What Is the London Metal Exchange (LME)?

The London Metal Exchange (LME) is the world’s largest market for trading industrial metals, with a history dating back to 1877. It serves as the global benchmark for prices on base metals such as aluminium, copper, nickel, and zinc — the very materials we at LUX METAL work with every day.

The LME plays a critical role in shaping the global metal economy by offering futures and options contracts, warehousing, and physical delivery. But now, it’s aiming to do more than just provide pricing — it’s positioning itself as a catalyst for sustainability.

LME’s Sustainability Initiative: What’s New?

The LME is currently engaging stakeholders across the metal supply chain to introduce sustainable metal premia — pricing differentials that will reflect the environmental credentials of specific metal brands. These premia will make the value of sustainable metal production transparent, empowering both suppliers and buyers to prioritize green alternatives.

According to Matthew Chamberlain, CEO of the LME:

“Our conversations with stakeholders have shown that there is support for establishing a way to reflect an LME brand’s sustainability in its price.”

This initiative will cover four key LME metals — aluminium, copper, nickel, and zinc — and aims to go beyond simple carbon footprint measures, incorporating broad sustainability criteria and third-party certifications.

How Will It Work?

The LME has partnered with Metalshub, a digital platform that facilitates the trading of low-carbon metals. The plan includes:

- Publishing sustainability premia for each metal based on real transaction data from the Metalshub platform.

- Establishing a pricing administrator to ensure transparency and fairness in the process.

- Using LMEpassport, a digital credentialing tool, to verify the sustainability credentials of each metal brand.

Sustainability criteria will include:

- Carbon footprint thresholds, calculated using industry-specific methodologies.

- Third-party sustainability assurance, such as The Copper Mark or the Aluminium Stewardship Initiative.

Breakdown of Sustainable Metal Standards

Here’s a summary of the proposed criteria for each metal:

| Metal | Carbon Methodology | Third-Party Assurance |

|---|---|---|

| Nickel | Nickel Institute methodology | Future: The Nickel Mark |

| Copper | International Copper Association methodology | The Copper Mark |

| Aluminium | International Aluminium Institute methodology | Aluminium Stewardship Initiative Performance Standard |

| Zinc | International Zinc Association methodology | The Zinc Mark |

This multi-layered approach aims to create credible sustainability premia and ultimately reshape the way we view and value metals on the global market.

Supporting a Greener, More Transparent Market

The introduction of sustainability premia will also:

- Incentivize greener production methods across the global supply chain.

- Reward manufacturers that adopt environmentally friendly practices.

- Empower consumers and investors to prioritize low-carbon, responsibly sourced products.

- Drive investment into new technologies and sustainable mining practices.

Nick Stansbury from Legal & General summed it up perfectly:

“Transparent pricing of sustainable materials is critical to incentivising investment into transition technologies in the mining industry.”

At LUX METAL, we echo this sentiment and are excited to see how this initiative will encourage innovation and investment in the metals sector globally.

LUX METAL Insights: Aluminium Market Dynamics Shift East — What It Means for the Future of Metals

In the ever-evolving landscape of global metals trading, few materials are as central to the manufacturing world as aluminium. At LUX METAL, where we deliver precision-engineered aluminium and stainless steel solutions across Malaysia and beyond, understanding global market forces helps us better serve our clients — and anticipate future trends.

Today, the spotlight is on a significant shift: the growing influence of Asia — especially China — on the London Metal Exchange (LME) Aluminium market. This evolution is not only changing how aluminium is priced and traded globally, but also rebalancing supply and demand patterns between East and West.

