Turkey: Sustained Growth Amid Higher Scrap Prices

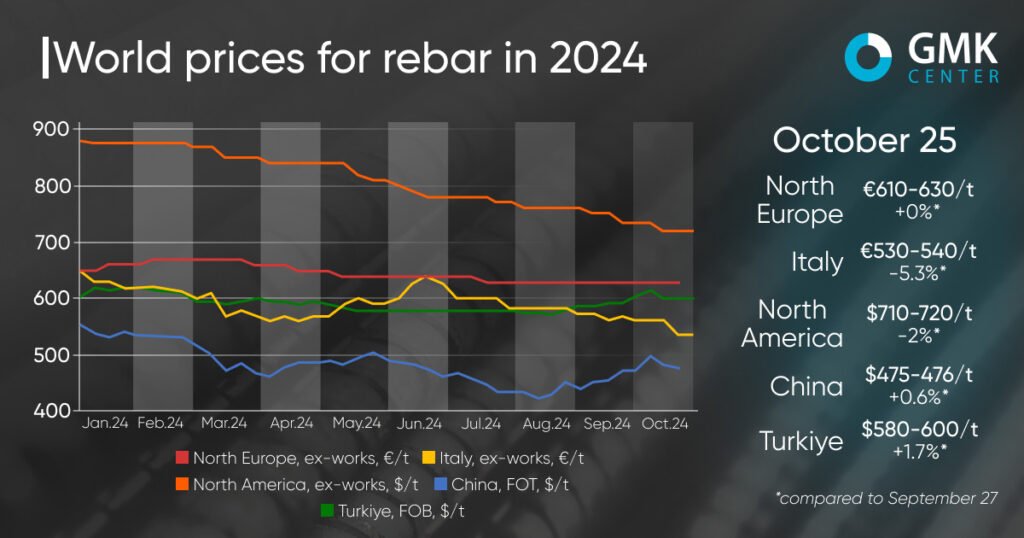

Rebar prices in Turkey increased by 1.7% in October, reaching $580-600/t FOB. This marked the second consecutive month of growth, driven by strong domestic demand and rising scrap prices. American and European scrap prices (HMS 1&2 80:20) stood at $376-377/t CFR, adding upward pressure on production costs and, consequently, rebar prices.

Turkish producers also benefited from China’s improved macroeconomic outlook and increased activity from European buyers due to a new quota period for EU imports. However, Turkish exports faced stiff competition from North African suppliers offering lower prices, such as $575-580/t FOB from Egypt and $560-590/t FOB from Algeria.

Despite challenges in export markets, domestic demand, particularly for certain rebar sizes, is expected to sustain Turkish prices. Forecasts suggest prices may stabilize between $590-610/t FOB in the coming months, with key influences including scrap prices and macroeconomic events such as the US elections and China’s policy updates.

Europe: Regional Variations and Import Competition

In Europe, rebar prices showed mixed trends. In Northern Europe, prices remained stable at €610-630/t Ex-Works for the third month, while Italy experienced a sharp decline of 5.3% to €530-540/t Ex-Works. Italian producers faced reduced demand and heightened competition from imported rebar, particularly from Egypt, which offered competitive prices of around €530/t Ex-vessel.

Local producers in Italy grappled with high energy and scrap costs, which squeezed margins and led to production restrictions. Some manufacturers planned temporary shutdowns in early November to manage costs. Although major producers like ArcelorMittal attempted to raise prices by €40/t, weak demand and low consumer activity hindered these efforts.

Looking ahead, Italian producers may aim for price increases of €30-40/t in November, but success will depend on demand recovery and scrap price dynamics. Competition from lower-priced North African imports is likely to continue limiting price growth across Europe.

USA: Weak Demand Drives Price Declines

In the US Midwest, rebar prices fell by 2% in October to $710-720/t Ex-Works, marking a continuous trend of price decreases throughout 2024. Weak demand, coupled with economic uncertainty surrounding the upcoming elections, significantly impacted the market.

Additional challenges included disruptions caused by a port workers’ strike on the US East Coast and natural disasters such as Hurricanes Helen and Milton. Moreover, declining prices for hot-rolled and cold-rolled coil exerted further downward pressure on rebar prices.

Short-term projections indicate that US rebar prices are likely to remain stable or decline slightly until economic and political uncertainties are resolved.

