Green Steel May Occupy 2.5% of Global Market by 2035 – But Major Challenges Remain

The global push for sustainable industrial practices is gaining momentum, and the steel sector—responsible for nearly 8% of total global carbon emissions—is under increasing pressure to decarbonize. One of the most promising solutions is green steel, primarily produced using hydrogen-based direct reduced iron (DRI). However, despite this potential, recent projections from the technology research firm IDTechEx suggest a slower adoption curve than anticipated.

According to a new report highlighted by Gasworld, hydrogen-based green steel production could reach 46 million tons by 2035. Yet, even this progress would represent only 2.5% of global steel production, pointing to the enormous technological and economic hurdles that still stand in the way.

Green Steel: What Is It and Why Does It Matter?

Traditional steelmaking relies heavily on coal-fired blast furnaces, which emit vast amounts of CO₂ during the process of reducing iron ore. Green steel, on the other hand, replaces coal with green hydrogen—hydrogen produced through renewable-powered electrolysis—with water vapor being the only byproduct. This breakthrough is seen as a cornerstone of decarbonizing heavy industry.

But making green steel at scale is not simple.

The Main Bottleneck: Hydrogen’s High Cost and Infrastructure Gaps

The report by IDTechEx points out that high hydrogen prices and a lack of supporting infrastructure are major impediments to rapid growth in green steel production.

- In Europe, the price of green hydrogen frequently exceeds €6 per kilogram, making large-scale production economically unattractive.

- Without substantial subsidies or policy certainty, many manufacturers are hesitant to make long-term investments.

These concerns are echoed by Fortescue Energy CEO Mark Hutchinson, who noted that electrolyzers (which produce hydrogen) are still prohibitively expensive, and government incentives haven’t lived up to expectations. While prices are expected to drop, the timeline is uncertain, and producers remain wary.

A Global Patchwork of Policies and Strategies

Different regions are taking varied approaches to promoting green steel:

Europe: Leading the Policy Push

- The Emissions Trading System (ETS) and the soon-to-be-implemented Carbon Border Adjustment Mechanism (CBAM) are driving European producers to explore low-carbon steel options.

- Public funding and regulatory support are accelerating green steel initiatives across the EU.

United States: Incentives and Grants

- The U.S. government offers tax credits and subsidies for clean hydrogen and carbon capture.

- However, the long-term viability of these support schemes—and the pace of industrial adoption—remain unclear.

China: Expanding Hydrogen, But Still Fossil-Heavy

- China is rapidly growing its hydrogen production capacity.

- Yet much of it relies on fossil-based sources, such as coke oven gas, to produce DRI—making it less environmentally beneficial in the short term.

Interim Solutions in the Steel Industry

While full hydrogen integration is still years away, steelmakers are adopting transitional strategies to cut emissions:

- Injecting hydrogen or biomass into existing blast furnaces

- Recycling furnace waste gases for energy reuse

- Increasing use of electric arc furnaces (EAFs), which can operate on scrap metal and electricity rather than raw iron ore and coal

These methods offer incremental improvements, but they are not long-term replacements for green hydrogen-based steelmaking.

Automotive Sector: Driving Demand for Green Steel

One bright spot in the push for sustainable steel is the automotive industry. With increasing pressure to cut Scope 3 emissions and comply with recycled content regulations, automakers are proactively seeking out greener materials.

According to IDTechEx:

- Using green steel would only increase car manufacturing costs by $100–$200 per vehicle—a premium that the industry is willing to absorb.

- Leading car manufacturers, such as Volvo and Mercedes-Benz, have already announced plans to use green steel in future models.

In contrast, sectors like construction, industrial equipment, and shipbuilding are progressing more slowly, largely due to tighter cost constraints and slower innovation cycles.

Billions Flowing into Hydrogen-Ready Projects

Despite the challenges, major steel producers are investing aggressively in future hydrogen-based capabilities. By the mid-2030s, up to 100 million tons of hydrogen-ready steel production capacity is expected to come online globally.