From West to East: A Market Rebalanced

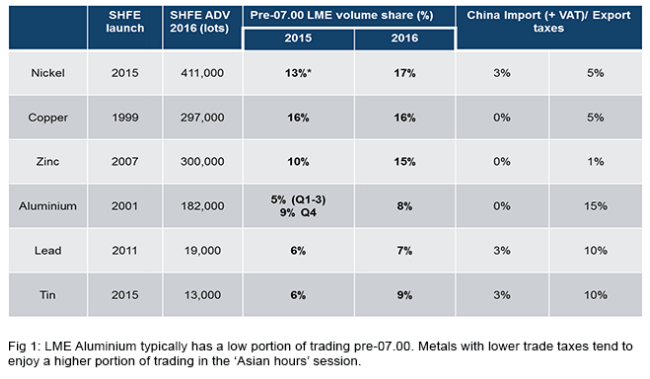

Since China imposed a 15% export tax on primary aluminium in 2006, its aluminium sector has largely operated in a self-contained loop. Most Chinese-produced aluminium stayed domestic, creating limited pricing interaction between China’s Shanghai Futures Exchange (SHFE) and the LME.

For years, this led to relatively quiet LME aluminium trading activity during Asian hours, typically before 3:00 p.m. Shanghai time (or 7:00 a.m. London). Unlike copper — which sees synchronized trading patterns between SHFE and LME — aluminium remained disconnected… until recently.

A Surge in Asian Trading Activity

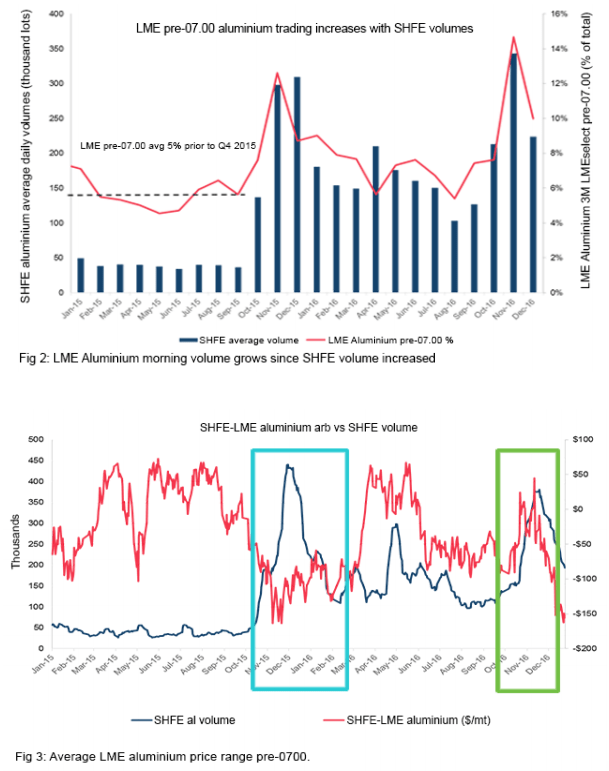

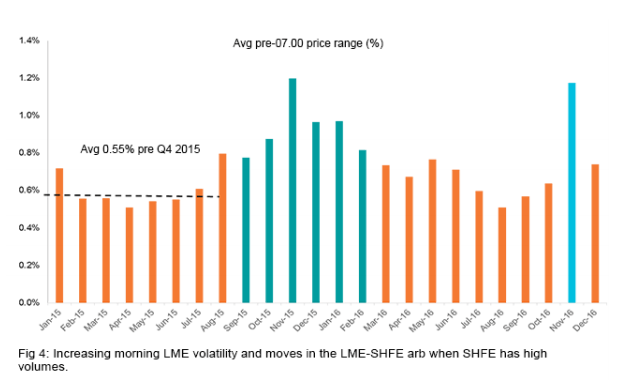

Something changed in Q4 2015. SHFE volumes jumped, and LME aluminium trading during Asian hours grew from just 5% of daily volume in the earlier part of the year to 8–9%. This might seem modest, but in the world of commodity trading, that’s a seismic shift.

LME aluminium prices also became more volatile during Asian hours, with price swings doubling during high-volume months like November 2015 and 2016. This signals not just increased volume but deeper interdependence between the two markets.

At LUX METAL, this is of critical importance. We source, fabricate, and deliver aluminium products that support Malaysia’s infrastructure, industrial, and consumer needs. A more synchronized aluminium market helps create greater transparency, better arbitrage opportunities, and clearer pricing signals — all of which help us deliver better value to our clients.

