Understanding America’s Labor Shortage: Causes and Solutions

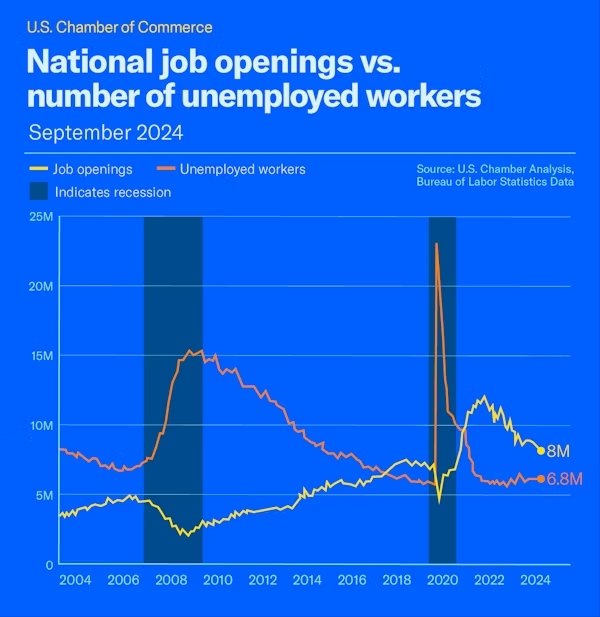

The U.S. labor market is grappling with an unprecedented challenge: a significant mismatch between job openings and the availability of workers. With 8 million job openings and only 6.8 million unemployed individuals, the numbers reveal a stark reality. Even if every unemployed person were to find a job, millions of positions would still remain unfilled.

A Snapshot of the Labor Shortage

At the height of the COVID-19 pandemic, the U.S. economy saw over 30 million workers unemployed and more than 120,000 businesses temporarily closed. Since then, the recovery has been uneven.

By 2023, employers added 3.1 million jobs, signaling a strong market rebound. Yet, despite these gains, many roles remain unfilled. The labor force participation rate, a key measure of workforce engagement, has not returned to its pre-pandemic levels. If participation matched February 2020 levels, an additional 2 million Americans would be in the workforce today.

Key Factors Driving the Labor Shortage

1. Early Retirements and an Aging Workforce

The pandemic accelerated retirement trends, with over 3 million adults retiring early by late 2021. Older workers (55+) now represent a growing share of the population exiting the workforce.

The U.S. demographic landscape is also shifting. Declining birth rates among younger generations contribute to an aging and shrinking labor pool. This trend poses long-term challenges, as fewer young workers are available to replace retirees.

2. Decline in Immigration

Historically, immigration has bolstered the U.S. labor market, particularly in industries like construction, agriculture, and healthcare. However, net international migration has hit historic lows.

Between 2020 and 2021, immigration contributed only 247,000 to population growth, a sharp decline from the 1 million peak in 2015–2016. This 76% drop further limits the availability of workers in critical sectors.

3. Lack of Access to Childcare

Childcare accessibility is a significant barrier to workforce participation, especially for women. The pandemic exacerbated existing issues, forcing many childcare providers to scale back or close.

Between February and April 2020, the childcare industry lost 370,600 jobs. By late 2021, the sector was still 10% below pre-pandemic employment levels. For working mothers, labor force participation dropped from 70% to 55% during the early pandemic months, and full recovery remains elusive.

4. Entrepreneurship and the Gig Economy

The rise of entrepreneurship is another factor reshaping the labor market. In 2023, Americans started 5.5 million new businesses—a record high. This entrepreneurial boom reflects a cultural shift toward self-employment, with many opting to leave traditional jobs or remain unemployed to build their own ventures.

Additionally, younger generations are leveraging digital commerce platforms. By 2020, 2 million individuals were earning six-figure incomes on social media. This trend underscores the growing appeal of non-traditional income streams, presenting new challenges for employers seeking to attract and retain talent.

