The Impact of Trump’s Aluminum and Steel Tariffs: A Comprehensive Analysis

On February 10, President Donald Trump announced a bold decision to impose a 25% tariff on steel and aluminum imports from all U.S. trade partners, effective March 12. The move, which aims to curb China’s growing dominance in global trade and bolster domestic production, is set to have far-reaching consequences. While Trump justifies the tariffs as a necessary measure to protect national security and revive American industries, the economic ripple effects are expected to impact various sectors, consumers, and international trade relationships.

In this article, we delve into the potential effects of these tariffs on the United States and its trade partners, using data and historical precedents to paint a clearer picture of the economic implications.

Why the Tariffs Were Imposed

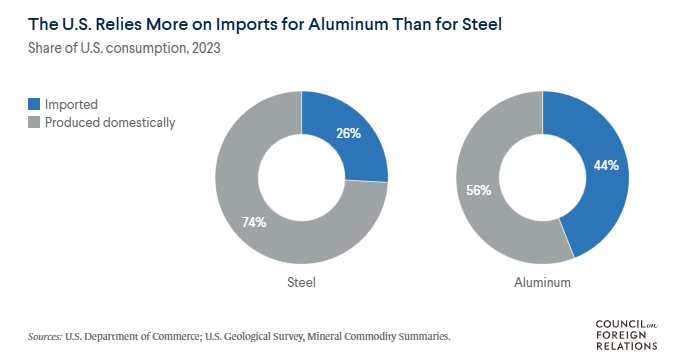

The tariffs were introduced under the premise of protecting American steel and aluminum industries from unfair competition, particularly from subsidized Chinese metals flooding global markets. The United States, according to Trump, has been overly reliant on foreign imports for its aluminum needs and, to a lesser extent, steel.

The U.S. imports about half of its aluminum, with Canada supplying two-thirds of these imports. For steel, domestic mills produce three-quarters of what Americans use, but specific steel products, such as pipes and rolled materials, are largely imported. These materials are critical for industries such as aerospace, automotive, construction, and energy. The new tariffs aim to incentivize domestic production, reduce reliance on imports, and strengthen national security by ensuring consistent supply chains for critical sectors.

The Economic Impact on U.S. Industries

1. Domestic Steel and Aluminum Production

The tariffs are expected to benefit U.S. steel and aluminum producers in the short term. Historically, such measures have boosted prices for these metals, creating favorable market conditions for domestic producers. For instance, after Trump imposed tariffs on steel and aluminum in 2018, prices for both metals rose by approximately 2%, and imports dropped by 25%. This led to job creation within the U.S. steel industry, which currently employs about 140,000 workers.

However, the long-term effects may be less positive. While the tariffs may temporarily shield domestic producers, they could also reduce competitiveness by insulating these industries from market forces that drive innovation and efficiency.

2. Downstream Industries

The tariffs will likely raise costs for industries that rely heavily on steel and aluminum. Key sectors include:

- Automotive Industry: A typical car requires about half a ton of steel. The 25% tariff could increase production costs by over $1,000 per vehicle, potentially leading to higher prices for consumers.

- Aerospace: Aluminum makes up 80% of an aircraft’s weight. Higher material costs could impact the competitiveness of U.S. aerospace manufacturers on the global market.

- Construction: Steel is a critical material for building infrastructure. Increased costs may slow down projects or inflate budgets, particularly for public infrastructure initiatives.

- Energy Sector: The U.S. imports about 40% of its steel pipes, which are essential for oil and gas drilling. Higher costs for these materials could directly affect production costs for American energy companies.

- Appliance Manufacturing: Companies like Caterpillar, which produces heavy machinery, previously reported $100 million in additional costs due to tariffs imposed in 2018. These costs are often passed on to consumers.

In 2018, research estimated that Trump’s tariffs led to the loss of 75,000 manufacturing jobs, primarily in industries reliant on steel and aluminum. If history repeats itself, the new tariffs could further strain these sectors, offsetting any gains in steel and aluminum production.

3. Consumer Prices

The higher production costs resulting from the tariffs will likely be passed on to consumers. Industries such as automotive, construction, and consumer goods are expected to see price increases. For instance, the Peterson Institute for International Economics estimated that Trump’s 2018 steel tariffs cost taxpayers more than $900,000 annually for every job saved or created in the steel industry. Similar outcomes can be expected this time, with higher costs for vehicles, appliances, and even everyday goods like canned beverages.

The U.S. Demand for Steel and Aluminum

Steel and aluminum are integral to the U.S. economy. According to the U.S. Geological Survey, the country consumes millions of metric tons of these materials annually. Steel is heavily used in the construction of buildings, bridges, and pipelines, while aluminum is key in automotive production, aerospace, packaging, and electrical systems.

Steel Consumption in the U.S.

The United States is a massive steel consumer, using an average of 100 million tons annually from 2012 to 2017, according to a U.S. Congressional research report. Steel is essential for key industries, including construction, automotive manufacturing, and energy infrastructure.