What’s Behind the Shift?

There are several drivers bringing these previously isolated markets closer together:

1. Rise in Semi-Finished Aluminium Exports from China

Unlike primary aluminium, semi-fabricated aluminium products benefit from export rebates, making them more economically viable to ship abroad. These “semi-arb” trades — where Chinese manufacturers export processed goods instead of raw aluminium — create stronger trade linkages between China and the global market.

For companies like LUX METAL, which frequently works with customised aluminium parts and semi-finished materials, this increase in cross-border trade improves access to diverse supply sources — often at more competitive prices.

2. On-Screen Traders and Aluminium Arbitrage

It’s not just producers and merchants involved in the change. Today’s aluminium markets are increasingly influenced by screen-based traders who arbitrage the difference between SHFE and LME prices. As a result, activity on one exchange directly impacts the other, especially during intra-day trading.

This increased liquidity is good news. Greater participation and price movement during Asian hours helps build a market that’s more reflective of real-time regional demand — including Southeast Asia, where Malaysia plays a growing role as a manufacturing hub.

A New Aluminium Hub: Asia Takes the Lead

After the 2008 financial crisis, most of the world’s LME aluminium stocks were concentrated in the US and Europe. These regions held long queues at major warehouses, creating discounted stock available for long-position holders to pick up cheaply. This bias gave the West pricing power in the OTC (over-the-counter) market.

But by 2016, the tide began to turn. Thanks to LME warehouse reforms, delivery tightness, and curve backwardation (tight forward supply), LME aluminium inventories began shifting back to Asia.

Today, for the first time since 2008, Asia holds more live aluminium warrants than the US or Europe. This is a major structural shift that’s moving aluminium’s pricing centre of gravity closer to the East — and with it, greater influence for Asian producers and consumers alike.

What It Means for Malaysia — and LUX METAL Clients

As Asia becomes a more central player in the aluminium market, manufacturers like LUX METAL benefit from:

✅ More Competitive Pricing

With stronger arbitrage opportunities between SHFE and LME, pricing becomes more responsive to Asian market realities, including local demand and production trends.

✅ Better Supply Chain Access

Higher volumes and stock availability in Asia reduce lead times and enhance access to primary and semi-finished aluminium. For a manufacturer like LUX METAL, this ensures greater responsiveness and flexibility in fulfilling project requirements.

✅ Regional Relevance

As Malaysia grows its own industrial and export sectors, having aluminium pricing that’s more closely aligned with the Asia-Pacific market means more accurate cost forecasting, sourcing, and product planning.

