Introduction

Every U.S. election brings anticipation and speculation, as policy shifts and new regulations often shape both the national economy and global industries. For the metal manufacturing sector, an industry deeply connected to trade, regulatory policies, and global supply chains, election outcomes in the U.S. can trigger far-reaching changes. With issues such as tariffs, environmental regulations, and labor laws on the table, metal manufacturers must stay informed and agile to navigate potential impacts.

In this article, we’ll dive into 10 critical factors that could influence the metal manufacturing industry worldwide, highlighting how the U.S. election could shape everything from supply chain dynamics to workforce demands. Understanding these factors can help businesses make informed decisions and adapt to shifts that may come after the election.

1. Trade Policies and Tariffs

The U.S. has a longstanding practice of using tariffs to protect domestic industries and negotiate trade agreements. Recent years have seen a series of tariffs impacting metals, notably steel and aluminum, affecting both U.S.-based manufacturers and their international counterparts.

- Current Context: Recent tariffs on imported metals have led to increased production costs for manufacturers relying on these resources. Depending on the election outcome, these tariffs could either be lifted, remain in place, or even be extended to cover other metals.

- Potential Impacts: A candidate pushing for a more protectionist stance may keep tariffs high to encourage domestic metal production, which could increase costs for industries that rely on imports. Conversely, a more trade-friendly administration might seek to remove or reduce tariffs, improving access to foreign metals and lowering material costs.

2. Environmental Regulations and Sustainability Goals

Environmental policy has become a top concern, with regulations tightening in recent years to address climate change. This affects metal manufacturing, an industry with significant environmental impact due to emissions from mining, smelting, and processing.

- Election Implications: Depending on the winning administration, environmental regulations on emissions and resource extraction may either become stricter or more lenient. A pro-sustainability administration would likely impose stricter regulations to lower the industry’s carbon footprint, whereas a more business-friendly government might relax regulations to promote economic growth.

- Industry Effects: Increased regulation may drive up production costs as companies invest in cleaner technologies and waste management. However, it may also create new opportunities for “green” metals with lower environmental impact, encouraging innovation in the sector.

3. Corporate Tax Policies

Tax policies influence corporate profitability, affecting businesses’ ability to invest in new technologies, expand operations, and manage costs. For the metal manufacturing sector, changes in corporate tax rates could alter cash flow significantly.

- Potential Changes: One candidate may propose corporate tax cuts to stimulate domestic manufacturing, while the other may prioritize higher tax rates to fund social and infrastructure projects. Corporate tax incentives can also play a role, especially if they’re targeted at sustainable practices or domestic production.

- Impact on Metal Manufacturing: Lower corporate tax rates could increase profitability for metal manufacturers, enabling more reinvestment into technology and expansion. Higher rates, meanwhile, could reduce margins but may lead to incentives that reward environmentally friendly practices or domestic growth.

4. Infrastructure Investment Plans

U.S. infrastructure initiatives have a direct impact on the metal industry, as projects in transportation, energy, and public works drive demand for materials like steel, aluminum, and copper.

- Election Context: Candidates may differ on the level and focus of infrastructure investment, with proposals ranging from modernizing existing infrastructure to developing new projects focused on green energy.

- Demand Surge: Increased infrastructure spending would likely boost demand for construction metals, which could drive production growth. A focus on green infrastructure, such as renewable energy facilities, might further increase demand for metals used in electric vehicles (EVs), solar panels, and wind turbines.

