⚡ Europe’s Electricity Prices in June 2025: Mixed Trends, Industrial Impact & Steel Sector Struggles

In June 2025, electricity prices across Europe exhibited mixed trends, shaped by fluctuating gas prices, rising CO₂ emission costs, volatile demand driven by heatwaves, and a diversified energy mix. These price shifts have serious implications for energy-intensive industries — particularly the steel sector — and expose the urgency for structural reforms in electricity pricing and industrial support.

📊 Wholesale Electricity Prices: Country Breakdown

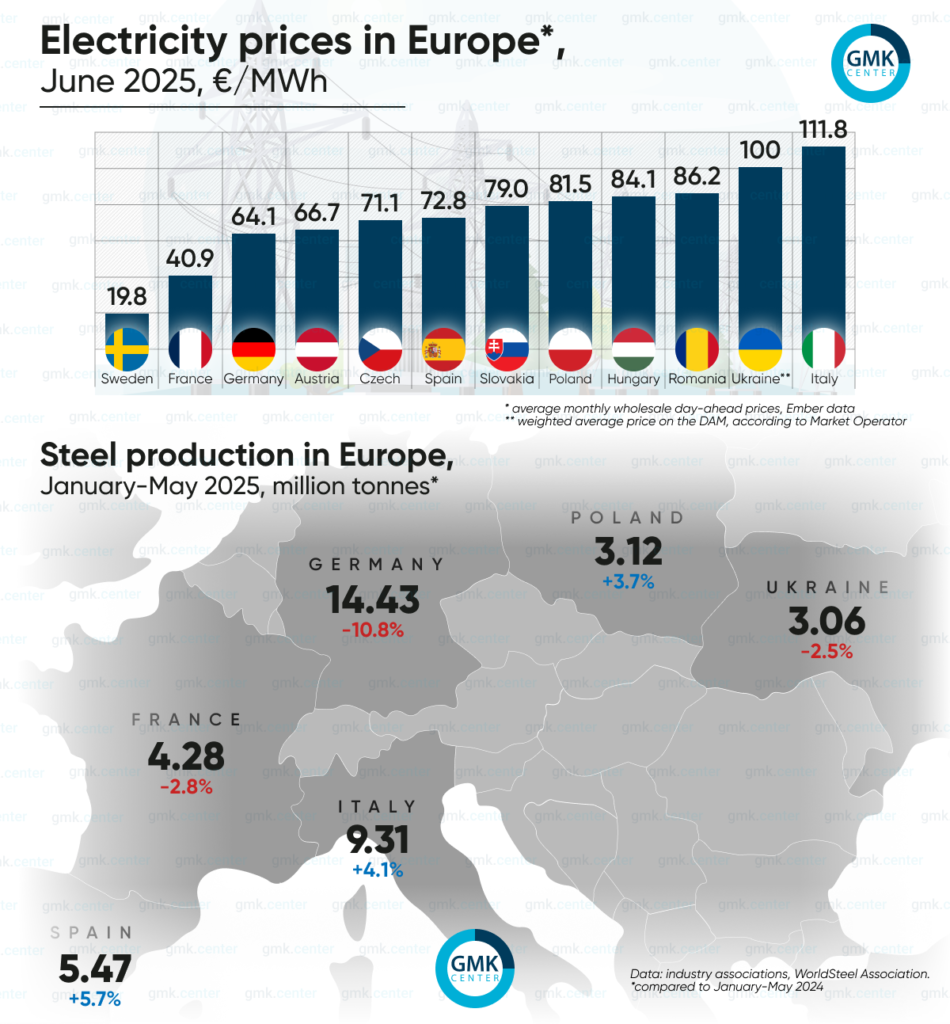

According to Ember data (as of July 4, 2025), day-ahead market prices varied widely across the EU:

- 🇮🇹 Italy: €111.77/MWh (+17.4% MoM)

- 🇫🇷 France: €40.9/MWh (+2.1x)

- 🇩🇪 Germany: €64.14/MWh (−3.9%)

- 🇪🇸 Spain: €72.88/MWh (+4.6x)

- 🇸🇪 Sweden: €19.83/MWh (−45.6%)

Other markets:

- 🇵🇱 Poland: €81.5/MWh

- 🇸🇰 Slovakia: €78.98/MWh

- 🇭🇺 Hungary: €84.13/MWh

- 🇺🇦 Ukraine: €100/MWh

Across the first half of June, prices exceeded €50/MWh in most markets, surging above €100/MWh in Italy, Spain, and UK markets by late June.

