Understanding the Steel Overcapacity Crisis

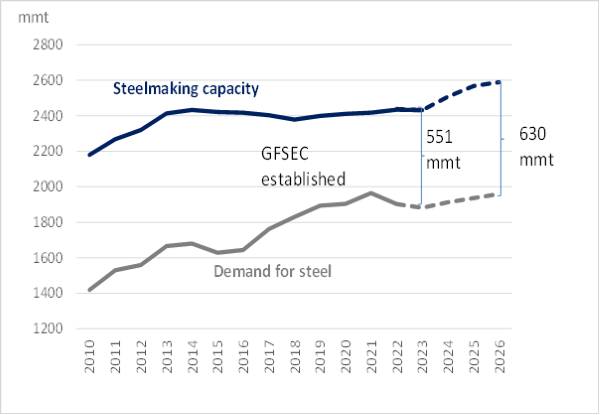

Steel overcapacity happens when production levels exceed the market demand, causing a supply glut and a sharp decline in prices. The GFSEC estimates that global steel overcapacity has risen from 532 million metric tons (MMT) in 2022 to 551 MMT in 2023, far exceeding the combined total steel production of all GFSEC members by 73 MMT. If current trends persist, global steel overcapacity could peak in 2026 at levels reminiscent of the crisis in 2016, when overproduction disrupted steel markets worldwide.

The GFSEC’s Ministerial Statement emphasizes that non-market policies are fueling this overcapacity, pushing the steel industry into a destabilizing cycle. The forum called for nations to counteract these non-market practices, stating that previous international efforts have made only limited headway in resolving this issue.

The Role of Non-Market Policies in Driving Steel Overcapacity

While the GFSEC did not specifically call out any nation in its recent statement, China is widely recognized as a primary driver of global steel overcapacity. China’s state-directed industrial policies, government subsidies, and access to discounted energy and raw materials allow its steel producers to maintain output levels far beyond what the market demands. As a result, this artificially sustained production floods the market with low-cost steel, driving down global prices and threatening the viability of other steel industries.

The United States Trade Representative (USTR) has been particularly vocal in attributing the steel overcapacity crisis to China’s policies. In a recent speech, Sushan Demirjan, Assistant U.S. Trade Representative for Small Business, Market Access, and Industrial Competitiveness, stated that China’s state-directed approach harms workers, creates strategic dependencies, and undermines decarbonization efforts in the steel industry. China is not a member of the GFSEC, which complicates efforts to achieve a coordinated global response.

Economic and Trade Implications of Overcapacity

Global steel overcapacity doesn’t just impact individual companies; it has ripple effects on entire economies. Malaysia, like other countries, experiences the following economic and trade implications:

- Price Volatility: With oversupply, prices for steel products remain unstable, fluctuating based on demand shocks, trade tensions, and production levels in other steel-producing countries. This instability disrupts local companies, limiting revenue predictability and undermining long-term planning.

- Trade Tensions: Countries facing steel overcapacity often resort to protectionist measures to shield domestic industries from low-cost imports. Trade disputes and tariffs on steel imports have strained international relations, including between Malaysia and major economies, as each tries to protect its own industry.

- Loss of Export Markets: Malaysia relies heavily on exports to markets like Turkey, Hong Kong, and Singapore. However, the influx of cheaper steel from China and other large producers threatens these market relationships, as local buyers opt for more affordable options. The adoption of free trade agreements, such as ASEAN’s AFTA, offers some opportunities to diversify export markets, yet overcapacity remains a barrier.

Economic Consequences of Global Steel Overcapacity

Steel overcapacity has widespread economic implications that extend beyond the steel sector. For instance, the GFSEC estimates that 134,000 to 190,000 steel jobs have been lost in member nations due to excess capacity, meaning that over 15% of steel industry workers could have been retained if the market were balanced. The issue also disrupts related sectors like automotive, solar energy, and infrastructure, which rely on stable steel pricing and availability to operate effectively.

In the U.S., the problem of Chinese steel overcapacity dates back to the early 2000s. Despite numerous policy interventions, including Section 232 and Section 301 tariffs, American steel mills continue to feel the pressure of low-cost imported steel. Between 2010 and 2015, for example, 10 U.S. steel mills closed, and 225,000 steelworkers lost their jobs. With China’s ongoing transshipment practices through third-party countries like Mexico, U.S. steelmakers remain vulnerable.

