🇹🇷 Turkey’s Steel Sector: Still in Flux

While Turkey began 2025 maintaining high steel price levels from last year, the industry faces serious headwinds. Despite a strong export push and rising import tariffs, domestic production fell 1.9% in January, highlighting a critical gap between local demand and supply. Imports surged nearly 25% year-on-year, especially for flat products and semi-finished materials, suggesting Turkish mills are struggling to meet quality or volume expectations.

This has led to criticism from local industry bodies who accuse Turkish steelmakers of relying too heavily on imported slabs instead of boosting their own production — putting the government in the middle of a battle between producers seeking protection and consumers demanding affordability and reliability.

📉 Turkey’s Steel Industry: From Boom to Uncertainty

1. From Record Highs to Production Contraction

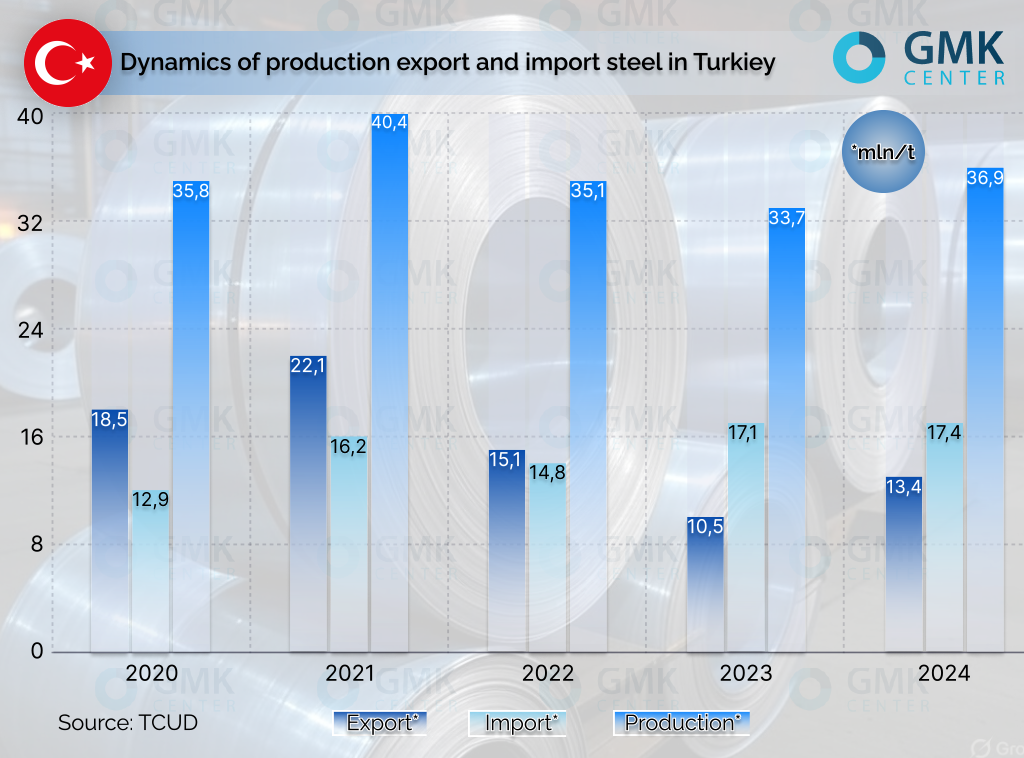

Turkey’s steelmakers enjoyed a historic peak in 2021, with record-breaking production volumes. However, the post-pandemic recovery was followed by economic instability, inflationary pressure, and soaring energy prices. By 2023, production had begun to decline, and 2024 saw only a mild recovery.

Now in 2025, the numbers tell a mixed story:

- Steelmaking dropped 1.9% in January compared to the previous year.

- Steel imports rose nearly 25% year-on-year, showing a heavy reliance on foreign suppliers.

- Flat product imports surged by 22%, while long product imports fell slightly.

- Local producers are increasingly turning to imported semi-finished materials like slabs rather than expanding domestic smelting.

This reliance on imports despite strong capacity has sparked criticism. Industry experts argue that Turkish mills are not scaling up efficiently and are failing to meet quality, cost, and delivery expectations.

