China’s Steel Industry: The Consequences of a “Great Leap” and Its Technological Crossroads

Three decades ago, China embarked on a transformative journey toward becoming the global leader in steel production. Today, that goal has been more than fulfilled. Yet, with achievement has come challenge—particularly a chronic overproduction problem that threatens the very core of the Chinese steel sector. Despite central planning, policy reform, and even technological advances, China’s steel industry faces one of its most difficult transitions yet.

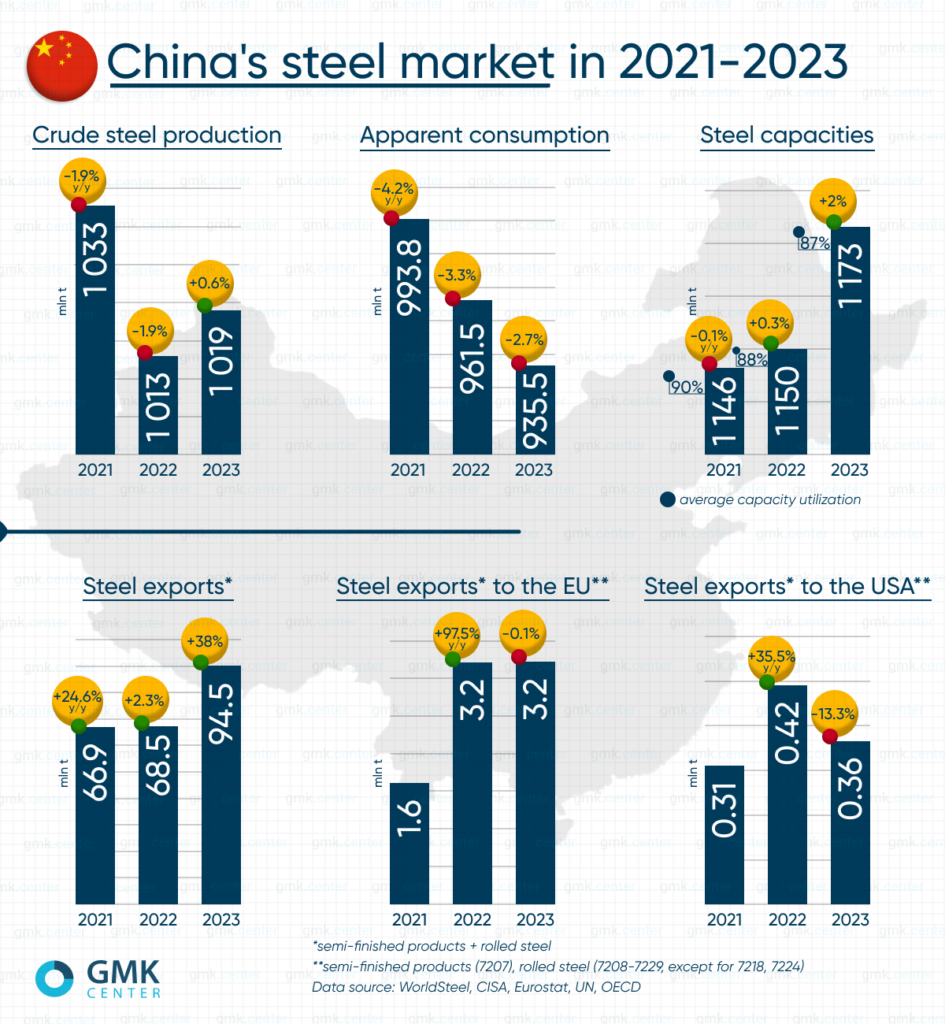

China’s Steel Industry (2021–2023): Growth in Capacity, Decline in Consumption

China remains the undisputed global leader in steel production. According to the Global Energy Monitor, as of 2023, the country operates approximately 500 steel mills, with a combined annual production capacity of around 1.17 billion tons. Yet behind this impressive figure lies a persistent and deepening issue—overcapacity—a challenge that has created structural imbalances in both domestic consumption and global steel markets.

