Vietnam to Impose Temporary Anti-Dumping Tariff

Vietnam has taken a significant step in protecting its domestic steel industry by imposing temporary anti-dumping tariffs on Chinese steel products. This decision follows growing concerns about the impact of cheap Chinese steel imports on local manufacturers and is part of broader global trade frictions surrounding China’s steel exports.

The new tariffs, announced by Vietnam’s Ministry of Industry and Trade (MoIT), specifically target hot-rolled coil (HRC) steel imported from China. The measure is intended to level the playing field for local producers, ensuring that Vietnamese steel companies remain competitive in an increasingly challenging market.

This move aligns with similar protective measures taken by other countries, including the United States, which recently reintroduced tariffs on Chinese steel. As trade tensions escalate, the Vietnamese government aims to strike a balance between protecting domestic industries and maintaining stable trade relations with China—its largest trading partner.

Vietnam has recently announced a temporary anti-dumping tariff on hot-rolled coil (HRC) steel imported from China, a move that is expected to significantly impact the domestic steel industry. The Ministry of Industry and Trade of Vietnam (MoIT) made the announcement on February 21, 2025, stating that the tariffs will be effective from March 8 and will last for 120 days.

The tariffs, which can reach as high as 27.8%, are designed to protect Vietnamese steel manufacturers from unfair competition posed by cheap Chinese imports. While this measure is seen as a protective shield for local producers, it is also expected to bring mixed consequences for various stakeholders in Vietnam’s steel industry, stock market, and broader economy.

This article provides an in-depth look at the rationale behind the tariffs, their expected impact on steel producers and importers, and the broader implications for the Vietnamese economy and stock market.

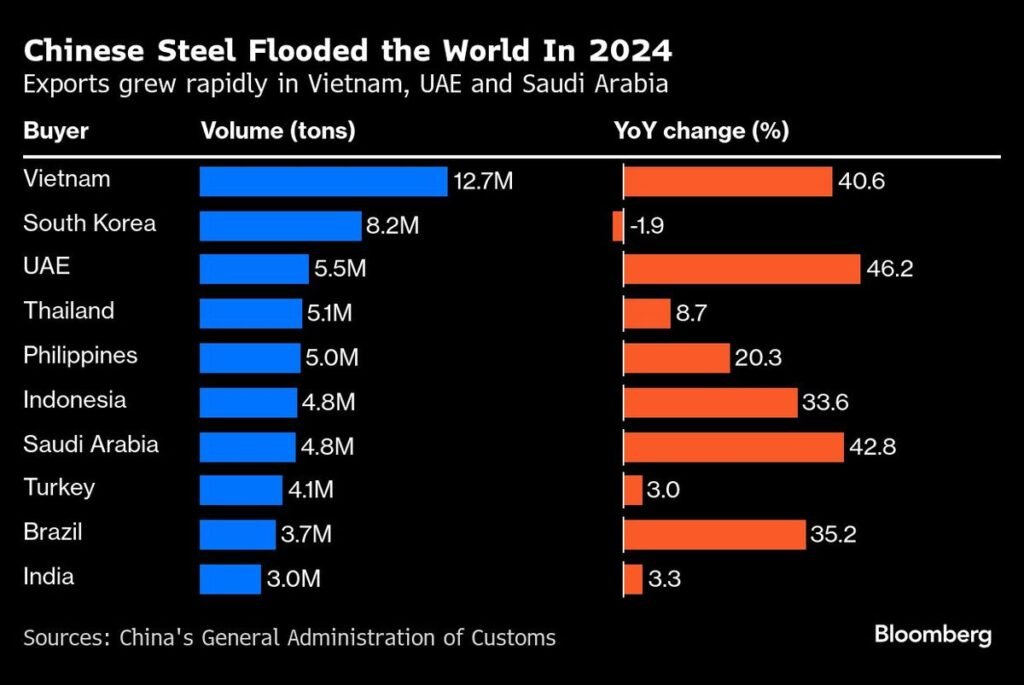

Vietnam is taking a decisive step in shielding its domestic steel industry from surging Chinese imports by imposing temporary anti-dumping tariffs on hot-rolled coil (HRC) steel products. Following the example of South Korea, India, and Brazil, the Southeast Asian nation has joined the global effort to counterbalance the impact of China’s massive steel exports.

With China exporting the most steel in nine years during 2024, international markets have been flooded, leading to protectionist measures worldwide. Vietnam, as the largest buyer of Chinese steel outside of China itself, is now introducing tariffs ranging between 19.38% and 27.83%, set to take effect on March 7, 2025, for a period of 120 days.

This move comes at a crucial time when global steel markets are grappling with oversupply, trade tensions, and economic shifts. In this article, we will explore the reasons behind Vietnam’s decision, its implications for the local and global steel industries, and what the future holds for international steel trade.

