Overview of Scrap Metal in the Steel Market

Scrap metal is a vital feedstock for steel production, especially in Electric Arc Furnaces (EAFs), which rely on recycled materials. The demand for scrap metal is directly tied to steel production, which in turn is influenced by global economic trends, construction activities, and industrial output.

A drop in scrap metal prices often signals reduced steel production or a surplus of scrap supply. Such fluctuations can ripple through the entire supply chain, affecting manufacturers, recyclers, and end-users.

Factors Contributing to the Decline in Scrap Prices

1. Economic Slowdown

Global economic challenges, including slower growth in major economies, have significantly impacted the steel market. Construction and manufacturing—two sectors that drive steel demand—are experiencing reduced activity. Consequently, the demand for scrap metal has declined, putting downward pressure on prices.

2. Steel Market Oversupply

An oversupply of steel products in the global market has exacerbated the decline in scrap prices. With steelmakers reducing production or opting for alternative raw materials, the demand for scrap has weakened. This imbalance between supply and demand has led to price drops.

3. Geopolitical Tensions

Geopolitical uncertainties, such as trade wars, sanctions, and regional conflicts, have disrupted supply chains and affected global trade. For instance, restrictions on scrap exports in some regions and increased tariffs have reduced international scrap trade volumes, further contributing to price volatility.

4. Energy Costs

High energy costs, especially in Europe, have made steel production more expensive. Steelmakers facing rising operational costs are scaling back production, which in turn reduces their demand for scrap metal.

5. Currency Fluctuations

Exchange rate volatility has also played a role in shaping global scrap prices. Depreciation of local currencies against the US dollar makes imports more expensive, reducing the appetite for foreign scrap materials in many markets.

Impact on the Steel Industry

1. Reduced Profit Margins

Falling scrap prices can be a double-edged sword for steelmakers. While it lowers input costs for some, the overall decline in steel demand and prices reduces profit margins.

2. Challenges for Recyclers

Recyclers, who rely on selling scrap metal to steel producers, are facing declining revenues. Many are forced to adjust their operations, scale back collection activities, or explore alternative markets.

3. Shift in Production Methods

Some steelmakers are turning to alternative raw materials, such as direct reduced iron (DRI) or pig iron, to mitigate the impact of scrap price volatility. This shift could have long-term implications for the recycling industry.

4. Market Consolidation

The challenging market conditions may lead to increased consolidation within the steel and recycling industries. Smaller players struggling to cope with declining margins may merge with larger companies or exit the market altogether.

Global Scrap Prices Experience Decline Amid Steel Market Turbulence

Global scrap metal prices have been under considerable pressure recently, influenced by weakening demand for steel and geopolitical and economic uncertainties. From Türkiye to the EU and the US, market trends reveal an interconnected web of factors causing fluctuations in scrap prices.

This comprehensive analysis delves into the latest developments, with a particular focus on major steel-producing regions, and explores the broader implications for the global steel industry.