Exploring the Evolving U.S. Labor Market: Trends and Insights

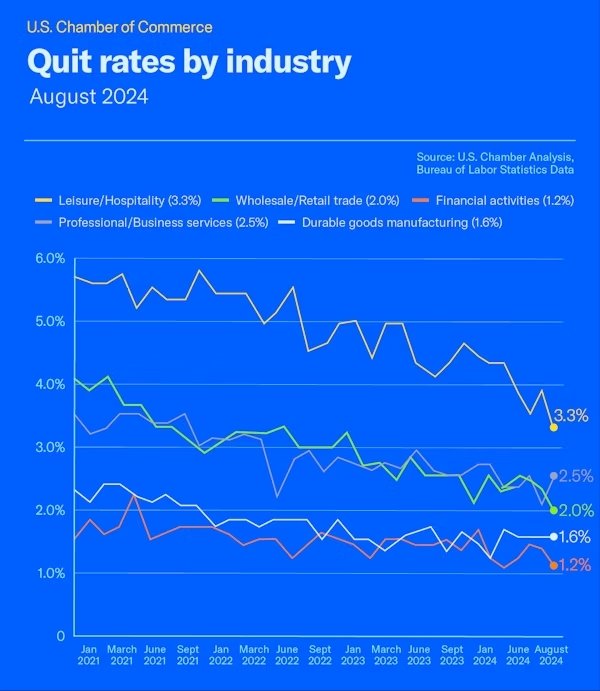

The COVID-19 pandemic brought seismic shifts to the American labor force, culminating in what many have dubbed “The Great Resignation.” By 2022, over 50 million workers voluntarily left their jobs, following a record 47.8 million in 2021. While this trend slowed in 2023 with 30.5 million resignations as of August, the underlying dynamics—referred to as “The Great Reshuffle”—highlight workers’ pursuit of better opportunities, improved work-life balance, and flexibility.

Key Trends in Labor Force Participation

1. High Quit Rates but Strong Hiring Rates

The leisure and hospitality sector has faced the highest quit rates across all industries, consistently hovering around or above 4% since July 2022. However, hiring rates in this industry have outpaced quits, with 1.05 million new hires in January 2024 compared to 781,000 workers who left. Since November 2020, this sector has maintained hiring rates between 6% and 19%, far exceeding the national average of 3.7%.

2. Persistent Workforce Gaps

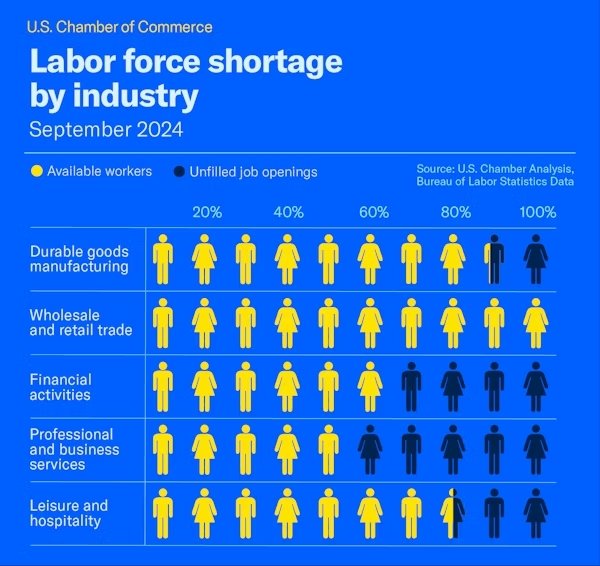

Despite steady hiring, many industries face a shortfall in workers due to low labor force participation. If participation matched February 2020 levels, an additional 2 million individuals would be in the workforce today. This gap underscores a structural labor shortage that continues to impact all states and industries.

3. Variations in Industry Recovery

- Manufacturing: The pandemic led to a loss of 1.4 million manufacturing jobs. While recovery has been stronger in durable goods, 622,000 manufacturing positions remain unfilled as of January 2024.

- Construction: Paradoxically, this industry faces a labor surplus, with more experienced workers seeking jobs than there are available openings. Despite this, geographic mismatches and other factors prevent seamless employment.

- Professional and Business Services: This broad sector, which includes roles from legal and scientific research to waste disposal, consistently reports high numbers of job openings.

- Education and Health Services: These sectors also experience elevated vacancies, reflecting growing demands but limited workforce availability.