The Need for Anti-Dumping Tariffs

The decision to impose anti-dumping duties stems from Vietnam’s concerns over unfair trade practices. Chinese steel manufacturers, benefiting from government subsidies and lower production costs, have been able to sell steel at significantly lower prices than Vietnamese producers. This has led to a surge in Chinese steel imports, putting immense pressure on local manufacturers and raising concerns about potential job losses and the sustainability of Vietnam’s steel industry.

According to MoIT, Chinese steel products have been flooding the Vietnamese market, undercutting domestic producers and causing substantial financial strain on local steel mills. The introduction of these tariffs is expected to curb the excessive influx of cheap steel, allowing local manufacturers to recover and compete on fairer terms.

Vietnam has witnessed a surge in steel imports, with Chinese steel accounting for a significant share. Reports indicate that in 2024, Vietnam imported over 10 million tonnes of steel, with a considerable portion coming from China. The influx of low-cost steel has eroded profit margins for Vietnamese producers, making it difficult for them to sustain operations.

Details of the Tariffs and Their Impact

The temporary anti-dumping tariff on Chinese steel will initially last for four months as Vietnamese authorities assess the situation further. While the exact percentage of the tariff has not been officially disclosed, industry analysts expect it to range between 12% and 25%, depending on the type of steel product.

The tariff is expected to have both immediate and long-term impacts on the Vietnamese steel market:

- Boost for Domestic Steel Producers

- Local steel manufacturers, such as Hoa Phat Group and Ton Dong A Corporation, will benefit from the reduced competition from cheaper Chinese imports.

- Increased demand for Vietnamese-made steel could lead to higher production levels, potentially boosting employment and investment in the sector.

- Higher Prices for End Consumers

- With Chinese imports becoming more expensive, steel prices in Vietnam may rise.

- Industries that rely heavily on steel, such as construction, manufacturing, and shipbuilding, could face higher costs.

- Potential Trade Retaliation from China

- Given the strong trade ties between Vietnam and China, there is a risk of trade retaliation from China, which could impact Vietnamese exports to China in other industries such as agriculture and electronics.

- Stabilization of Steel Prices

- While the tariff may lead to a short-term price increase, it could help stabilize the market in the long run by reducing the oversupply of cheap steel.

Comparison with Global Trade Policies on Chinese Steel

Vietnam is not alone in taking measures against Chinese steel imports. Other nations, particularly the United States and the European Union, have imposed similar tariffs in response to what they perceive as China’s unfair trade practices.

- United States Tariffs on Chinese Steel

- The U.S. recently reintroduced 25% tariffs on Chinese steel under the Trump administration, citing national security concerns and unfair trade practices.

- This move is expected to further intensify global trade tensions and impact China’s steel exports.

- European Union’s Stance on Chinese Steel Imports

- The EU has also imposed anti-dumping duties on certain Chinese steel products, reflecting growing frustration over China’s state-backed steel production and market manipulation.

- Other Asian Countries’ Response

- Countries such as India, Indonesia, and Malaysia have also expressed concerns about Chinese steel imports and are considering similar protective measures.

Vietnam’s decision reflects a broader global trend of countries seeking to protect their domestic industries from the adverse effects of China’s steel overproduction.

The Rationale Behind Vietnam’s Anti-Dumping Tariffs on Chinese Steel

The decision to impose anti-dumping duties on Chinese HRC imports is primarily aimed at addressing unfair pricing practices and reducing Vietnam’s dependence on foreign steel.

1. Unfair Pricing and Market Distortion

Chinese steel manufacturers often benefit from subsidies and lower production costs, allowing them to sell their products at prices significantly lower than those of domestic Vietnamese producers. The result is an influx of cheap Chinese steel that undermines Vietnam’s local industry.

A report by VPBank Securities (VPBankS) highlighted that Chinese HRC products are typically $15-$45 per tonne cheaper than locally produced steel, creating a price gap of 2.9% to 9%. This puts Vietnamese producers at a competitive disadvantage, making it difficult for them to maintain profitability and sustain operations.

2. The Need to Strengthen Domestic Steel Production

Vietnam’s annual steel demand ranges between 10 to 13 million tonnes, while the country’s current production capacity stands at 8.2 million tonnes per year. This means Vietnam still relies heavily on imports to meet domestic demand.

By imposing these tariffs, the government aims to increase local steel consumption, benefiting domestic steel giants such as Hòa Phát Group (HPG) and Formosa Hà Tĩnh (FHS). The tariffs will redirect demand toward Vietnamese-produced steel, encouraging higher investment in domestic production capacity.

3. Protecting Jobs and Economic Stability

Vietnam’s steel industry plays a crucial role in its economy, employing thousands of workers across the country. The rapid influx of low-cost Chinese steel threatens the job security of local workers, making anti-dumping measures necessary to ensure the sustainability of the industry and the broader economy.

Immediate Impact of the Tariffs on Vietnamese Steel Producers

With the new anti-dumping duties in place, domestic steel manufacturers are expected to experience several key benefits:

1. Increased Demand for Locally Produced Steel

The tariffs will make Chinese HRC imports more expensive, leading Vietnamese businesses to purchase steel from domestic producers instead. This will significantly benefit leading Vietnamese steel companies such as:

- Hòa Phát Group (HPG) – Expected to see higher sales and improved revenue as companies shift away from Chinese imports.