In recent years, the U.S. has relied heavily on domestic steel production to meet its demand. American steel mills have supplied between 70% to 90% of the country’s consumption over the past decade. However, the remaining portion—approximately 25%—is met through imports. This dependency on foreign steel leaves the U.S. vulnerable to changes in global markets and trade policies.

In 2023, U.S. steel production saw a modest increase of 1.1% compared to 2022, according to the American Iron and Steel Institute (AISI). Meanwhile, steel imports declined by 8.7%, with finished steel imports decreasing by 14.1%. This trend reflects the impact of tariffs and trade strategies aimed at promoting domestic steel production.

Aluminum Consumption in the U.S.

Aluminum consumption in the U.S. paints a different picture. The country is far more dependent on imports to meet its needs, with approximately 50% of aluminum used domestically sourced from other countries. Aluminum’s versatility, lightweight properties, and corrosion resistance make it a critical material for industries such as automotive, aerospace, and construction.

Unlike steel, the U.S. aluminum smelting industry is relatively small by global standards, contributing only 1.73% of total global smelter capacity. This limited production capacity necessitates heavy reliance on foreign suppliers, with Canada leading the way as the largest aluminum exporter to the U.S.

Where Does the U.S. Source Its Steel and Aluminum?

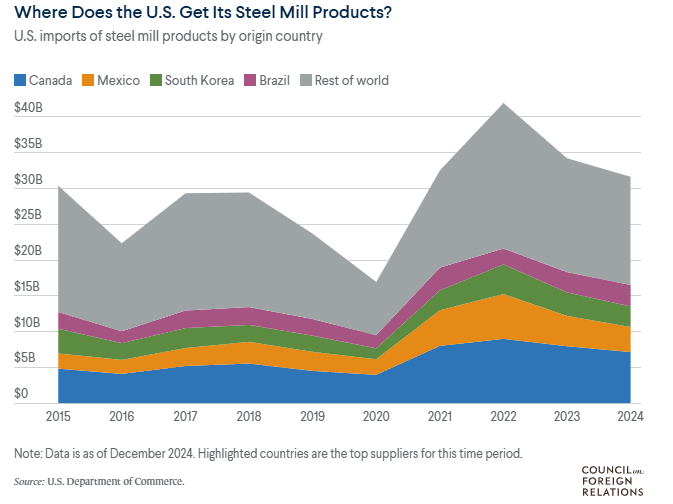

Top Suppliers of Steel to the U.S.

The U.S. imports steel from a diverse group of trade partners. The top three suppliers—Canada, Brazil, and Mexico—account for nearly 50% of total U.S. steel imports, according to the U.S. International Trade Administration. Other key suppliers include South Korea, Japan, Germany, and Vietnam.

- Canada: Canada is the largest supplier of steel to the U.S., leveraging its proximity and strong trade relationship to account for 16% of total imports.

- Brazil: Brazil provides around 11% of U.S. steel imports, focusing on semi-finished products that are further processed in American mills.

- Mexico: Mexico supplies approximately 13% of steel imports, benefiting from the United States-Mexico-Canada Agreement (USMCA) and geographic proximity.

- China: Despite being the world’s largest steel producer, China plays a minor role in U.S. steel imports due to high tariffs. In 2023, Chinese steel represented just 1.8% of total U.S. steel imports.

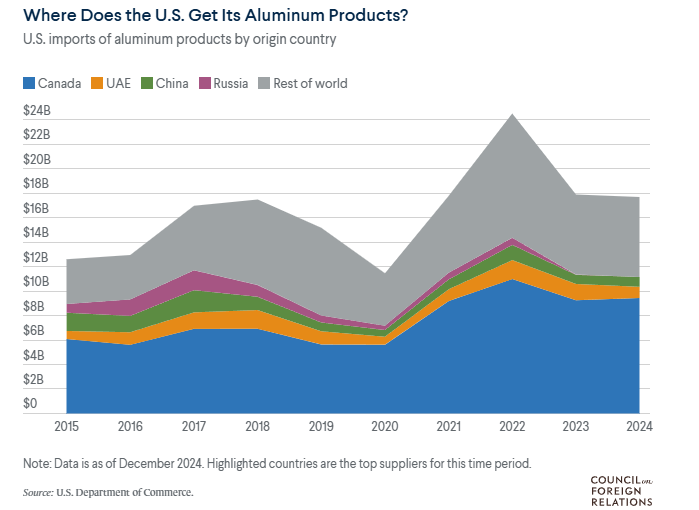

Top Suppliers of Aluminum to the U.S.

The U.S. is heavily reliant on aluminum imports, with Canada dominating the market.

- Canada: Canada supplies nearly 60% of all aluminum imported into the U.S., amounting to 3.2 million tons in 2023—more than double the total of the next nine countries combined.

- United Arab Emirates (UAE): The UAE is the second-largest aluminum supplier, providing 347,034 metric tons annually.

- China: China remains an important supplier of aluminum, sending 222,872 metric tons to the U.S. in 2023 despite trade restrictions.

- South Korea and Bahrain: These countries also play notable roles in supplying aluminum to the U.S. market.