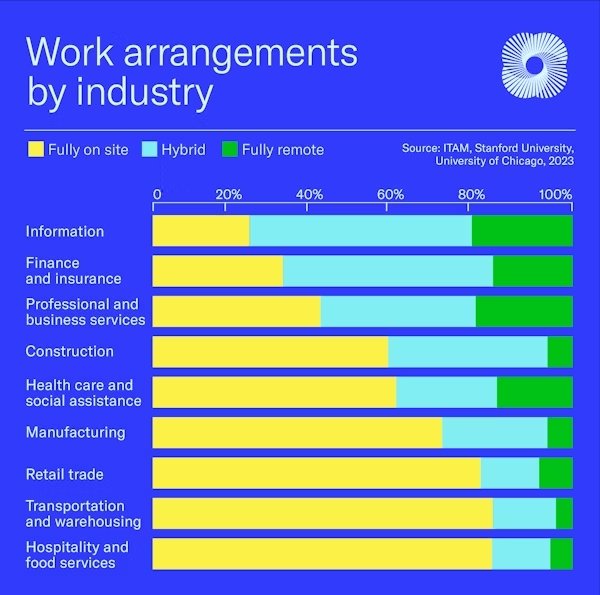

4. Decline in Remote Work

While remote work surged during the pandemic, it has dropped significantly, with only 25% of employees working remotely part-time in 2024. Still, this figure is much higher than pre-pandemic levels, suggesting remote and hybrid work will remain a fixture in certain industries.

Industry-Specific Labor Trends

1. Leisure and Hospitality

This sector exemplifies high turnover but robust hiring. Roles in food services and accommodation require in-person work, contributing to persistent challenges in retaining staff.

2. Education and Healthcare

With elevated job openings, these sectors are under pressure to attract skilled professionals. Burnout, an aging workforce, and increasing demand exacerbate staffing shortages.

3. Financial Activities and Information Technology

These higher-paying industries report lower quit rates and are more likely to embrace remote or hybrid work models, making them attractive to employees.

4. Mining and Logging

This smaller industry saw only 286,000 hires in 2023, underscoring its limited scale compared to sectors like leisure and hospitality, which hired 13 million workers in the same period.

Addressing the Labor Shortage

1. Boosting Workforce Participation

Policymakers and businesses can work together to encourage greater workforce participation. This includes targeted support for childcare, flexible working arrangements, and incentives for older workers to remain employed longer.

2. Immigration Reform

Increasing net migration through thoughtful immigration reform could help address labor shortages in industries like agriculture, healthcare, and manufacturing. Expanding work visa programs and streamlining application processes are potential solutions.

3. Investing in Training and Reskilling

Businesses should invest in workforce development programs to upskill existing employees and attract new talent. Training initiatives focused on emerging industries and technologies can help bridge the skills gap.

4. Embracing Automation

In some industries, automation can alleviate labor shortages by enhancing efficiency and reducing the dependency on human labor for repetitive tasks. This is particularly relevant for manufacturing and logistics.

The Role of Businesses

While systemic changes are necessary, individual businesses can take proactive steps. Offering competitive wages, benefits, and a strong focus on workplace culture can make a significant difference in attracting and retaining talent. Additionally, businesses can leverage technology to streamline operations and reduce the burden on existing employees.

Looking Ahead: Workforce of the Future

The U.S. labor market will continue to face challenges as the workforce ages, participation rates remain low, and job creation outpaces population growth. However, businesses that proactively adapt to these dynamics—investing in their workforce, innovating in recruitment, and embracing flexibility—will be better positioned for success.

At Lux Metal, we are committed to empowering industries through high-quality, customized metal solutions designed to meet evolving needs. Learn more about how we can support your business at Lux Metal.

For further insights into labor trends and strategies, explore the U.S. Chamber of Commerce’s resources on the America Works Data Center.

References:

- U.S. Chamber of Commerce. (2024). Understanding America’s Labor Shortage: The Most Impacted Industries. Retrieved from https://www.uschamber.com/workforce/understanding-americas-labor-shortage-the-most-impacted-industries

- U.S. Chamber of Commerce. (2024). Understanding America’s Labor Shortage. Retrieved from https://www.uschamber.com/workforce/understanding-americas-labor-shortage

- MaintainX. (2024). How Manufacturers Can Deal with Labor Shortages. Retrieved from https://www.getmaintainx.com/blog/how-manufacturers-can-deal-with-labor-shortages

- ECI Solutions. (2024). Manufacturing Jobs Deficit: Which U.S. States Are Struggling the Most?. Retrieved from https://www.ecisolutions.com/blog/manufacturing/manufacturing-jobs-deficit-which-us-states-are-struggling-the-most/