Scrap Market Trends in Türkiye

Declining Prices and Weak Demand

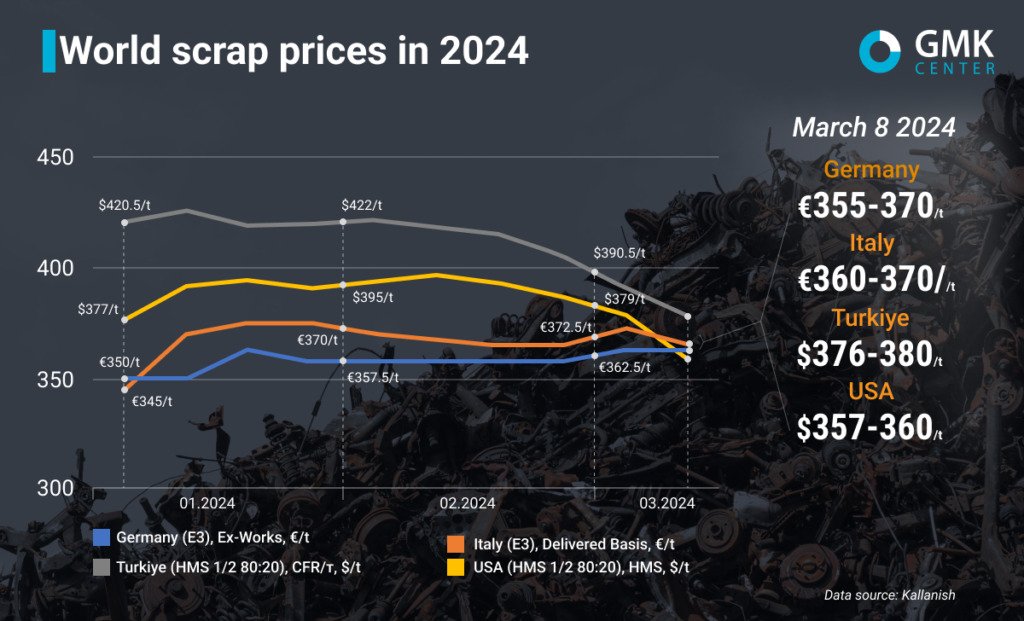

In early March 2024, Türkiye’s scrap market experienced continued price declines. Prices for HMS 1&2 (80:20) scrap dropped by $11 per ton (2.8%) between March 1 and March 8, falling to $376-380 per ton CFR. This marks an 8.6% decrease since the beginning of the year, reflecting ongoing volatility in raw material prices.

The decline began in February, fueled by reduced purchases from Asian consumers during the Lunar New Year and a slump in finished steel sales. Turkish steelmakers, facing an oversupply of scrap materials, adopted a cautious approach, buying only essential volumes and waiting for a clearer market outlook.

Oversupply and Domestic Challenges

While the Turkish market crossed the $400 per ton mark at the end of February, hopes for a recovery were dashed by persistently weak demand. Domestic steel producers, burdened by low sales and abundant raw materials, refrained from making significant purchases. The upcoming Ramadan period (March 10–April 9) is expected to further dampen activity, with many steelmakers planning to shut down operations temporarily.

Impact of the Chinese Economy

The Turkish market’s future also hinges on developments in China, a key player in global steel consumption. Despite post-holiday activity in China, its economy remains fragile, adding another layer of uncertainty for Turkish exporters.

European Scrap Market Stability Amid Volatility

Germany

Germany’s scrap prices remained relatively stable in early March 2024. E3 scrap was priced between €355-370 per ton Ex-Works, maintaining February levels. Since the beginning of the year, prices have risen modestly by €10 per ton.

Italy

In Italy, the situation was slightly different. E3 scrap prices fell by €5 per ton in early March to €360-370 per ton Delivered Basis. While there was an uptick earlier in the year, demand has slowed, and the market is now dominated by a cautious, wait-and-see approach.

Turkish Influence on European Scrap

Türkiye, a key export destination for European scrap, has drastically reduced its imports. This slowdown has led to oversupply in the European market, limiting price increases despite a relatively stable demand from domestic steelmakers.

Predictions for the EU Market

The Italian association Assofermet forecasts further declines in scrap prices unless steel production levels rise. With weak steel consumption, particularly in the construction sector, the EU market may remain under pressure for the foreseeable future.

Turkish Market: Stabilization Amid Pre-Holiday Activity

Slight Price Increase

In Türkiye, scrap prices rose by $6 per ton (1.6%) to $386 per ton CFR as of June 25, 2024. This upward trend, seen primarily in early June, was driven by increased local demand for raw materials, coupled with a stronger euro against the dollar. Steelmakers rushed to replenish stocks ahead of Ramadan, providing suppliers with leverage to increase prices.

Raw Material Shortage

Scrap sellers highlighted a shortage of raw materials caused by collection difficulties, further supporting higher price levels. However, as most steel mills completed their procurement plans, activity slowed down, and prices stabilized.

Future Outlook

Market participants expect prices to remain in the $380-390 per ton range in the short term, as neither significant demand surges nor supply pressures are anticipated.

EU Market: Stability with Minor Fluctuations

Germany: A Steady Trend

In Germany, E3 scrap prices remained stable at €345-355 per ton Ex-Works as of June 21, reflecting unchanged domestic demand and reduced export activity. This stability is likely to persist through the summer holiday season, given the current equilibrium in the commodity markets.