🌍 Key Drivers Behind Price Fluctuations

Several macro and microeconomic factors have shaped pricing trends:

- Natural Gas Volatility: TTF futures hit €42/MWh on June 19.

- CO₂ Emissions Costs: Fluctuations impacted production expenses.

- Weather Patterns: Intense heatwaves pushed up electricity demand.

- Generation Mix: Renewables contributed to volatile pricing.

- Negative Hourly Prices: Recorded in several EU markets due to solar surpluses during daylight and lower demand at night.

🇪🇺 EU & UK Policy Reactions

Recognizing the industrial threat of high energy costs, both the EU and UK governments introduced major reforms:

EU – Clean Industry Agreement (CISAF):

- Adopted on June 25, CISAF introduces state aid policies valid until 2030.

- Allows member states to offer electricity price support for energy-intensive exporters.

- In return, companies must invest in decarbonization.

UK – Industrial Electricity Reform:

- Announced on June 23, the new strategy offers:

- 25% electricity bill reduction for ~7,000 large industrial firms from 2027.

- Green fee exemptions for aerospace, auto, and chemical sectors.

- Network charge discounts increased from 60% to 90% by 2026 for heavy industries.

🏗️ Energy Prices Threaten Steel Sector Viability

The European steel sector is calling for urgent intervention.

- 🇩🇪 ArcelorMittal scrapped plans for €1.3B green conversion of German plants due to high energy costs.

- 🇩🇪 Thyssenkrupp continues with a €3.5B green steel project but warned of the need for favorable conditions.

- 🇵🇱 Polish steel unions announced protests for Autumn 2025 demanding:

- A unified €60/MWh industrial rate across the EU.

- A revision of the EU Green Deal and ETS (Emission Trading System).

🇺🇦 Ukraine: High Energy Tariffs Pressure Steelmakers

For Ukrainian steel producers, electricity has become a critical cost burden:

- In 2021, energy accounted for 7% of product cost; in 2025, it jumped to 20%.

- ArcelorMittal Kryvyi Rih warned that continued high tariffs (above €94/MWh) could lead to plant shutdowns.

- The company cited the lack of a competitive electricity market and limited access to imports as root causes.

Ukraine’s June 2025 electricity metrics:

- Average DAM price: UAH 4,783/MWh (~€100/MWh), +3.12% MoM

- Electricity imports: 203.8k MWh, +5% MoM

- Electricity exports: 237k MWh, +150% MoM

To support system stability and revenues, the Ministry of Energy increased export capacity to the EU and Moldova to 900 MW in early July.