Capacity Grows, Utilization Falls

Despite Beijing’s efforts to restructure and green its economy, China’s steelmakers continue to increase production capacity year after year:

- 2021: 1.146 billion tons

- 2022: 1.149 billion tons

- 2023: 1.173 billion tons

However, this expansion comes with declining capacity utilization:

- 2021: 90.1%

- 2022: 88.1%

- 2023: 86.9%

Such statistics point toward significant underuse, resulting in oversupply—steel that must either be stockpiled or exported.

Steel Production Peaked in 2020, Then Stabilized

China’s steel production peaked in 2020 at 1.065 billion tons, fueled by pandemic recovery and delayed demand. But government-imposed limits to reduce emissions triggered a slowdown. By 2023, production stabilized at 1.019 billion tons, only slightly up from 1.013 billion tons in 2022.

Domestic Consumption Continues to Slide

Over the last three years, apparent steel consumption has steadily declined:

- 2021: 993.8 million tons

- 2022: 961.5 million tons

- 2023: 935.5 million tons

This 5.9% drop—58.3 million tons—is primarily attributed to the prolonged crisis in China’s real estate sector. With construction demand falling, the gap between production and consumption has widened.

Exports Surge to Absorb Surplus

To mitigate the surplus, China turned to foreign markets:

- 2020: 53.7 million tons

- 2021: 66.9 million tons

- 2022: 68.5 million tons

- 2023: 94.5 million tons

That’s a 76% increase in exports over three years, with 2023 hitting the highest level since 2016. Competitive pricing, driven by weak domestic demand and low input costs, made Chinese steel attractive globally.

Most exports went to regions without strict trade barriers—Southeast Asia, the Middle East, South Asia, Central America—accounting for 80%+ of total volume.

Trade With the EU and US: Restrictive, Yet Growing

European Union

- 2021: 1.61 million tons

- 2022: 3.18 million tons

- 2023: 3.18 million tons

Despite quotas and anti-dumping duties, Chinese exports to the EU almost doubled in 2022. The surge was partially caused by the energy crisis in Europe, which made local steel less competitive.

United States

- 2021: 310,000 tons

- 2022: 420,000 tons

- 2023: 364,000 tons

U.S. trade barriers have been more effective. In fact, under President Biden’s direction, tariffs on Chinese steel and aluminum will rise to 25% in 2024 under Section 301 of the Trade Act.

Global Impact and Escalating Trade Tensions

The expansion of Chinese steel exports has broader implications. As Chinese products flood global markets, price pressure builds, affecting producers in Korea, ASEAN, Turkey, and Europe.

Andriy Tarasenko, Chief Analyst at GMK Center, comments:

“The crisis in China has once again resulted in a new wave of trade restrictions. As the Asian market becomes crowded, prices are falling, and products from Korea and ASEAN countries are putting pressure on other markets… Countries are reacting by closing their markets with protective quotas.”

Overcapacity: The Root of All Troubles

Between January and February 2025, China produced 166.3 million tons of steel, a year-on-year decrease of 1.5%. According to S&P Global, this trend is expected to continue, with annual production forecasted to dip by 1% to 996 million tons by year-end. Interestingly, this decline is not purely driven by the well-documented slump in real estate.