China: Modest Price Growth Amid Volatile Demand

China’s rebar market saw a moderate price increase of 0.6% in October, reaching $475-476/t FOT. However, this growth was less pronounced compared to previous months. Volatile demand and cautious macroeconomic expectations continued to weigh on the market.

While early October showed stability, investor confidence declined after the State Council’s press conference failed to deliver the anticipated real estate market support. Although the People’s Bank of China eased credit policies, including reduced lending rates, demand remained subdued due to ongoing challenges in the construction sector.

Despite high inventory levels, the Chinese rebar market is expected to remain relatively stable in the short term, with limited volatility. Potential macroeconomic stimulus measures from the upcoming National People’s Congress may offer slight support, though significant price growth is unlikely.

Understanding Steel Rebar and Its Scope

Steel rebar, short for reinforcing bar, is a critical construction material designed to strengthen concrete structures. Composed primarily of carbon steel, its ridged or deformed surface improves adhesion to concrete, enhancing the tensile strength of structures such as buildings, bridges, and highways.

Why Steel for Rebar?

- Thermal Compatibility: Steel’s thermal expansion coefficient closely matches that of concrete, ensuring durability.

- Recyclability: Steel can be recycled, making it an environmentally friendly choice.

- Flexibility: Its ability to be bent into various shapes ensures versatility in construction applications.

- High Availability: Widespread production and distribution make steel rebar readily accessible.

Key Market Drivers

1. Infrastructure Development and Urbanization

The increasing focus on urbanization and infrastructure projects globally is a major driver of the steel rebar market. Governments across various countries are investing heavily in smart cities, green urban projects, and transportation infrastructure.

- Examples of Urbanization Projects:

- India: In October 2021, 75 urban development projects were launched under the Smart Cities Mission in Uttar Pradesh.

- Europe: In May 2023, the European Urban Initiative committed USD 128.56 million for urban projects like sustainable tourism and green city developments.

These initiatives emphasize the material’s importance in meeting the growing demands of urban populations.

2. Rising Demand from Non-Residential Construction

Non-residential construction—covering commercial, industrial, and public infrastructure—continues to drive demand for steel rebar. Key indicators include:

- U.S. Non-Residential Spending: According to the U.S. Census Bureau, non-residential construction spending grew by 1.9% in April 2023, reaching USD 1.05 trillion.

- Applications: Rebar is crucial for building large-scale facilities like factories, bridges, and public infrastructure, where enhanced tensile strength and durability are paramount.

Future Opportunities

1. Innovations in Manufacturing Technologies

Advances in steel manufacturing and processing are unlocking new opportunities for the rebar market. High-strength alloys and eco-friendly production techniques are at the forefront of innovation.

- High-Strength Alloys: Advanced metallurgical techniques are enabling the creation of materials with superior tensile strength, making them ideal for high-rise buildings and long-span bridges.

- Efficient Production Methods:

- Hybar’s Green Rebar Mill: In August 2023, Hybar announced a USD 700 million investment in a green rebar mill in Arkansas, USA. By incorporating components from SMS Group and Primetals Technologies, the mill is expected to set new standards in energy efficiency for rebar production.

Such innovations not only enhance product quality but also reduce the environmental footprint of steel production.

2. Expanding Use Cases in Emerging Markets

The rapid industrialization and urbanization of developing economies offer untapped potential for the steel rebar market. These regions are investing in:

- Transportation Infrastructure: Railways, highways, and airports require substantial quantities of rebar for concrete reinforcement.

- Sustainable Construction: Growing awareness of eco-friendly building practices is driving demand for recyclable and durable materials like steel rebar.

Challenges and Competitive Landscape

Despite its growth potential, the steel rebar market faces challenges such as fluctuating raw material prices and competition from alternative construction materials. However, leading players are addressing these issues through strategic investments in technology and sustainability initiatives.

Notable Market Players:

- Hybar

- ArcelorMittal

- Tata Steel

- Gerdau

- Nippon Steel

These companies are focusing on innovation and efficiency to maintain a competitive edge.