2. Tariffs and Trade Wars Intensify

In response to the influx of cheaper steel imports, the Turkish government introduced a series of anti-dumping measures in late 2024 and early 2025. This includes:

- Tariffs on hot-rolled steel from China, India, Japan, and Russia

- Investigations into galvanized steel and rolled products from China and South Korea

- Extended duties on wire rod imports until 2027

These measures shift the balance of power in favor of domestic producers but have led to tensions with industrial consumers who claim Turkish steel doesn’t yet meet the standards of foreign competitors.

3. The Lira’s Fall: A Double-Edged Sword

Turkey’s currency devaluation has had a twofold effect:

- On the positive side, it made Turkish steel exports more competitive by reducing labor, energy, and logistics costs in dollar terms.

- On the negative side, the cost of importing raw materials (scrap, iron ore, coking coal) increased, eating into margins and raising dependency on global pricing trends.

The monetary policy remains volatile, and while the central bank aims to support GDP growth and reduce inflation, manufacturers are caught between cost advantages and raw material vulnerabilities.

🚗 Turkish Auto Industry: Warning Lights Flashing

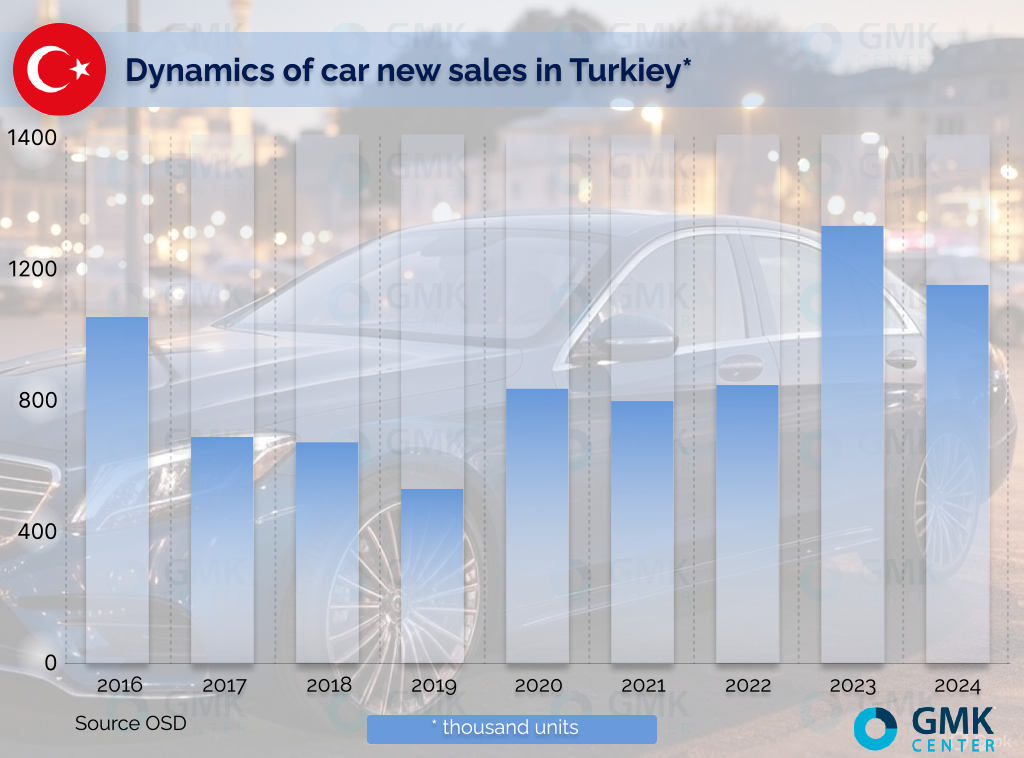

The auto industry, a major steel consumer, experienced a rocky start to 2025. While exports remain Turkey’s top contributor, domestic production and sales have declined.

- Passenger car production fell 5.1% in 2024

- Sales dropped 15% in early 2025

- Auto exports dipped 4%

While hopes remain for a rebound later in the year, global trends — especially in Europe — show increased competition and shifting regulatory frameworks that may keep Turkish exports under pressure.

🏗️ Construction Sector: A Long-Term Bright Spot

Construction, another steel-hungry sector, is expected to drive long-term recovery. The Turkish government has ambitious goals to rebuild after the 2023 earthquake, with nearly 700,000 homes planned by the end of 2025.