The Growing Challenge of Steel Overcapacity

At the recent SteelOrbis Fall 2024 Conference & 91st IREPAS meeting in Paris, economist and policy analyst Luciano Giua of the OECD emphasized the strategic importance of steel in the global economy. Steel plays a critical role across various sectors, from construction to national defense, and provides employment for millions worldwide. This indispensable nature of steel has led many governments to treat the industry as a priority, which also makes it especially vulnerable to protectionist policies. Giua pointed out the downside of these policies, noting that many steel firms supported by subsidies tend to be inefficient, leading to overproduction and heightened emissions, which pose sustainability challenges for the industry.

The OECD is tackling these issues through three dedicated bodies: the Global Forum on Steel Excess Capacity (GFSEC), the OECD Steel Committee, and the Climate Club. Despite their efforts, the global steel market faces a widening gap between production capacity and demand. In 2023, overcapacity reached 551 million metric tons, with projections for 2024-26 showing a possible rise to 630 million metric tons. This excess has destabilized prices and affected steelmakers worldwide, highlighting the need for coordinated action.

The situation is further complicated by regional challenges. Giua noted that steel demand in Europe declined in recent years due to several factors, including high energy costs, trade issues, and the economic impact of the Russia-Ukraine conflict. Globally, steel demand decreased by 1.1% in 2023 but is expected to rebound with a projected growth of 1.7% in 2024 and 1.2% in 2025.

The current landscape calls for a balanced approach to policies that promote fair competition and efficiency in the steel sector. As the OECD and industry leaders work to bridge the gap between production and demand, sustained efforts to address overcapacity are essential to creating a stable and sustainable future for global steel markets.

The Urgent Need for Policy Reform and International Collaboration

Despite international trade regulations intended to limit unfair competition, current policies are proving inadequate to address the scale and complexity of the global steel overcapacity crisis. According to Demirjan, the crisis highlights the need for modernized trade policies that can effectively curb market-distorting behaviors. He advocates for initiatives like the Leveling the Playing Field Act 2.0, which would streamline investigations into tariff circumvention practices.

GFSEC members and other steel-producing nations must work together to develop policies that promote fair market practices. The U.S., for instance, has implemented tariffs to provide temporary relief to its steel sector, but a lasting solution will require more than protective measures. Coordinated international efforts to enforce anti-dumping regulations, control excess capacity, and foster market-oriented practices in the steel industry are crucial to prevent long-term instability.

Sustaining the Global Steel Market: The Road Ahead

As another steel crisis looms, policymakers face the challenge of protecting their domestic industries while promoting a stable global market. The U.S. is focusing on policy measures to shield its steel sector from the destabilizing effects of overcapacity, and similar initiatives are needed in other nations to preserve jobs and industry stability. These protective measures, however, must be paired with international collaboration to establish effective rules that address non-market behaviors and support balanced production.

Addressing steel overcapacity requires a two-fold approach: First, countries must enact policies that prevent their industries from becoming collateral damage to non-market practices. Second, they need to invest in modern trade tools to address circumvention and dumping, which often bypass current regulations.

Future Outlook for Malaysia’s Steel Industry

The future of Malaysia’s steel industry is closely linked to its ability to adapt to a rapidly changing global landscape. The growing importance of sustainable practices in steelmaking presents both a challenge and an opportunity for Malaysia. By prioritizing green technology and collaborating with both regional and international stakeholders, Malaysia’s steel industry can potentially secure a competitive advantage in the long run.

However, a critical factor in this transition is policy support. The government’s moratorium on expansion, though beneficial for managing overcapacity, is a short-term solution. Long-term success will require comprehensive policies that address structural challenges in the industry, from workforce skill development to incentives for green technology investments.

The industry also faces increasing expectations from the global market to meet environmental standards. Major steel-producing countries have already begun implementing stricter regulations, and Malaysia will need to follow suit if it wants to remain relevant on the global stage. This shift will require a proactive approach to adopting green steel production techniques and fostering a culture of sustainability within the industry.

Conclusion

The issue of steel overcapacity, driven in large part by China’s state-directed policies, poses significant risks to the global economy. Unchecked, it has the potential to disrupt industries, lead to widespread job losses, and create strategic vulnerabilities across critical sectors. The GFSEC’s call for action underscores the need for urgent policy reforms and international cooperation to restore balance to the steel market.

As this crisis unfolds, it is vital for steel-producing nations to work together, enforce fair competition practices, and promote a sustainable steel industry. With global steel overcapacity expected to peak in 2026, a coordinated response is essential to safeguard the steel sector’s future and maintain stability in the broader global economy.

For more insights and updates on the steel industry, visit Lux Metal’s website.

References:

Check out recent report for more policy recommendations and a breakdown of how Chinese overcapacity endangers not only the U.S. steel sector but also industries like autos and solar.