However, most of these projects will initially run on natural gas as a transitional fuel, with plans to switch to green hydrogen once it becomes more affordable and widely available.

The Green Premium Dilemma

One of the biggest obstacles for green steel’s widespread adoption is the green premium—the additional cost of producing steel using environmentally friendly methods. Until now, most buyers are unwilling to pay for this premium unless mandated by regulation or incentivized by subsidies.

As Fortescue Energy’s Mark Hutchinson highlighted, demand for hydrogen—and by extension, green steel—remains tepid largely because buyers don’t yet see a compelling business case.

Creating robust demand will require:

- Clear government procurement policies

- Carbon tariffs like CBAM to level the playing field

- Collaborative public-private initiatives to drive innovation

China Strengthens Carbon Control in Steel Industry: A Major Step Towards Global Emissions Accountability

As the world’s largest producer of steel, China is once again under the spotlight—but this time, for a significant environmental pivot. In a move that could reshape the global steel industry’s trajectory, the Chinese Ministry of Ecology and Environment recently launched a public feedback initiative for its proposed guidelines on greenhouse gas (GHG) emissions reporting within the steel sector. This bold step reflects China’s commitment to integrating its steelmakers into a broader national carbon market by the end of 2024.

At Lux Metal, as a leading player in Malaysia’s steel manufacturing sector, we recognize the critical importance of staying informed about such international developments. These regulatory changes signal shifting global standards, and aligning with these changes positions us—and our partners—for long-term competitiveness and compliance.

What is Steel’s Carbon Footprint?

In 2020, steel was responsible for 2.6 billion tonnes of CO2e (carbon dioxide equivalent) emissions. That’s around ~8% of global emissions. This makes it one of the world’s top 3 highest emitting materials, alongside aluminum and cement.

Across the 15 countries that produce the most steel, around 2 tonnes of CO2e are produced per tonne of crude steel.

Reducing emissions from steel is a geopolitical, as well as a geographical challenge. The steel industry is strategically important, so many countries choose to produce steel locally rather than using cheaper, cleaner, or better quality imports. The EU CBAM aims to address steel’s carbon footprint.

What Causes Steel’s Emissions?

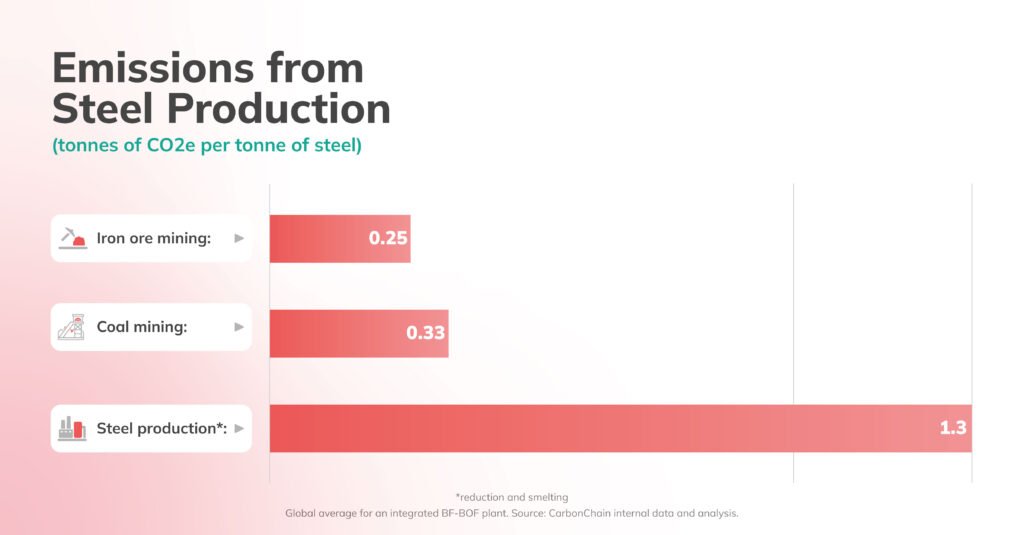

Broadly, there are 3 stages to making steel: the mining of iron ore, reduction into iron, and smelting into steel.