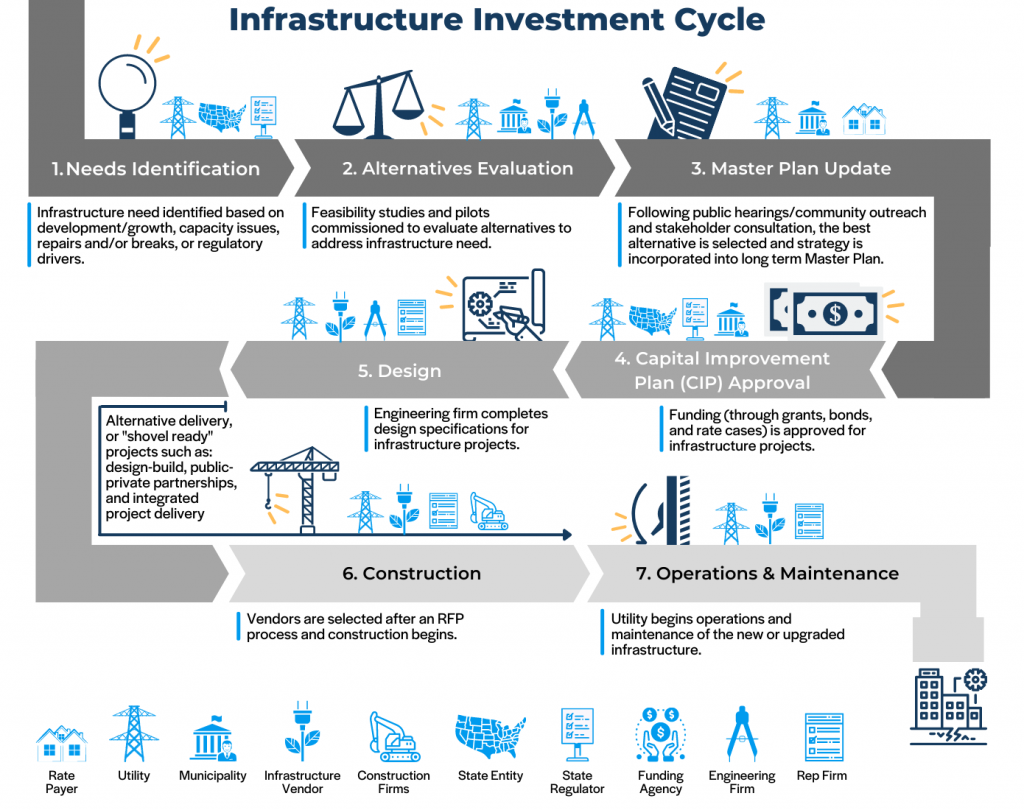

Reference: An Inside Look At The Infrastructure Investment Cycle

5. Labor Policies and Workforce Implications

Labor policies play a crucial role in shaping the workforce landscape, affecting everything from minimum wage to worker protections. Changes in labor laws can have far-reaching effects on manufacturing costs, especially for labor-intensive industries like metal production.

- Key Considerations: A pro-labor administration may increase minimum wage rates, implement stricter worker safety regulations, and strengthen union protections, potentially raising labor costs. Alternatively, a more business-oriented administration might seek to ease regulatory burdens on employers.

- Implications for Metal Manufacturing: Increased labor costs may squeeze profits or push companies to invest in automation to reduce reliance on manual labor. Conversely, a stable or reduced regulatory environment could maintain lower costs, though it might also affect worker satisfaction and retention.

6. Foreign Relations and Geopolitical Tensions

Geopolitical factors greatly influence metal manufacturing, particularly as it relates to international trade, market access, and supply chain stability. The U.S. has significant economic relationships with metal-producing countries like China, Russia, and Brazil.

- Election Factors: Candidates may differ in their approach to international relations, with one potentially pursuing a more isolationist stance, while the other may favor open trade agreements and alliances.

- Global Supply Chain Impact: Restrictive policies might limit imports from key metal-producing countries, raising material costs for manufacturers. Conversely, a diplomatic approach could promote partnerships and reduce tariffs, supporting more stable and affordable access to materials.

7. Investment in Green Technologies and Renewable Energy

The global shift toward renewable energy and sustainable practices is reshaping the metal industry, as metals are essential for components in green technology. Policies encouraging renewable energy would likely stimulate demand for metals like lithium, copper, and nickel.

- Election Dynamics: The focus on renewable energy varies among candidates. One may prioritize green investment, including subsidies for renewable energy and technology, while another may emphasize traditional energy sources.

- Industry Opportunities: Increased investment in green energy could drive demand for metals used in renewable technologies, from batteries to wind turbines. Metal manufacturers would benefit from diversifying into “green metal” production to meet this emerging market need.

8. Supply Chain Resilience and National Security Concerns

Recent disruptions, such as the COVID-19 pandemic, have exposed vulnerabilities in global supply chains. Many industries, including metal manufacturing, are reassessing supply chain resilience as a priority, and national security concerns are increasingly influencing policy decisions.

- Election Impact: Candidates may promote policies aimed at securing the supply chain for critical resources like metals, particularly those used in defense and technology. An emphasis on domestic production and stockpiling could become more pronounced, depending on the administration.

- Metal Manufacturing Effects: Policies supporting domestic production may lead to incentives for onshore manufacturing, which could be beneficial for U.S.-based metal companies. For global suppliers, however, restrictions on exports to the U.S. might lead to shifts in demand and market realignment.

9. Technology and Innovation Incentives

Technological advancements are transforming manufacturing, with AI, automation, and digitalization enabling more efficient production. Government incentives can accelerate the adoption of these technologies, particularly in sectors where innovation can boost competitiveness.

- Policy Differences: Some candidates emphasize tech investment, proposing grants or incentives for industries adopting advanced manufacturing technologies. Others may focus less on tech-specific incentives, leaving innovation to market forces.

- Implications for Metal Manufacturing: Incentives for technology could enable metal manufacturers to streamline operations, reduce costs, and improve product quality. On the other hand, without government support, companies may face higher costs to implement these technologies independently, which could limit their competitive edge.

10. Global Market Stability and Currency Impacts

Elections often affect economic stability, which can lead to currency fluctuations and volatility in global markets. For the metal industry, these changes in market stability and currency values can influence pricing and profitability.

- Election Effects: Depending on the election outcome, investor confidence and currency exchange rates may experience short-term fluctuations. Policies aimed at economic growth may stabilize the dollar, while more radical changes could introduce volatility.

- Pricing and Cost Implications: For metal manufacturers trading globally, a strong dollar could make U.S. exports less competitive, while a weaker dollar could increase demand for U.S.-based metals. Exchange rate shifts also impact the cost of importing metals, particularly from countries with fluctuating currency values.

Conclusion

The U.S. election holds significant implications for the global metal manufacturing industry, with numerous factors potentially influencing policies, demand, and profitability. From trade policies and tariffs to technology incentives and labor laws, metal manufacturers worldwide must prepare for a range of possible outcomes.

As the industry navigates these factors, companies should adopt flexible strategies and stay informed on policy developments. While uncertainties remain, an election-informed approach allows metal manufacturers to proactively address changes and secure their positions in an evolving market.

Staying adaptable is the key. As we’ve explored, shifts in environmental policies, infrastructure spending, and international relations could reshape the industry. By understanding these ten factors, metal manufacturing businesses can position themselves to thrive, regardless of the election outcome.

Whether you need custom metal parts for a DIY project, or specialized components for industrial applications, Lux Metal has the expertise and facilities to bring your vision to life. Visit our website at Lux Metal to explore our services and see how we can assist you in your next project.