Additionally, infrastructure investments are on the rise:

- A 2,000-km high-speed railway backed by Chinese banks

- Major energy initiatives, including nuclear, wind, and solar projects

- Mordor Intelligence projects the Turkish construction market will reach $68.43 billion by 2029

Despite short-term challenges, this sector provides a clear path forward for increased steel demand.

📉 Risks and Outlook for 2025

The Central Bank of Turkey forecasts a 3% GDP growth, but risks persist:

- Escalation of trade wars

- Inflation volatility

- Regional political tensions

The Turkish government is expected to continue easing monetary policy, but global competition and local inefficiencies may undercut steelmakers’ ambitions to raise capacity utilization from 62.6% to 70%.

🇹🇷 Turkey’s Steel Comeback in 2024: What It Means for Global Metal Buyers in 2025

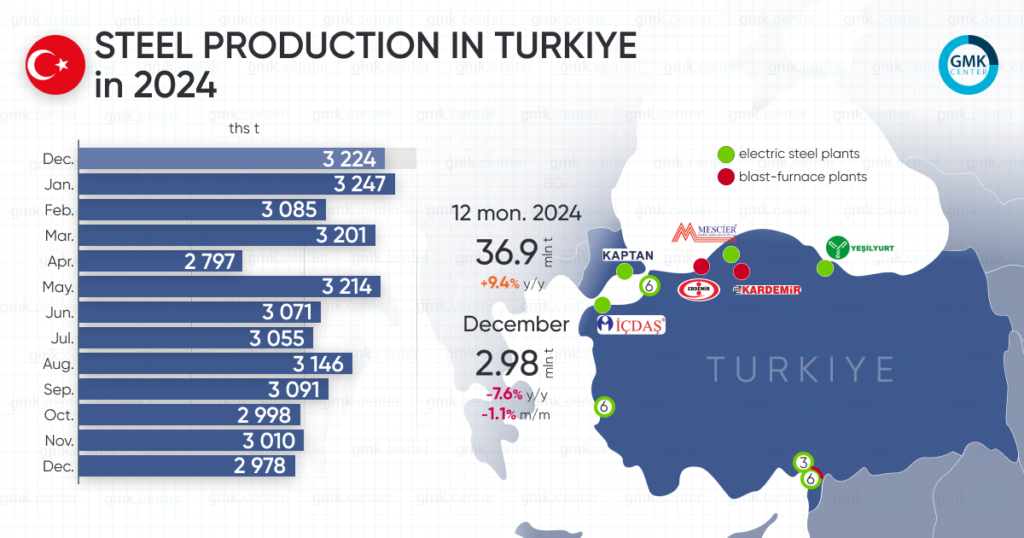

After two years of decline, Turkey’s steel industry roared back to life in 2024, posting a significant 9.4% year-on-year increase in steel production, reaching 36.89 million tons. Alongside this, pig iron production surged by 17.2%, fueled by rising infrastructure demand, post-earthquake reconstruction, and strategic export positioning.

As one of the world’s top 10 steel producers, Turkey’s steel industry plays a vital role in the global metals supply chain. But in 2025, the sector is navigating economic headwinds, trade policy shifts, and volatile demand across core industries like automotive and construction. For buyers, suppliers, and fabricators worldwide — including us at Lux Metal — these developments are more than just headlines. They directly impact sourcing strategy, pricing stability, and supply timelines.

📈 The Comeback in Numbers

According to the World Steel Association (WorldSteel):

- Steel production in Turkey rose 9.4% y/y in 2024 to 36.89 million tons

- Pig iron output increased 17.2% y/y to 10.19 million tons

- Average monthly steel production hit 3.07 million tons, up from 2.81 million tons in 2023

- Monthly pig iron production also climbed to 848,800 tons, up from 724,200 tons in 2023

These figures mark Turkey’s strongest annual growth since 2021, positioning it firmly back in the ranks of the top 10 global steel producers.

🔧 What Drove the Growth?

Turkey’s 2024 rebound wasn’t just a statistical recovery — it reflected strategic transformation across its metallurgy and construction sectors. Key growth factors include:

1. Earthquake Recovery and Infrastructure Surge

Following the devastating 2023 earthquakes, massive reconstruction efforts began across several provinces. Steel demand soared, particularly for:

- Reinforced concrete structures

- Prefabricated and modular buildings

- Transport infrastructure (roads, bridges, and railways)

2. Metallurgical Modernization

The industry saw substantial upgrades in production technology, improving efficiency, reducing waste, and expanding capacity. These investments helped stabilize operations and lower costs amid inflation and currency devaluation.