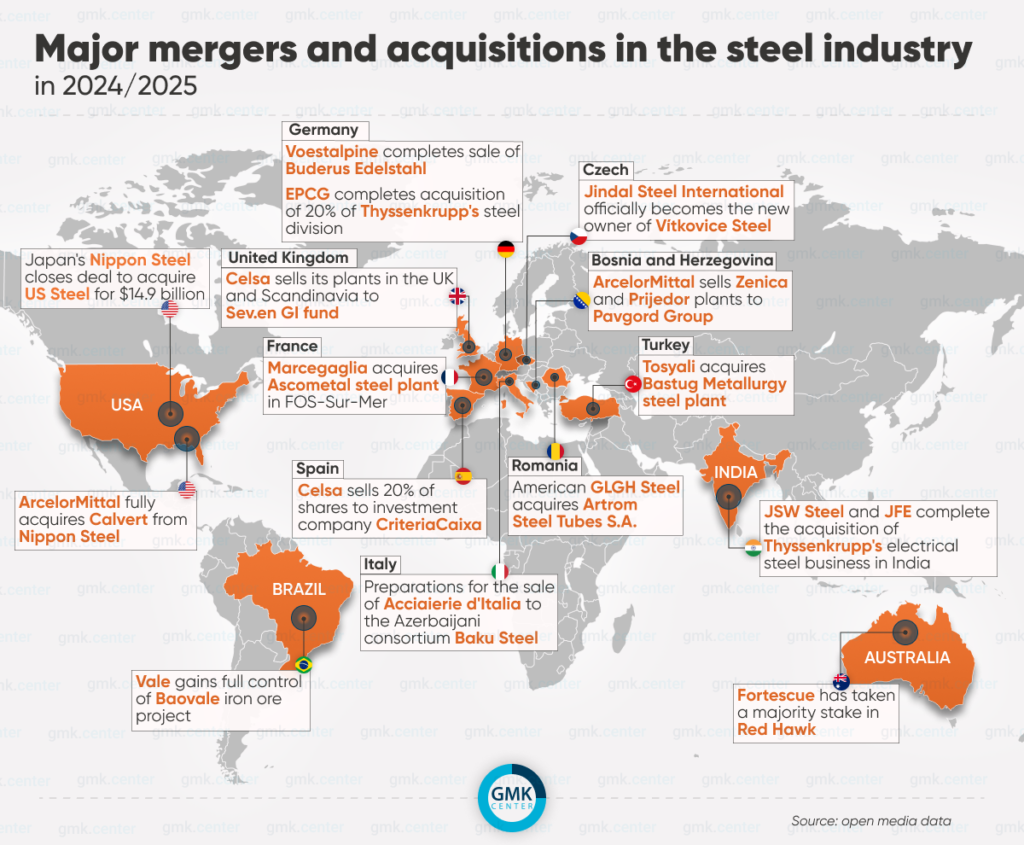

🌐 Global Steel Industry Shake-Up: Mega Mergers Redefine the Future of Steel Production (2024–2025)

The global steel industry is undergoing one of its most transformative periods in recent history. From Asia to Europe to the Americas, 2024–2025 has seen an unprecedented wave of mergers and acquisitions (M&A), shifting control of strategic assets, reconfiguring global supply chains, and redrawing the map of steel production.

These M&A moves are not merely about growth—they’re about survival, modernization, and market dominance in an industry facing decarbonization pressure, rising costs, and trade barriers.

🏭 Nippon Steel’s Landmark Acquisition of U.S. Steel

The most high-profile deal of the period was Japan’s Nippon Steel’s acquisition of U.S. Steel for $14.9 billion, marking the largest M&A in Japanese steel history. The deal comes with “golden share” protections, ensuring U.S. national interests—such as retaining Pittsburgh headquarters and American leadership.

🔧 Strategic Highlights:

- Nippon Steel to invest $11 billion in U.S. assets by 2028.

- U.S. government granted veto rights over major strategic decisions.

- Full integration of U.S. Steel into Nippon’s global structure.

🌎 ArcelorMittal’s Expansion Across Three Continents

ArcelorMittal is making bold moves in both North and South America, strengthening its presence while optimizing its European portfolio.

Key Developments:

- Acquired full ownership of the AM/NS Calvert plant in Alabama from Nippon Steel.

- Investing over $3 billion in Calvert, including a new electric arc furnace (EAF) and electrical steel production line.

- Sold unprofitable assets in Bosnia and Herzegovina, recording losses of around $200 million.

- Acquired 28.4% of French premium pipe maker Vallourec, expanding into energy-sector products.

- Bought 60% of Brazil’s Tuper, one of Latin America’s top pipe manufacturers.

🇪🇺 Europe: Restructuring & Realignment

Europe has seen a flurry of asset sales, state interventions, and new players entering the market:

- Voestalpine sold its German Buderus Edelstahl subsidiary to Mutares, while acquiring Italy’s ITALFIL to boost its welding tech portfolio.

- Thyssenkrupp entered into a 50/50 joint venture with the Czech EP Corporate Group.

- Jindal Steel International acquired Vítkovice Steel in Czechia, pledging €150 million in green transformation investments.

- Marcegaglia (Italy) acquired Ascometal’s Fos-sur-Mer plant in France, committing €600 million in modernization.

🚨 Liberty Steel: A Company in Crisis

Once seen as an aggressive industry consolidator, Liberty Steel is rapidly collapsing:

- Whyalla Steelworks (Australia) placed under external management and up for sale.