- Formosa Hà Tĩnh (FHS) – Will also gain as domestic demand for steel rises.

The upcoming expansion of the Hòa Phát Dung Quất 2 Iron and Steel Production Complex is projected to increase Vietnam’s steel production capacity to 12.8 million tonnes annually, helping the country meet its own demand without relying on imports.

2. Improved Profit Margins for Local Manufacturers

With reduced competition from cheaper Chinese imports, Vietnamese steelmakers will have greater pricing power. This means they can sell their products at more profitable prices, improving financial performance and boosting investor confidence in the industry.

3. Potential for Job Growth and Industry Expansion

As demand for domestic steel increases, local steel manufacturers may expand their production facilities and hire more workers. This will not only strengthen the industry but also provide employment opportunities, contributing to Vietnam’s overall economic growth.

Challenges for Vietnamese Companies That Rely on Imported Steel

While the tariffs benefit Vietnamese steel producers, they pose challenges for companies that rely on Chinese HRC imports, such as:

- Hoa Sen Group (HSG)

- Nam Kim Steel (NKG)

These companies have historically depended on cheaper Chinese HRC for their manufacturing processes. However, with the new tariffs in place, they may face:

1. Higher Costs of Production

With Chinese steel becoming more expensive, these companies will need to:

- Shift to domestic steel sources, which may be more costly than what they previously imported.

- Look for alternative suppliers from other countries, such as Japan or South Korea, which may also come with higher costs.

2. Increased Operational Challenges

Adapting to higher raw material costs could impact profit margins, forcing these companies to adjust their pricing strategies and find ways to optimize production efficiency.

3. Potential Supply Chain Disruptions

Companies that fail to secure stable alternative supply sources may experience production delays, impacting their ability to meet customer demand.

Despite these challenges, many Vietnamese steel firms have stockpiled Chinese steel before the tariff announcement, allowing them to mitigate short-term impacts. However, in the long run, they must adapt to a changing steel market landscape.

Impact on Vietnam’s Stock Market

The announcement of the anti-dumping tariff has had a significant effect on Vietnam’s stock market, particularly in the steel sector.

1. Steel Stocks Surge on VN-Index

Following the news of the tariffs, steel stocks saw a major rally, with the VN-Index surpassing the 1,300-point threshold. Some of the biggest winners included:

- Hòa Phát Group (HPG) – Experienced a massive trading volume of 45 million shares in just 30 minutes, with transactions exceeding VNĐ1.28 trillion ($50.1 million).

- Tiến Liên Steel Group – Hit its daily price ceiling with a 6.8% increase.

- Vietnam Germany Steel Pipe JSC and Vietnam Steel Corporation – Also saw substantial gains.

2. Market Experts Predict Continued Growth for Steel Stocks

Financial experts believe that the anti-dumping measures will continue to drive up steel stock prices, particularly for companies like Hòa Phát.

- Đinh Quang Hinh, head of Macroeconomics and Market Strategy at VNDIRECT Securities, stated that the tariffs would serve as a long-term growth catalyst for Vietnamese steel stocks.

- Phan Dũng Khánh, an investment advisor at Maybank Securities, noted that while short-term gains are strong, investors should also consider long-term business strategies before investing.

What’s Next for Vietnam’s Steel Industry?

With the 120-day temporary tariff period set to expire in July 2025, Vietnam will need to evaluate the effectiveness of the policy and decide whether to extend it or implement permanent trade restrictions.

Potential Outcomes

📌 Scenario 1: Tariff Extension or Permanent Duties

- If the tariffs successfully boost domestic production and stabilize the market, Vietnam may extend them beyond the temporary period.

- This would further encourage local steelmakers to expand capacity.

📌 Scenario 2: Removal of Tariffs

- If the tariffs lead to higher domestic steel costs, negatively impacting industries such as construction and manufacturing, Vietnam might withdraw them after 120 days.

📌 Scenario 3: Negotiations with China

- Vietnam and China may engage in trade talks to find a balanced approach that protects Vietnam’s steel industry while maintaining healthy trade relations.

Conclusion: A Bold Move with Long-Term Implications

Vietnam’s temporary anti-dumping tariffs on Chinese steel mark a significant shift in the country’s trade policy, signaling a stronger commitment to protecting domestic industries.

While these tariffs provide immediate relief for local steelmakers, the long-term impact will depend on China’s response, Vietnam’s production growth, and broader global economic conditions.

With China facing growing trade barriers worldwide, it remains to be seen whether Beijing will implement supply-side reforms to address global concerns over excess steel production.

For now, Vietnamese steel companies stand to gain, while industries dependent on cheap imports must adapt to rising costs. As the market adjusts, the next few months will be critical in determining the future of Vietnam’s steel sector and its role in the global steel supply chain.

Visit Lux Metal for high-quality steel and metal fabrication solutions in Malaysia. 🚀