3. Export Market Expansion

Amid softening demand from Europe, Turkish steelmakers diversified their export destinations, expanding into:

- North Africa

- Southeast Asia

- The Middle East

This helped offset weakness in traditional EU markets and increased competitiveness despite global price volatility.

📉 A Sobering December: The Risks Beneath the Surface

Despite the impressive annual gains, the end of 2024 exposed vulnerabilities:

- Steel output in December fell by 1.1% m/m and 7.6% y/y, the lowest since April 2024

- Pig iron production dropped by 8.6% m/m and 15.1% y/y, reaching the lowest level since September 2023

Why the slowdown?

- Seasonal declines in construction activity

- Oversupply of steel in global markets

- China’s economic deceleration, impacting global demand for steel and pig iron

💰 The Turkish Economy: Stabilizing, But Fragile

- GDP growth in 2025 is forecasted at 3%, according to the Turkish Central Bank

- Inflation, while down from 2022 highs, remains a concern

- Foreign investment is slowly returning, but political tensions and regional instability cast a shadow

The Turkish economy is trying to navigate between monetary tightening and support for export-driven industries like steel. However, geopolitical uncertainty, global trade conflicts, and raw material costs continue to weigh on the outlook.

🌐 Global Steel Demand Outlook: Still Fragile

According to WorldSteel’s latest short-term forecast:

- Global steel demand fell 0.9% in 2024, totaling 1.75 billion tons

- Turkey’s steel demand dropped 5.5% in 2024 to 36 million tons

- A further 1.7% decline is expected in 2025, bringing demand to 35.5 million tons

Despite higher production, domestic consumption is weakening. This divergence is expected to increase Turkey’s export volumes — creating both opportunities and risks for buyers abroad.

🌍 What This Means for Buyers and Distributors

For international steel buyers — especially in construction, automotive, and infrastructure — the Turkish situation underscores the importance of diversified sourcing. High tariffs, unstable domestic output, and price fluctuations can create a volatile procurement environment.

🌏 What This Means for Global Buyers — Especially in Asia

For distributors, contractors, and manufacturers in Malaysia and across Southeast Asia, Turkey’s internal steel challenges offer both risks and opportunities:

- Short-term price volatility due to shifting trade policies and currency movements

- Uncertainty in delivery timelines as producers manage capacity shortfalls

- Opportunities to secure competitive deals as Turkish exporters seek alternative markets

🧭 What This Means for Southeast Asia and Lux Metal Clients

At Lux Metal, we closely monitor global supply chains to help clients in Malaysia and the broader region make informed sourcing decisions. Turkey’s steel resurgence brings:

✅ Greater availability of flat and long steel products for importers

✅ Potentially competitive pricing due to excess production capacity

⚠️ Volatility in delivery timelines due to trade frictions, especially with the EU and China

⚠️ Currency-driven price shifts as the Turkish lira remains unstable

For businesses in construction, manufacturing, or custom fabrication, understanding these global supply trends is critical to planning procurement, cost structures, and project timelines.

🏗️ Lux Metal: Local Precision Backed by Global Insight

As a leading metal fabrication company in Malaysia, Lux Metal combines local craftsmanship with global awareness. Whether you’re building homes, factories, or high-precision components, we deliver reliable steel and metal solutions backed by industry knowledge.

🔩 Our capabilities include:

- CNC laser cutting and bending

- Sheet metal fabrication

- Stainless steel structures

- V-cutting, welding, and polishing

- Custom component fabrication with high precision

We stay informed, so you stay prepared.

📩 Need a reliable steel solution?

Visit www.luxmetalgroup.com or contact us to get a quote for your next project.

🛠️ Final Thoughts: Navigating a Changing Steel Landscape

Turkey’s steel industry in 2024 proved its resilience and adaptability. But as 2025 unfolds, buyers must remain vigilant. A rising producer with fluctuating domestic demand, Turkey will likely continue exporting aggressively, shaping regional steel dynamics across Asia and the Middle East.

At Lux Metal, we help you navigate this shifting environment with trusted sourcing, transparent pricing, and high-quality production — all from a partner who understands the stakes.

📚 References

- GMK Center. Turkey increased steel production by 9.4% y/y in 2024

- GMK Center. Turkish steel market under question mark