- Dudelange plant (Luxembourg) sale to Tosyalı canceled due to EU rule changes.

- Ongoing bankruptcies in Poland, Czech Republic, Belgium, and Hungary.

- Governments stepping in to prevent massive job losses and economic fallout.

🇪🇸🇮🇹 Spain & Italy: Strategic Pivots

- Grupo Celsa (Spain) sold UK and Scandinavian assets to Sev.en GI to reduce debt.

- Acciaierie d’Italia (ADI) returned to state control amid financial turmoil. A €1.1 billion offer from an Azerbaijani consortium is under review, with promises of €4 billion in investments.

🛢️ Raw Materials: Japanese and U.S. Moves

Japan is securing its raw materials future:

- Mitsui to invest $5 billion in Australia’s Rhodes Ridge project.

- Nippon Steel and Sojitz acquire 49% of Canada’s Kami iron ore project.

Meanwhile, Cleveland-Cliffs (U.S.) acquired Stelco for $2.5 billion, expanding its control of flat-rolled steel capacity.

Glencore (Switzerland) will acquire 77% of Teck Resources’ coal business for $6.9 billion, with Canadian regulatory approval.

🔮 What This Means for the Industry

The past two years have brought tectonic shifts in steel industry dynamics:

- Japan is now firmly positioned in the U.S. market.

- ArcelorMittal is leading in both American continents and pivoting away from weaker European assets.

- Europe is seeing increasing government involvement, especially where private investments have failed.

- Trade barriers and climate policy are accelerating the consolidation of assets and strategic vertical integration.

As Stanislav Zinchenko, CEO of GMK Center, aptly summarized:

“These transformations will determine the new geography of steel production over the next 3 to 5 years.”

ArcelorMittal Kryvyi Rih: Ukraine’s Largest Steelmaker Faces a Fourth Year of Financial Losses

ArcelorMittal Kryvyi Rih, Ukraine’s largest steel producer, is now navigating through one of its toughest periods in recent history. For the fourth consecutive year, the company has been operating at a loss, a situation worsened by soaring electricity costs, ongoing war conditions, and a lack of systemic support from the state. The company’s CEO, Mauro Longobardo, voiced these concerns at the recent GMK Center round table, highlighting the urgent need for state-level intervention.

Energy Crisis at the Core of the Losses

One of the primary factors crippling the company is the exponential rise in energy prices. In 2021, electricity costs accounted for just 7% of product prices. By 2025, this figure has nearly tripled to 20%, making both steel and iron ore concentrate production financially unsustainable.

“We have optimized everything possible. But without a systemic solution from the state, particularly regarding energy tariffs, we will not be able to continue operations,” said Mauro Longobardo.

Basic Survival Over Growth

ArcelorMittal Kryvyi Rih currently requires at least $150 million annually in investments just to maintain minimal activity. While a production target of 3 million tonnes of steel per year is the minimum required to break even, more than half of that output is already unprofitable.

Under current conditions, the company has shelved any plans for a green transformation. Initiatives such as building electric arc furnaces (EAFs), switching to direct reduced iron (DRI) technology, and other low-emission investments totaling $1 billion have been postponed indefinitely.

“We can’t talk about green transformation now. First, we must survive the war, stabilize operations post-war, and then consider strategic investments,” Longobardo explained.

Commitment to Local Economy Remains Strong

Despite the financial strain, ArcelorMittal continues to support the city of Kryvyi Rih’s economy. With nearly 20,000 employees today (compared to over 27,000 in 2021), the plant’s contribution to local payrolls, taxes, and contractor employment accounts for up to 50% of the city’s budget.

In the past three years, the ArcelorMittal Group has injected over $1 billion into its Ukrainian division to keep operations running. However, this financial support cannot continue indefinitely.

“We are not asking for subsidies, only for fair and competitive energy prices,” Longobardo concluded, urging the government to take action before it’s too late.

A Call for State Intervention

As one of the pillars of Ukraine’s economy, ArcelorMittal Kryvyi Rih’s survival is not just a corporate concern—it’s a national priority. The ongoing financial hemorrhage and energy burden threaten to halt production entirely, a move that would devastate the local economy and disrupt the national industrial ecosystem.