Steel Rebar Market Segmental Analysis

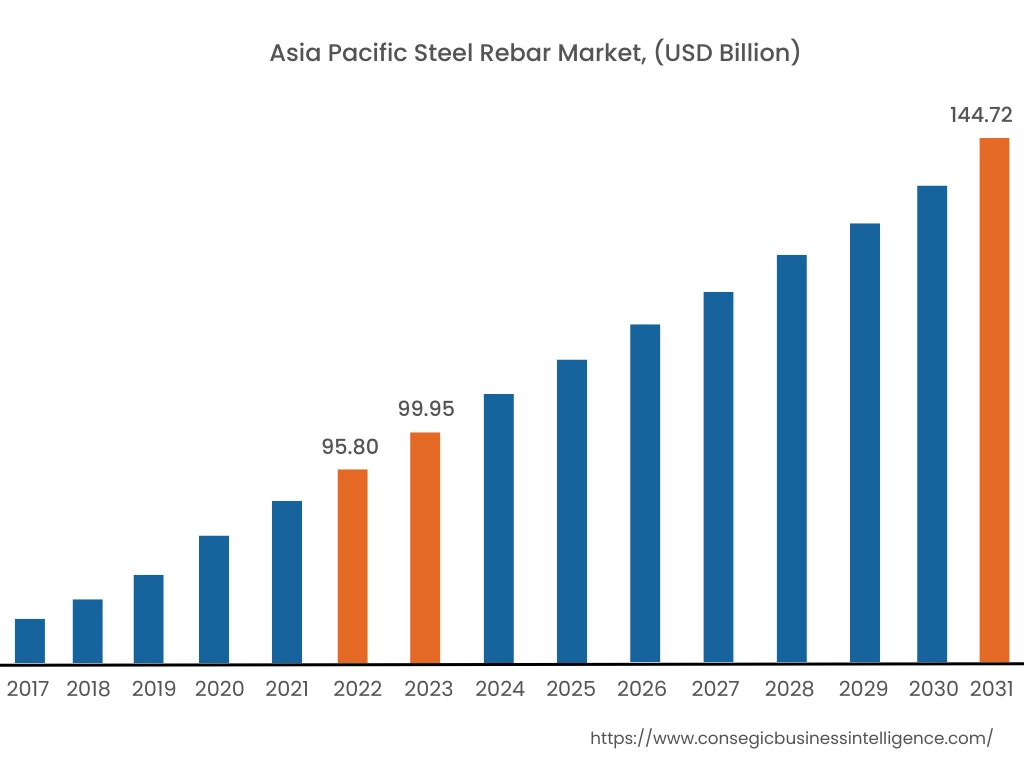

In 2022, the Asia Pacific region accounted for the highest steel rebar market share, holding 38.65%, which was valued at USD 95.80 billion. This figure increased to USD 99.95 billion in 2023 and is expected to reach USD 144.72 billion by 2031. Within the Asia Pacific region, China led the market with the highest share of 22.30% during the base year of 2022.

The significant growth in construction projects across the region has been the primary driver of this market expansion. For instance, according to data published by the China State Council Information Office in February 2023, Chengdu, the capital of southwestern China’s Sichuan province, announced the launch of 900 major construction projects that year. Among these, 145 were key infrastructure projects with a total investment of USD 132.13 billion. Additionally, coastal areas have seen a surge in capital directed toward high-end industries.

India has also contributed significantly to the region’s growth in the steel rebar market. According to the National Investment Promotion and Facilitation Agency, the rapid rise in the urban population is driving growth in the construction sector, which is expected to reach USD 1.4 trillion by 2025. These developments underline the strong demand for steel rebar in Asia Pacific.

Conclusion

The global steel rebar market in October 2024 highlighted regional disparities influenced by factors such as raw material costs, economic uncertainties, and competitive pressures. Turkey and China managed to achieve modest price growth, supported by domestic demand and macroeconomic developments. Meanwhile, the USA and Europe faced headwinds due to weak demand and increased competition from lower-cost imports.

The steel rebar market is poised for robust growth, driven by increasing demand from infrastructure and non-residential construction sectors. Innovations in production technology and the rising focus on sustainability further strengthen the material’s market position.

As the world continues to urbanize and prioritize infrastructure development, the demand for high-quality, durable construction materials like steel rebar is expected to soar. The combination of government initiatives, private investments, and technological advancements ensures a promising future for the industry.

For custom stainless steel solutions tailored to your project needs, visit Lux Metal. Explore how Lux Metal’s expertise in precision metal fabrication can support your construction endeavors.

References: