eco-friendly production techniques. This shift, while beneficial in the long term, has temporarily increased production costs, impacting prices.

Regional Dynamics of the Hot-Rolled Steel Market

The dynamics of the HRC market vary significantly across regions:

- Asia-Pacific:

Asia, particularly China, remains the largest producer and consumer of hot-rolled coil steel. However, tighter environmental policies and reduced construction activities have impacted demand in the region. - Europe:

Europe has faced challenges due to energy crises and rising operational costs. This has led to reduced production in some countries and increased reliance on imports, further affecting HRC pricing. - North America:

In the U.S. and Canada, the market is shaped by strong construction and automotive sectors. Despite economic pressures, steady demand for HRC products has kept pricing relatively stable compared to other regions.

European Market: Stability Amidst Weak Demand

Price Trends in Europe

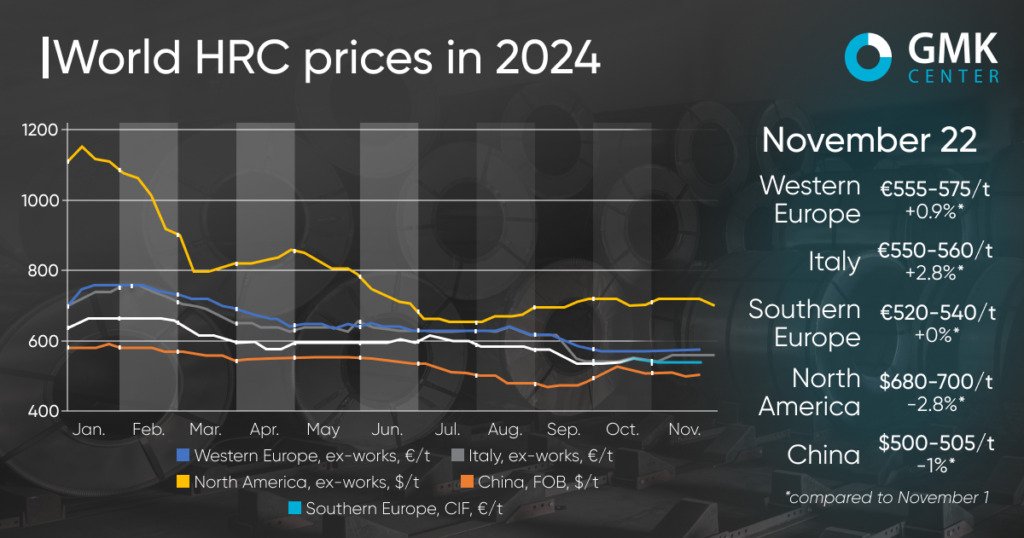

In Europe, the HRC market remained relatively stable, with modest price changes in some regions:

- Western Europe: Prices rose by 0.9%, reaching €555-575/tonne Ex-works.

- Southern Europe: Prices remained stable at €520-540/tonne CIF.

- Italy: Prices increased by 2.8% to €550-560/tonne Ex-works.

However, these price increases did little to offset the weak demand, as consumption in key sectors like automotive and engineering continued to decline.

EU Market Trends

The European HRC market experienced a modest 1.4% m-o-m price increase in November. However, this was primarily attributed to a weakening euro, which enhanced competitiveness against imports rather than actual demand growth.

Key challenges included:

- Declining Steel Consumption: Apparent steel consumption in Europe is estimated to drop by 3.5% year-on-year (y-o-y) in Q4 2024.

- Automotive Industry Slowdown: Steel usage in the automotive sector is projected to fall by 6.5% y-o-y in 2024.

Challenges Facing European Producers

European producers faced significant challenges, including:

- Minimal Profit Margins: Many service centers and re-rollers operated at minimal profitability or incurred losses due to low prices.

- Holiday Season Production Declines: Producers planned to suspend operations for the December holidays, potentially reducing supply.

- Import Competition: Buyers were hesitant to place large orders due to long delivery times and risks associated with import tariffs.

Short-Term Market Outlook

The European HRC market may experience a short-term boost as buyers replenish stocks before year-end production shutdowns. However, low margins, weak demand, and economic uncertainty suggest a challenging start to 2025.