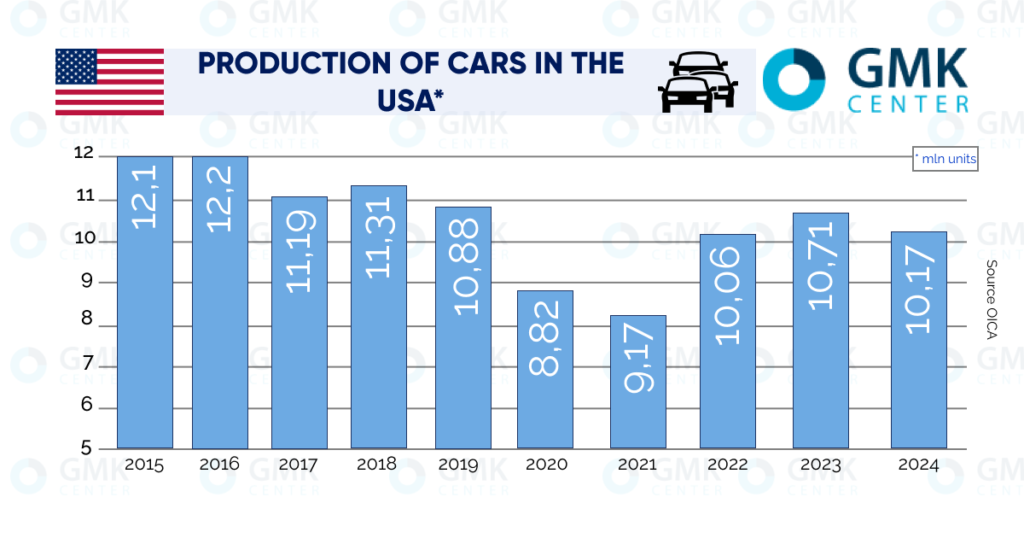

Analyst Xinyi Shen of the Center for Research on Energy and Clean Air (CREA) underscores that real estate accounts for only 20% of steel consumption in China. The bulk—some 50%—comes from industrial manufacturing, while infrastructure consumes 30%. Therefore, despite the continued growth in China’s automotive sector, it hasn’t been enough to offset declining output elsewhere.

In 2024, China’s auto sales rose 4.1% to 31.4 million units, and early 2025 figures show car production jumping by 39.6% year-on-year in February alone. However, steel production dropped 1.7% to 1.005 billion tons—showing that increased demand in one sector is insufficient to stabilize the entire industry.

A Misalignment Between Demand and Output

This disconnect points to the central issue: excess production capacity. The Chinese government recognizes the challenge. In March, the National Development and Reform Commission (NDRC) announced the closure of steel plants totaling 50 million tons of capacity by the end of 2025. By 2030, this figure is set to reach 200 million tons in phased reductions.

These cuts align closely with domestic consumption estimates. In 2024, China consumed just 863 million tons out of its total production of over 1 billion tons. That leaves more than 200 million tons in theoretical excess.

The Export Dilemma and Rising Trade Barriers

While China attempts to export the surplus, this strategy is losing viability. In 2024, Chinese steel exports rose by 25.1% to a record 117 million tons. However, these exports are increasingly facing resistance abroad. Between January 2024 and February 2025, 29 trade investigations into Chinese steel were launched, nearly double the number from 2020 to 2023.

Countries including Vietnam, South Korea, Colombia, the EU, and Malaysia imposed anti-dumping duties on 5 million tons of annual Chinese steel exports. Another 9.44 million tons are under investigation. As a result, 2025 exports are projected to shrink by 12% to 102.6 million tons, and the real figure could be worse if new cases arise.

In response, five government departments jointly issued regulations in March 2025 to tighten control over steel exports. These include mandatory tax registration checks during customs declarations and stricter penalties for fraudulent practices. The goal is to clean up the export market and restore international trust, which could reopen trade corridors for compliant producers.