The industrial revolution was spurred by a groundbreaking, inexpensive way of mass-producing steel: the carbon-intense Bessemer process, which burns iron ore with coal to reduce it to metallic iron.

Today, scrap metal can be recycled into steel without burning coal. But, scrap alone can’t meet global demand for steel.

New steel continues to be produced from iron ore, mostly relying on a modern version of the coal-powered 200 year-old Bessemer process: the BF-BOF method (outlined below). For steel that’s produced in this way, coal mining contributes to its carbon footprint:

The Motivation Behind China’s Push for Emission Transparency

China’s steel sector accounts for roughly 17% of its total GHG emissions. The majority of its production remains dependent on coal-powered blast furnaces, leading to an average carbon dioxide emission rate of 2.3 tons per ton of steel. This figure sharply contrasts with the global average of 1.4 tons, according to a report by the Asia Research & Engagement think tank.

This emission intensity has put pressure on Beijing to take tangible steps toward decarbonization. The proposed guidelines for GHG reporting are not just a domestic effort—they reflect the growing pressure from international mechanisms such as the European Union’s Carbon Border Adjustment Mechanism (CBAM), which compels exporting countries to report and reduce their carbon footprint.

Standardizing Carbon Reporting: The First Step to Accountability

The new emissions guidelines are designed to standardize how steel producers report their emissions. All mills participating in the national carbon market will need to comply. Proposals and public comments on the guidelines are open until December 16, 2024, signaling a clear and urgent roadmap toward full implementation.

Once implemented, this initiative will:

- Improve transparency and traceability in carbon data reporting.

- Ensure that Chinese steel exports remain eligible in international markets, especially Europe.

- Enhance emissions monitoring capacity across hundreds of industrial facilities.

Expansion of China’s Carbon Market

China’s mandatory carbon market currently covers around 2,200 energy companies. By expanding its reach to include the steel, cement, and aluminum industries, Beijing aims to cover up to 70% of national emissions by 2030.

This expansion reflects a key strategic shift: previously focused solely on the power sector, China’s emissions trading scheme (ETS) will now influence the country’s heavy industries. This inclusion will not only encourage low-carbon innovation but also create new market dynamics in global steel trade.

Implications for Global Trade and Southeast Asian Steelmakers

For steel manufacturers in Southeast Asia, including companies like Lux Metal, these developments are far from isolated. As more countries implement carbon pricing and emissions-related import policies, supply chains will need to evolve.

Here’s how this shift might impact the region:

1. Stricter Carbon Regulations on Imports

Countries like Malaysia that export steel products to China, Europe, or the United States may soon need to comply with carbon verification procedures similar to CBAM. This means local steelmakers will need to track, report, and eventually reduce their emissions to remain globally competitive.

2. Push Towards Green Steel

The global market is shifting toward green steel—steel produced using low or zero-carbon methods such as hydrogen-based production or electric arc furnaces powered by renewable energy. China’s reporting initiative is a precursor to broader adoption of green technologies, and regional manufacturers will likely face increasing demand for similar accountability.

3. Increased Demand for Clean Technology

China’s environmental standards are creating ripple effects. Steel manufacturers that invest early in cleaner technologies and transparent emissions reporting will have a distinct advantage in attracting foreign partnerships, especially as companies in Europe and North America tighten their sustainability goals.

China’s Carbon Ambition: Driven by Domestic and Global Pressures

China’s urgency in reforming its steel sector stems from both internal and external factors:

- Domestic Pollution and Climate Goals: With targets to reach carbon neutrality by 2060 and peak carbon emissions by 2030, China must address its most carbon-intensive sectors.

- International Market Access: Trade access to environmentally regulated markets, particularly the EU, is becoming contingent on strict carbon reporting. CBAM alone has forced Chinese exporters to rethink their entire production and supply chain models.