⚡ Power Crisis: How High Electricity Costs Threaten Steel Industry and Regional Stability

Ukraine’s steel sector is at a breaking point. Consuming around 250 MWh per hour—just at partial capacity—electricity now represents nearly 20% of production costs, compared to only 7% before the war. With wholesale prices soaring past €94/MWh in May and averaging €100/MWh in June—consistently the highest in Europe—it’s clear the current energy crisis is not just hurting margins, it’s threatening survival.

🔍 Why Electricity Prices Have Spiraled Out of Control

- High transmission costs have drastically increased energy delivery expenses.

- Reliance on domestic generation forces reliance on expensive tariffs; there’s limited access to cheaper imports.

- Global exposure: Steel product prices are linked to global benchmarks, leaving local producers unable to pass on these high energy costs to customers.

These factors contributed to a UAH 3.8 billion loss in the first five months of 2025, despite ambitious output targets.

📉 Competitiveness Eroded—Globally and Locally

- Ukraine primarily exports to Europe, where energy costs are lower and infrastructures better managed.

- Even with tariff waivers under EU integration, combined logistics and high electricity pricing leave Ukrainian producers at a disadvantage.

- Export volumes have shrunk, and the domestic construction market remains stagnant, amplifying the pressure on margins.

💡 A Vital Industry—and Local Economic Lifeline

Ukraine’s largest steel producers are also pillars of local economies. For example:

- 27,000 jobs in 2021, now still employing ~20,000 workers.

- Steel taxes, wages, and partner businesses generate 50% of the Kryvyi Rih city budget.

Yet operational viability is at risk when break-even electricity prices exceed €60/MWh—a threshold critical for survival.

⚠️ Not Investment-Driven, But Survival-Driven

While global peers are investing in green steel and electric arc furnaces, Ukraine is still fighting to survive:

- €1 billion in investment is needed for EAF transitions—far out of reach under current financial strain.

- CapEx goals suspended, as the focus shifts from growth to operational sustainability.

🛠️ What Needs to Be Done: A Realistic Solution Roadmap

- Establish a fair, industry-tailored electricity rate, ideally competitive with European benchmarks, to preserve steel export viability.

- Enable access to lower-cost imported energy, mitigating excessive domestic price premiums.

- Unlock government-industry dialogue for emergency support, rather than speculative strategic shifts.

- Protect and stabilize jobs and local economies dependent on steel production, starting with targeted intervention for high-energy users.

🌍 Conclusion: Electricity Pricing Isn’t a Policy—It’s an Existential Debate

Ukraine’s steel industry is not seeking windfall profits—it’s asking for stability just to stay operational. Electricity tariffs must be re-balanced not as industry favors, but as a matter of national economic strategy.

If these measures are not taken swiftly, Ukraine may lose not only vital export capacity but also the economic backbone of cities, regions, and labor markets built around steel and its supply chain.

📢 Want to Stay Ahead of Steel Industry Shifts?

At LUX Metal, we understand the importance of staying ahead of global trends. While global giants reshape the steel industry, our commitment to precision metal fabrication, stainless steel solutions, and state-of-the-art equipment ensures your projects never fall behind.

💡 From custom CNC solutions to high-quality material sourcing, LUX Metal is your trusted partner in an ever-changing industry.

At Lux Metal, we specialize in customized metal fabrication solutions to meet the most demanding industrial and architectural needs. From CNC laser cutting to bending, rolling, welding, and V-grooving, our state-of-the-art machinery ensures precision, reliability, and exceptional quality. We serve various sectors including construction, manufacturing, energy, and infrastructure with a focus on innovation, efficiency, and sustainability.

Our advanced capabilities and customer-centric approach make us a trusted partner in the evolving metal and steel industry landscape.

Our state-of-the-art facilities include:

- Laser Cutting Machines

- Bending, Milling, and Rolling Machines

- CNC & V-Cutting Systems

- Welding and Wire Cut Equipment

- Laser Marking for detailed custom works

LUX METAL stands out for its ability to rapidly adapt to custom specifications and deliver efficient, reliable products for construction, machinery, and infrastructure projects.

➡️ Learn more about LUX METAL and their full service offerings at www.luxmetal.com.my