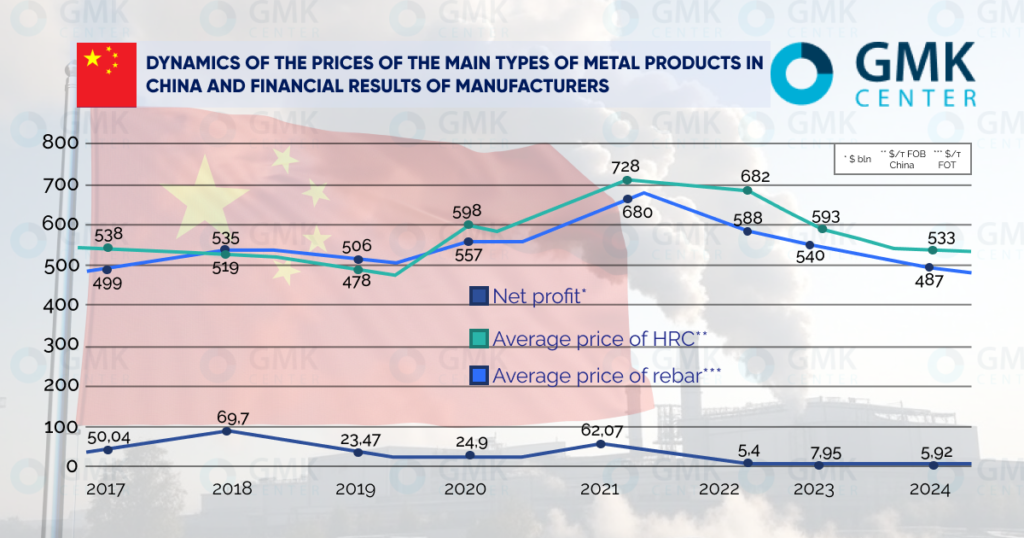

Financial Strains Behind the Scenes

Profitability in the steel sector has been volatile. According to the China Iron and Steel Association (CISA), net profit among its member companies plummeted by 50.3% in 2024 to just $5.92 billion. This aligns with falling steel prices—hot-rolled coil prices dropped from $555/ton in January to $481/ton in December, while rebar fell from $532/ton to $449/ton.

However, a striking turnaround appeared in early 2025. From January to February, net losses shrank nearly ninefold to just $213 million, even though steel prices barely changed. This abrupt improvement raises questions. Experts like Professor Usha Haley of Wichita University suggest that these figures reflect not market gains, but heavy state subsidies. In fact, subsidies account for up to 80% of the financial results reported by many mills.

But this strategy is running out of steam. New bond issues by provincial governments are increasingly used to cover past debts to steelmakers. This debt-financed support system is not sustainable long-term.

Forecast for 2025: More Storms Ahead

Investment in housing construction fell by 9.8% in the first two months of 2025, with new home sales declining by 5.1%. Infrastructure is also losing momentum, with road construction investment down 7.2%. This does not bode well for long steel products like rebar and structural steel.

On the bright side, passenger car sales are projected to grow 4.4% in 2025 to 32.66 million units, suggesting continued demand for flat-rolled products. But once again, excess capacity will likely dilute the benefits to the steel industry.

A Persistent Problem: 10 Years of Overcapacity

The issue of overcapacity is far from new. In 2016, MPI Director Li Xinchuan warned that overproduction would be hard to resolve. Nearly a decade later, little has changed. While China’s steel industry still has a margin of safety, it’s thinning every year.

Emerging Technologies: A New Hope for Chinese Steel?

Despite these structural problems, China is not standing still. As the world shifts toward decarbonization and Industry 4.0, Chinese steelmakers are investing in green and smart technologies.

- Hydrogen-Based Steelmaking: Baowu Steel is experimenting with hydrogen instead of coal to reduce carbon emissions.

- Digital Twins and AI: Major firms are implementing digital twin platforms and AI-driven quality control to increase operational efficiency.

- Smart Logistics: Integration with 5G networks and industrial IoT is streamlining supply chain visibility and reducing delivery delays.

- Circular Economy Models: Steel scrap recycling and closed-loop systems are being promoted to reduce raw material dependency.

These innovations may not resolve overcapacity immediately, but they could enhance competitiveness and environmental compliance—two areas increasingly crucial in global trade.

Conclusion: Can Steel Regain Its Shine?

China’s steel industry is now paying the price for its breakneck expansion. Oversupply, shrinking markets, and global protectionism have made old business models obsolete. While the government is trying to intervene through regulation and consolidation, deeper reforms may be needed—especially those focused on market mechanisms, green technologies, and global cooperation.

The “great leap” into steel dominance gave China global heft. But unless the industry can rebalance itself, the weight of that success may become too much to bear.

From 2021 to 2023, China’s steel industry deepened its structural imbalance—expanding production capacity amid falling domestic consumption. With a slowing real estate sector and limited room for exports, Beijing faces mounting pressure to resolve its long-standing overcapacity dilemma. The path forward will likely require tougher reforms, cleaner production policies, and a shift toward high-value downstream steel applications.

Looking for Quality Steel Solutions in Malaysia?

If you’re seeking precision metal fabrication or customized steel services in Southeast Asia, look no further than LUX METAL – Malaysia’s trusted name in custom steel solutions, stainless steel works, and advanced machining.

We specialize in:

- CNC laser cutting and bending

- Sheet rolling, V-cutting, and wire cut machining

- Stainless steel fabrication for construction, automotive, and industrial projects

📍 Visit us online or stop by our factory in Malaysia — we’re ready to support your steel and metalwork needs with unmatched quality and customer service.

🔗 Explore our full services here