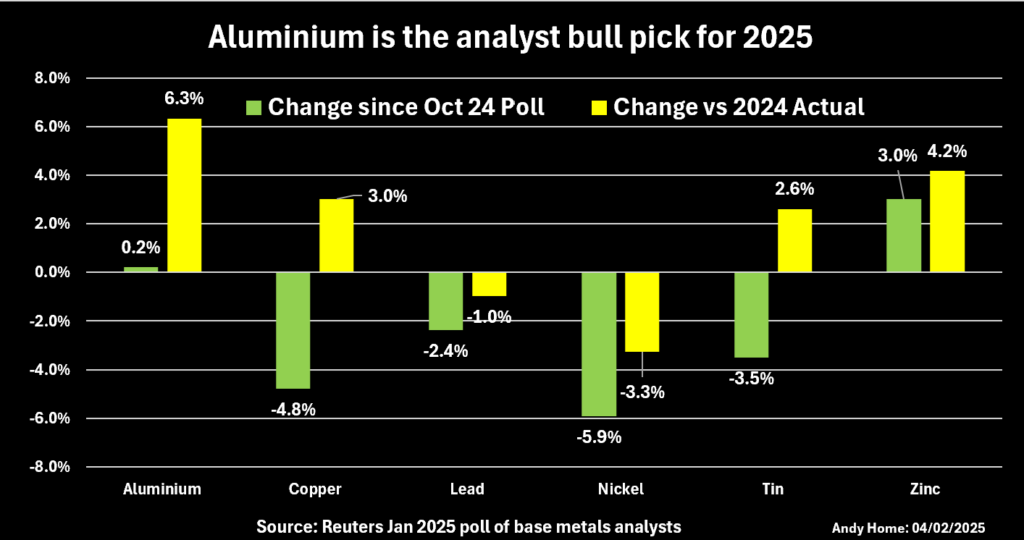

Aluminium: The Base Metal to Watch in 2025

According to the latest Reuters Base Metals Poll (January 2025), analysts expect the average aluminium cash price to rise 6.3% this year to $2,573.50 per metric ton, building on a 4.9% increase in 2024.

But beyond the numbers, it’s the shift in market fundamentals that makes aluminium the standout metal for 2025 and beyond:

🔹 Forecasted Supply Deficit

The aluminium market is now projected to shift into a deficit of 8,000 tons in 2025, a sharp reversal from earlier oversupply expectations. By 2026, the gap is expected to widen to 365,000 tons, suggesting long-term supply tightness.

🔹 Smelter Capacity Limits in China

China — the world’s top aluminium producer — is now operating near its national cap of 45 million metric tons. With production growth hitting a ceiling, global aluminium supply growth is constrained, setting the stage for a tighter market.

🔹 Rising Alumina Prices and Raw Material Costs

Tightness in the alumina market (a key input for aluminium production) is supporting higher aluminium prices, especially as energy and processing costs remain elevated.

The Bigger Picture: Why Aluminium is More Than Just a Price Chart

Aluminium’s bullish outlook isn’t just about markets — it’s about global transformation. This lightweight, corrosion-resistant, and endlessly recyclable metal is crucial to:

- Sustainable construction and green buildings

- Electric vehicles and renewable energy infrastructure

- Consumer electronics and lightweight machinery

As the world shifts toward cleaner technologies and smarter manufacturing, aluminium becomes a strategic material of the future. Malaysia’s industrial and export sectors stand to benefit — and LUX METAL is ready to support that growth.

Industry Outlook Beyond Aluminium

While aluminium leads the 2025 base metals pack, here’s a quick snapshot of the other key LME metals:

| Metal | 2025 Forecast Trend | Insights |

|---|---|---|

| Zinc | +4.2% | Tight supply now, but expected to ease in 2026. |

| Copper | +3.0% | Slower growth due to macro headwinds and trade tensions. |

| Tin | +2.6% | High volatility and wide price expectations. |

| Nickel | Flat-to-slight-recovery | Oversupplied in 2025; recovery expected only by 2026. |

| Lead | Stable | Minimal price movement expected. |

Aluminium, meanwhile, is the only metal expected to maintain a strong upward trajectory into 2026 — driven by long-term structural constraints and rising global demand.

Looking Ahead: LUX METAL’s Commitment to Smart Sourcing

At LUX METAL, we understand that global market intelligence is key to providing cutting-edge solutions. Whether it’s aluminium pricing, sustainable materials, or supply chain dynamics, we keep a close watch on the evolving landscape.

This shift of aluminium’s pricing and trading activity toward Asia is more than a trend — it’s a structural evolution. And we’re here for it.

By staying connected to both global exchanges and regional suppliers, LUX METAL ensures our clients always get precision-crafted metal products backed by smart sourcing, competitive pricing, and on-time delivery.

Visit our website at Lux Metal to learn more about how we can support your manufacturing needs and help you navigate these challenging times.

📚 References & Further Reading

For those interested in diving deeper into the global aluminium outlook and pricing dynamics, check out the following articles:

- 🔗 LME explores establishing price premia for sustainable metals – LME News

- 🔗 Aluminium is base metals analysts’ bull pick for 2025 – Reuters, Andy Home

- 🔗 LME Aluminium: West to East as Asian influence rises – LME Insight