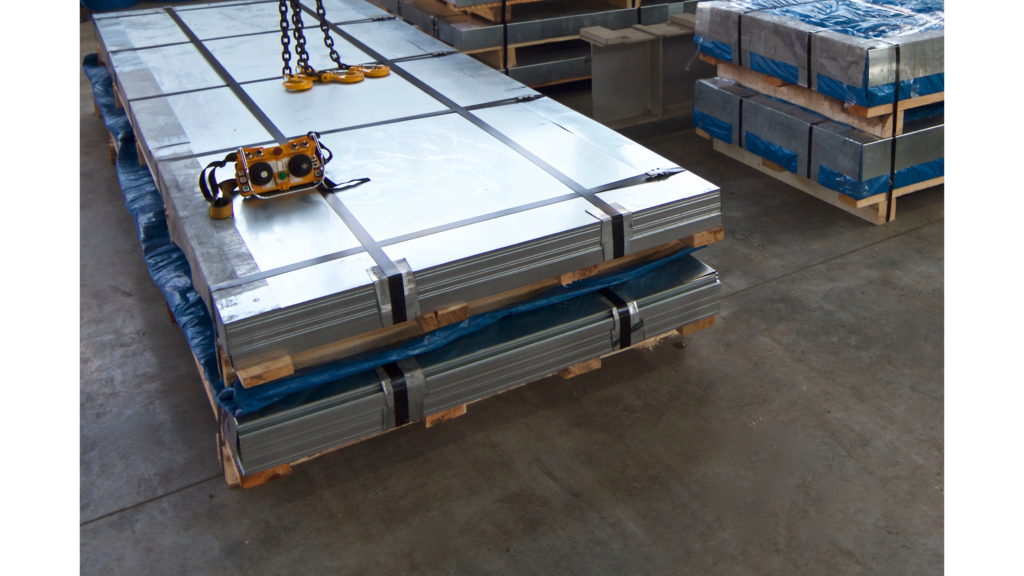

The global stainless steel production is expected to grow by 4.4% in 2024, reaching 60.53 million tons. This forecast was announced at the ICDA 2024 member meeting in Hong Kong, as reported by Kallanish.

Han Jianbiao, CEO of ZLJ Steel, stated, “We expect global stainless steel production to reach the range of 60-61 million tons, which corresponds to an increase of 2-3 million tons.”

The main contributors to this growth will be China and Indonesia. China’s production is projected to increase by about 5%, reaching approximately 40 million tons. Meanwhile, Indonesia’s production could rise by 20% year-over-year, reaching 5.5 million tons. Conversely, Europe is expected to experience a decline in production by 1.8% in 2024, according to ICDA forecasts.

As a result, the combined global share of Chinese and Indonesian stainless steel production is anticipated to reach 72.63%, up from 71.6% in 2023 and significantly higher than the 53.24% share in 2015.

The demand for stainless steel in 2024 will remain strong across various sectors, including infrastructure, consumer goods, chemical, petrochemical, and energy industries. However, there will be a reduction in demand from the heavy industry sector, and the automotive industry is also likely to see a decline in demand.

According to the World Stainless Association, it was noted that global stainless steel production in 2023 increased by 4.6% compared to 2022, reaching 58.4 million tons. Europe saw a decrease in production by 6.2% year-over-year to 5.9 million tons, and the United States experienced a decline of 9.6% year-over-year to 1.82 million tons. Production in Asia (excluding China) decreased by 7.2% year-over-year to 6.88 million tons. On the other hand, China’s production increased by 12.6% year-over-year to 36.68 million tons.

These trends highlight the shifting dynamics in the global stainless steel market, with Asia, particularly China and Indonesia, playing increasingly dominant roles.

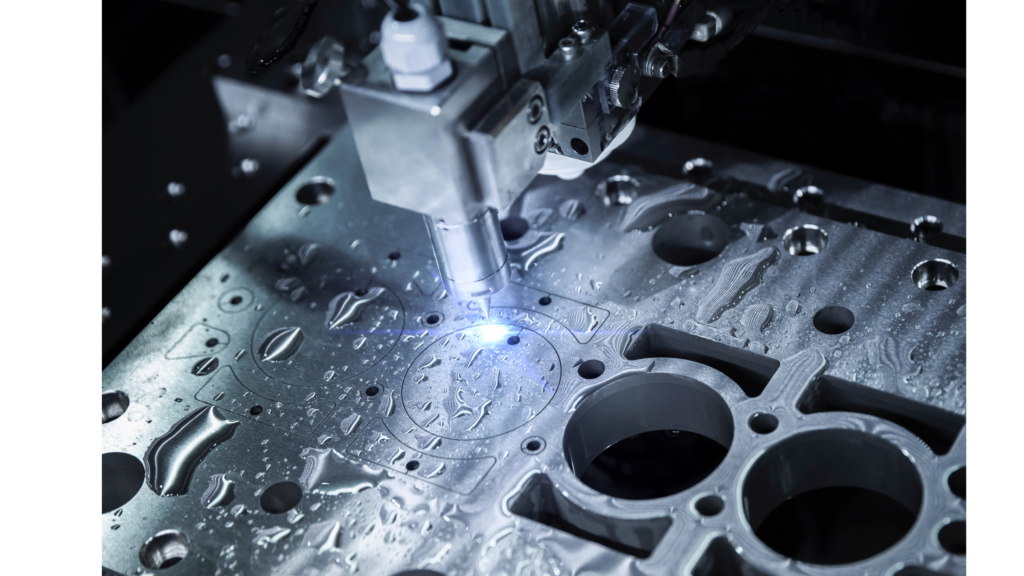

Stainless Steel Prices in Asia Robust and Continuing to Rise

Stainless steel prices in Asia are on the rise, with market participants reporting increasing prices, especially for cold-rolled products. This upward trend is driven by rising demand and heightened market activity. Additionally, raw material prices, despite some volatility, have remained stable and are generally trending upwards.

The supply situation in some regions, such as the European Union, remains tight with no immediate signs of improvement. This supply constraint further supports the rising prices in the Asian market.

Strong Performance Expected for IT, Utilities, and Raw Materials Companies in Asia

The reporting season for the first quarter has begun in Asia, with analysts from Deutsche Bank forecasting robust earnings growth for companies within the MSCI AC Asia ex Japan Index. These companies are expected to report an average earnings growth of nearly 24% in 2024.

Key Sectors Leading the Growth

- Information Technology (IT): The IT sector is poised for significant growth, with profits in the region expected to increase by 57% this year. This surge is likely driven by ongoing digital transformation efforts and increased demand for tech services and products.

- Utilities: Utilities companies are also expected to perform well, with forecasted earnings growth of 48%. The push for sustainable energy and infrastructure investments are key factors contributing to this growth.

- Raw Materials: Raw materials companies, benefiting from the rising prices of stainless steel and other commodities, are projected to see a profit growth of 40%. The robust demand for raw materials in various industries supports this optimistic outlook.

Conclusion

The stainless steel market in Asia is experiencing a robust period with prices continuing to rise due to strong demand and stable raw material costs. At the same time, the broader Asian market is witnessing significant earnings growth, particularly in the IT, utilities, and raw materials sectors. These trends highlight the dynamic and resilient nature of the Asian market, setting the stage for continued economic growth and investment opportunities in the region.

As the global market adjusts to these changes, stakeholders in various industries should keep a close eye on these developments to strategically position themselves and leverage the opportunities arising from these market dynamics.

For more information, visit the SteelNews.biz and GMK Center articles.

Visit Lux Metal Group for more insights and updates on stainless steel and other metal industry trends.