United States Market: Declining Prices Amid Oversupply

November Price Trends

The US HRC market experienced a notable price decline in November, reflecting oversupply and weak demand:

- Early November: Prices remained relatively stable at $710-720/short tonne Ex-works.

- Mid-November: Prices started to decline, reaching $690-720/tonne.

- End of November: Prices dropped further to $680-700/tonne, with reports of transactions as low as $600/tonne in some cases.

US Market Trends

The US HRC market followed a similar trajectory, with the 3-month futures price on the Chicago Metals Exchange (CME) increasing by 3% m-o-m to $866/mt. However, prices declined in the second half of November due to:

- Weak Domestic Demand: Steel shipments fell by 1% y-o-y in September and by 4% y-o-y in the first nine months of 2024.

- Reluctant Purchases: Consumers remained cautious about future steel consumption, limiting their buying activity.

Key Factors Driving Declines

- High Inventory Levels: Sufficient stocks at service centers reduced the urgency for new purchases.

- Weak Demand: Industries like automotive and machinery continued to experience sluggish demand.

- Seasonal Slowdown: Many producers and consumers scaled back operations ahead of the holiday season, reducing sales volumes.

- Discounted Pricing: Distributors offered significant discounts for large orders, adding to price pressure.

Future Outlook

As the financial year ends, US producers hope for improved demand in Q1 2025. However, intense competition and consumer pressure for lower prices may keep the market challenging.

China Market: Volatility Amid Domestic and International Pressures

Price Movements

China’s HRC market exhibited volatility throughout November:

- Prices began the month stable at $500-505/tonne FOB.

- Mid-month: Prices declined due to weak economic signals and falling futures contracts.

- Late November: Prices recovered slightly before dropping again as futures markets weakened.

China’s HRC and Iron Ore Markets: A Persistent Downtrend

Declining Prices and Demand

In November, Chinese export HRC prices fell by 4% m-o-m due to weak demand, while domestic prices also declined. Despite government stimulus measures announced in late September, their impact on steel consumption and construction activity has been minimal.

Real Estate and Construction Challenges

- Real Estate Investment: Declined by 12% y-o-y in October, the fastest drop in seven months.

- New Property Builds: Plummeted by 23% y-o-y for the first ten months of 2024, compared to a 22% y-o-y decline in the first nine months.

Market expectations remain muted, with the construction output downtrend anticipated to persist through the end of 2024.

Seasonal Trends and Stimulus Limitations

Traditionally, raw material purchases intensify in China ahead of the Lunar New Year (January 2025). While this could lead to higher iron ore prices, the impact on the broader steel market remains uncertain.

Key Influences on Chinese HRC

- Domestic Consumption: Higher consumption and lower stock levels supported prices temporarily.

- Export Challenges: The lack of significant export deals, particularly with Vietnam, and anti-dumping investigations by Australia created headwinds.

- Government Incentives: While anticipated government measures provided some optimism, their impact on market dynamics was limited.

Market Challenges

China’s HRC market continues to grapple with domestic overcapacity, unstable export opportunities, and the risk of new trade barriers in key markets.

Global Challenges in the Hot-Rolled Coil Market

Weak Demand Across Key Sectors

The decline in demand from industries like automotive and engineering has been a common theme globally. This trend has placed downward pressure on prices and limited producers’ ability to maintain profitability.

Impact of Seasonal Slowdowns

The approach of the holiday season has led to reduced operations and sales volumes in many regions, exacerbating existing challenges in the market.

Competition from Imports

Imported steel continues to be a significant factor in global markets, often providing competitive pricing that pressures domestic producers to lower their prices.

Economic Uncertainty

Global economic instability remains a critical factor affecting the steel industry, influencing both consumer confidence and industrial activity.

Opportunities for Recovery in 2025

Infrastructure Investments

Governments worldwide are increasing investments in infrastructure projects, which could drive demand for HRC. These projects require large volumes of steel, presenting an opportunity for producers to capitalize on increased activity.

Technological Advancements

Innovations in steel production, including automation and smart manufacturing, could help producers reduce costs and improve efficiency, allowing them to remain competitive in a challenging market.

Environmental Sustainability

As demand for eco-friendly building materials grows, producers that focus on low-carbon steel and recycling initiatives may find new opportunities to differentiate themselves and attract environmentally conscious buyers.