- Technological Advancement: Modernizing production through AI-based emission monitoring, carbon capture and storage (CCS), and hydrogen-based processes requires standardized data. These guidelines will set the stage for digital transformation in the steel industry.

U.S. Senators Propose Foreign Pollution Fee Act to Level the Carbon Playing Field

In a major development that could reshape international trade and climate policy, U.S. Republican Senators Bill Cassidy and Lindsey Graham have reintroduced an updated version of the Foreign Pollution Fee Act in 2025. The bill, aimed at protecting American manufacturing and promoting environmental responsibility, proposes a carbon tax on imports from countries with high-emission production practices—most notably China.

The bill seeks to close the gap between domestic and international manufacturing standards, discourage environmental negligence abroad, and promote clean production across global supply chains.

Why the Foreign Pollution Fee Act Matters

For years, American manufacturers have been subject to strict environmental regulations that limit emissions and ensure sustainable practices. While these measures are crucial for protecting the planet, they come at a financial cost. In contrast, many international competitors—including China—operate under looser environmental standards, allowing them to lower production costs by up to 20%, according to Senator Bill Cassidy.

This disparity has led to two major challenges:

- Unfair Competition – Foreign companies benefit from cheap production and flood U.S. markets with low-cost goods.

- Environmental Outsourcing – Polluting industries shift to countries with lax regulations, defeating global climate goals.

The Foreign Pollution Fee Act directly addresses these concerns, pushing for a fairer global trade environment that rewards clean production and penalizes pollution-heavy imports.

“It is long past time that the polluters of the world, like China and others, pay a price for their policies. This bill calls out the foreign polluters and rewards American businesses who are doing the right thing,” – Senator Lindsey Graham

Key Features of the Foreign Pollution Fee Act

The updated 2025 draft of the Foreign Pollution Fee Act is a refined version of the bill initially introduced in 2023. The revision reflects the feedback received during the public consultation period and demonstrates a more targeted approach to carbon regulation at the U.S. border.

1. Targeted Carbon Fee Based on Emissions

- The bill abolishes the original blanket 15% carbon tax on all imports.

- Instead, the updated version applies only to imports with higher carbon intensity than equivalent American-made goods.

- The tax begins with a base rate and allows for an additional 40% surcharge based on the product’s carbon footprint.

This targeted method ensures that only polluting imports are penalized while environmentally responsible foreign producers are not unfairly taxed.

2. Sectors Covered

The carbon fee will apply to six of the most emission-intensive industries:

- Aluminum

- Cement

- Iron and Steel

- Fertilizers

- Glass

- Hydrogen

These sectors are not only central to industrial economies but are also among the largest contributors to global carbon emissions.

3. Support for U.S. Manufacturing

The bill aims to:

- Revitalize American manufacturing by disincentivizing imports made through polluting processes.

- Expand U.S. export markets by rewarding clean production.

- Strengthen global supply chain resilience by encouraging trade with environmental and economic allies.

International Impact: Spotlight on China

China is the primary target of the bill’s policy push. As the world’s leading manufacturing hub, China’s heavy reliance on coal-based energy and industrial-scale production makes it one of the largest carbon emitters globally.

The new legislation challenges China’s current trade practices and could significantly alter how goods from China are treated at U.S. ports. By attaching a financial penalty to environmentally harmful imports, the U.S. aims to push global producers toward cleaner technologies.

Strategic Goals of the Legislation

The Foreign Pollution Fee Act is about more than environmental protection—it’s a strategic trade and economic policy designed to achieve multiple objectives:

- Create a Level Playing Field – Ensure that American manufacturers are not disadvantaged by competing with countries that ignore environmental costs.

- Encourage Global Decarbonization – Push international producers to adopt cleaner, greener production methods.

- Promote Environmental Accountability – Reward countries that enforce environmental regulations.

- Drive Innovation in Clean Technology – Provide a market incentive for investing in lower-emission technologies.

- Align Trade With Climate Goals – Support the broader U.S. agenda for carbon neutrality and leadership in climate diplomacy.