Italy: Demand Weakness Balances Supply Shortages

The Italian market experienced a slight decline, with E8 scrap prices falling by €10 per ton (-2.4%) to €380-400 per ton Ex-Works. The weak steel market and reduced demand for raw materials were offset by a limited scrap supply, preventing prices from dropping further.

Regional Dynamics

Similar trends were observed in France and Luxembourg, where stable conditions have kept price fluctuations minimal. The broader EU market is expected to maintain its current trajectory unless there are unexpected shifts in steel demand or scrap availability.

North American Market: Gradual Recovery

In North America, scrap prices on the US East Coast increased by $4 per ton (1.1%) to $358 per ton FOB between May 31 and June 21.

Export Demand from Türkiye

The slight price uptick was supported by improved export demand, particularly from Türkiye. However, weak demand from domestic steelmakers, facing lower hot-rolled steel prices, continues to cap significant gains.

Future Prospects

While seasonal factors may provide mild support, the overall market sentiment suggests limited price movements in the near term, as domestic and export markets remain in a delicate balance.

Chinese Market: Declining Scrap Prices Amid Seasonal Challenges

In China, scrap prices dropped by $11 per ton (-2.9%) to $373.04 per ton by the end of June.

Seasonal Factors Impacting Demand

Seasonal weather challenges, including high temperatures and heavy rains, have dampened steel demand and production, forcing many steelmakers to lower capacity utilization or undertake maintenance shutdowns.

Cost-Effectiveness of Pig Iron

Some steelmakers reported favoring pig iron over scrap due to cost advantages, further reducing scrap demand. Despite these challenges, the reduced collection of raw materials has provided some price support, preventing a more significant decline.

Future Outlook for the Global Scrap and Steel Markets

1. Regional Demand Recovery

- Türkiye’s Reconstruction Efforts: Post-earthquake rebuilding activities in Türkiye could lead to a significant increase in demand for steel and scrap materials. This reconstruction wave may stabilize or even push up prices as local steelmakers replenish their inventories.

- China’s Infrastructure Investments: Although China’s steel market has faced setbacks, its government’s focus on infrastructure investments could boost demand in the medium term, potentially revitalizing global scrap markets.

2. Environmental and Regulatory Pressures

- Sustainability in Steel Production: The steel industry’s commitment to reducing carbon emissions is expected to increase the use of recycled materials, including scrap. Governments and industries worldwide are pushing for greener practices, which could support higher scrap utilization rates.

- Regulations on Scrap Exports: Countries aiming to secure raw material supplies for domestic industries may impose stricter regulations on scrap exports. This could lead to regional price disparities and supply constraints in certain markets.

3. Global Economic Recovery

The trajectory of the global economy will significantly influence steel and scrap markets. Key factors include:

- Rebound in Construction and Manufacturing: As major economies recover from inflationary pressures, increased activity in construction, automotive, and manufacturing sectors will likely drive steel demand, creating a ripple effect on scrap prices.

- Infrastructure Spending: Governments prioritizing infrastructure projects to stimulate economic growth could enhance steel consumption, benefiting the scrap industry in turn.

4. Supply Chain Adjustments

- Technological Advancements: Innovations in scrap processing and steel production technologies will enhance efficiency, potentially reducing costs and increasing output quality.

- Decentralized Supply Chains: To mitigate risks from geopolitical tensions, many companies may diversify their supply chains, leading to a more balanced demand-supply equation across regions.

5. Seasonal and Market-Driven Price Adjustments

- Short-Term Stability: In the near term, oversupply in certain regions and weak steel demand may cap price increases. However, seasonal trends, such as reduced activity during summer months in some regions, may add volatility.

- Long-Term Growth Potential: As industries gradually adapt to current challenges, a stronger demand base is expected to emerge, driven by innovations and a focus on circular economies.

Lux Metal’s Role in the Steel Industry

At Lux Metal, we are committed to providing top-tier metal solutions that adapt to market trends and client needs. Our expertise in sustainable practices and advanced manufacturing ensures reliability and efficiency in every project.

Explore our offerings at Lux Metal Group and partner with us for innovative and sustainable metal solutions.