Emerging Trends Shaping the Future of the HRC Market

- Digital Transformation in Steel Trading

The integration of advanced technologies, such as AI-driven demand forecasting and blockchain-enabled supply chain transparency, is transforming how steel is traded globally. These tools enable better market predictions and more efficient transactions. - Focus on Sustainability

As industries align with global sustainability goals, there is an increasing focus on low-carbon steel production. Manufacturers are investing in renewable energy sources and adopting innovative production techniques, such as hydrogen-based steelmaking. - Consolidation of Steel Producers

Consolidation through mergers and acquisitions is becoming a key strategy among steel companies to achieve economies of scale, enhance competitiveness, and navigate market uncertainties.

Challenges Facing the Industry

While the HRC market continues to evolve, several challenges remain:

- Price Volatility: Fluctuating raw material costs and demand uncertainties make it difficult for businesses to maintain stable pricing strategies.

- Trade Protectionism: The imposition of tariffs and anti-dumping duties disrupts free trade and creates additional barriers for exporters.

- Supply Chain Disruptions: Global supply chain issues, stemming from logistical bottlenecks and geopolitical conflicts, continue to hinder the seamless flow of goods.

Opportunities for Growth

Despite the challenges, the hot-rolled steel market offers opportunities for growth:

- Expansion in Emerging Markets:

Developing regions with growing infrastructure needs present a significant demand for HRC products. - Technological Advancements:

The adoption of Industry 4.0 technologies in manufacturing processes can help steel producers reduce costs, improve efficiency, and enhance product quality. - Focus on Niche Applications:

By catering to specialized applications, such as lightweight automotive components or high-strength construction materials, manufacturers can differentiate themselves in the market.

Hot-Rolled Steel: A Key Driver in Infrastructure Development

Steel’s Role in National Development Projects

Governments globally are investing in infrastructure projects, including highways, bridges, and railways, which rely heavily on hot-rolled steel. This has sustained demand in regions undergoing rapid urbanization.

Challenges in Meeting Infrastructure Demand

Producers often face challenges such as raw material shortages, environmental regulations, and supply chain disruptions when scaling up to meet infrastructure demands.

How Technology Is Transforming Steel Production

Smart Manufacturing in the Steel Industry

The adoption of smart technologies, such as AI and IoT, has improved production efficiency. These advancements enable predictive maintenance, quality control, and real-time monitoring.

The Role of Automation

Automation in steel plants reduces human error, increases output, and optimizes resource utilization, resulting in better quality and cost control.

Environmental Sustainability in Steel Manufacturing

Low-Carbon Steel Innovations

With growing environmental awareness, the steel industry is investing in low-carbon technologies. Hydrogen-based steel production is one such innovation that reduces greenhouse gas emissions.

Recycling in Steel Production

The use of scrap steel in production processes helps reduce reliance on raw materials and minimizes environmental impact, making the industry more sustainable.

Green Building Materials

Steel manufacturers are focusing on producing eco-friendly materials to support sustainable construction practices.

Conclusion: Navigating a Challenging Landscape

The global hot-rolled coil market remains under pressure, with weak demand, competitive pricing, and economic uncertainty shaping its trajectory. While challenges persist, opportunities for recovery exist in infrastructure development, technological advancements, and sustainability initiatives. Producers must adapt to these dynamics and position themselves strategically to thrive in a volatile market.

For high-quality steel solutions tailored to your needs, explore the comprehensive range of products offered by Lux Metal Group.

The Role of Lux Metal in Supporting Industries

Why Choose Lux Metal?

Lux Metal offers high-quality steel solutions tailored to meet the diverse needs of industries. With state-of-the-art facilities and a commitment to sustainability, we ensure that our products align with industry standards and customer expectations.

Our Product Range

From hot-rolled coil steel to customized metal solutions, Lux Metal provides comprehensive offerings to support projects in construction, automotive, and other sectors.

Commitment to Excellence

At Lux Metal, we prioritize quality, precision, and customer satisfaction. Our team works closely with clients to ensure timely delivery and optimal solutions.

Visit Lux Metal Group for more information on premium steel products and solutions.