Support from U.S. Industry

The updated bill has been well received by key U.S. industrial stakeholders. Organizations such as the American Iron and Steel Institute (AISI) and the Steel Manufacturers Association (SMA) have publicly expressed their support for the initiative.

Their endorsement underlines a growing consensus among American producers that climate-conscious trade policy is not only desirable but necessary.

Encouraging Global Compliance and Partnerships

One of the long-term goals of the Foreign Pollution Fee Act is to encourage cleaner production methods among U.S. trade partners. Rather than creating barriers, the bill offers an incentive structure:

- Countries with cleaner production get better access to the U.S. market.

- Those with high-emission outputs are pressured to reform or lose competitiveness.

This mechanism could lead to broader adoption of environmental standards in countries eager to preserve trade relationships with the United States.

Furthermore, the act aims to deepen trade alliances with countries that share the U.S. vision of sustainable economic growth—potentially giving rise to a new global coalition for green trade.

The Role of Lux Metal in the New Era of Green Steel

As the global steel market transitions, Lux Metal stands prepared to meet the challenges and opportunities of this evolving landscape. Our focus remains firmly on sustainable, precision-based, and customizable steel manufacturing services for both industrial and DIY applications.

Our Commitment to Sustainable Steel Fabrication

Lux Metal is actively exploring and implementing the following initiatives:

- Upgraded Machinery: Our facility is equipped with state-of-the-art equipment such as CNC laser cutting machines, V-cutting machines, and precision welding tools that reduce energy waste and minimize material scrap.

- Recycling and Waste Management: Through internal recycling protocols and responsible sourcing, we work toward minimizing our carbon footprint at each stage of production.

- Data-Driven Operations: We are enhancing our internal tracking systems to monitor material usage, emissions, and energy consumption—aligning with global standards for emissions transparency.

Custom Steel Solutions for Every Sector

Whether you are in the construction industry, industrial equipment manufacturing, or a creative DIYer, Lux Metal provides tailored solutions designed to meet your needs:

- Custom Fabrication Services – Bending, milling, turning, welding, and sheet rolling for complex steel components.

- Laser Cutting & Engraving – Precision laser machinery that handles everything from large industrial jobs to fine detailing.

- Metal Design Consultation – Expert guidance for customized projects that require innovative steel design and functionality.

- Fast Turnaround & Delivery – Responsive production timelines that help you stay on schedule.

Visit Us: Lux Metal Official Website

Conclusion:

The introduction of the Foreign Pollution Fee Act marks a pivotal moment in the evolution of trade and climate strategy. By tying carbon accountability to international commerce, the U.S. is sending a strong message: Environmental responsibility is now a global trade requirement.

As the world’s leading economies adjust to this new paradigm, manufacturers must prepare to meet rising expectations in sustainability, transparency, and innovation. Those who adapt early—by embracing clean technologies and responsible sourcing—will not only survive this transition but emerge as leaders in the new era of green trade.

China’s initiative to seek public feedback on emissions reporting guidelines for the steel sector is a landmark move in global decarbonization efforts. As one of the largest contributors to greenhouse gases, China’s actions will directly influence worldwide environmental strategies and trade regulations.

For manufacturers, suppliers, and clients across the globe—including in Malaysia—this represents both a challenge and a massive opportunity. Companies that can adapt to these standards early will not only survive but thrive in the green economy of tomorrow.

At Lux Metal, we’re not just watching the future unfold—we’re helping to shape it.

References:

- China collects feedback on project to measure emissions in steel industry

https://gmk.center/en/news/china-collects-feedback-on-project-to-measure-emissions-in-steel-industry/ - Green steel may occupy 2.5% of the market by 2035 – study

https://gmk.center/en/news/green-steel-may-occupy-2-5-of-the-market-by-2035-study/ - US senators introduce updated bill on cross-border carbon tax

https://gmk.center/en/news/us-senators-introduce-updated-bill-on-cross-border-carbon-tax/ - Understand Your Steel Emissions – CarbonChain

https://www.carbonchain.com/blog/understand-your-steel-emissions