Industries Dependent on Steel and Aluminum

Steel and aluminum are foundational materials for multiple U.S. industries, which use these resources extensively in their operations.

- Automotive Industry:

- Steel is used in body frames, chassis, and engine components.

- Aluminum is increasingly utilized for lightweight parts to improve fuel efficiency and reduce emissions.

- Construction and Infrastructure:

- Steel is critical for constructing buildings, bridges, and pipelines, offering strength and durability.

- Aluminum is used for roofing, siding, and other architectural applications.

- Aerospace:

- Aluminum is a key material in aircraft production due to its lightweight properties, while steel is used in landing gear and other structural components.

- Appliance Manufacturing:

- Household appliances such as refrigerators and washing machines rely on steel and aluminum for their construction.

- Energy Sector:

- Steel is used in pipelines, wind turbines, and other energy infrastructure, while aluminum is sometimes used in electrical transmission lines.

The Impact of Trade Policies on Steel and Aluminum Imports

Trade policies have a significant impact on U.S. steel and aluminum imports. In 2018, the Trump administration imposed tariffs of 25% on steel and 10% on aluminum under Section 232 of the Trade Expansion Act. These tariffs aimed to protect domestic industries by discouraging imports and boosting local production.

Effect on Steel Imports

The tariffs effectively shut out most Chinese steel from the U.S. market, which previously accounted for a small portion of imports. However, close allies like Canada, Mexico, and Brazil were exempted or given allowances, ensuring that the majority of U.S. steel imports remained unaffected.

Effect on Aluminum Imports

Similarly, aluminum tariffs targeted imports from countries like China and Russia. Canada, as the largest supplier, was largely exempt from these restrictions. Despite the tariffs, the U.S. remains heavily reliant on Canadian aluminum to meet its needs.

Impact on U.S. Trade Partners

Canada

As the United States’ largest supplier of both steel and aluminum, Canada will be hit the hardest by these tariffs. Nearly 60% of U.S. aluminum imports and a significant portion of its steel imports come from Canada. Given that most of Canada’s steel exports are destined for the United States, the tariffs could have a substantial economic impact.

Canada’s aluminum and steel exports to the U.S. account for 0.8% of its GDP, making it heavily reliant on access to the American market. The Canadian government is likely to seek exemptions or negotiate quotas to minimize economic fallout, as it did during Trump’s first term.

Brazil and South Korea

Brazil and South Korea, major steel suppliers to the U.S., also stand to lose. Brazil sends nearly half of its steel exports to the United States, while South Korea has historically been one of America’s top steel suppliers. Though these countries have diversified their markets since 2018, the U.S. remains a crucial trading partner.

During Trump’s first term, both countries negotiated quotas to avoid full tariffs. A similar strategy may be pursued this time. However, if negotiations fail, retaliatory measures could strain trade relationships further.

China

Ironically, the tariffs will have minimal impact on China, the world’s largest steel and aluminum producer. Due to existing tariffs and trade restrictions, China exports only a small fraction of its metals to the U.S. In 2023, for example, Chinese steel accounted for just 1.8% of total U.S. steel imports.

China’s dominance in global markets remains unchallenged, but its limited trade with the U.S. shields it from the direct impact of Trump’s tariffs. Instead, Beijing may continue focusing on other markets and leveraging its cost advantage to maintain global competitiveness.

International Retaliation and Negotiations

Countries affected by the tariffs may retaliate with countertariffs, as they did in 2018. During Trump’s first term, Canada, Mexico, and the European Union targeted billions of dollars’ worth of U.S. goods, including bourbon whiskey, jeans, motorcycles, and agricultural products.

While some of these countertariffs were eventually lifted, others remain in place. The European Union, for instance, has already threatened to resume and double its original duties if no exemptions are granted. Brazil has also vowed to retaliate, while the United Kingdom has signaled its preference for negotiating exemptions first.

On the other hand, Canada and Mexico may use the tariffs as leverage to fast-track a review of the United States-Mexico-Canada Agreement (USMCA), originally scheduled for 2026. Similarly, countries like Japan and Australia, which previously secured exemptions, are likely to push for similar deals under the new tariffs.

Why the U.S. Relies on Imports

Despite having domestic production capabilities, the U.S. relies on imports due to several factors:

- Cost Efficiency: Imported steel and aluminum are often more cost-effective than domestically produced materials, even after factoring in tariffs.

- Specialty Products: Many imported materials, especially from countries like Japan and Germany, cater to niche industries requiring specialty steel and aluminum products.

- Capacity Constraints: U.S. production capacity is insufficient to meet the massive domestic demand for these materials.

- Trade Agreements: Free trade agreements with neighboring countries like Canada and Mexico make imports easier and more economical.

Environmental Considerations

Recycling plays a significant role in meeting the U.S. demand for steel and aluminum. Over 70% of steel and 50% of aluminum consumed in the U.S. is derived from recycled materials. Recycling not only reduces dependence on imports but also minimizes environmental impact.

However, the recycling industry alone cannot satisfy the growing demand, necessitating continued imports to fill the gap.

How Tariffs Aim to Strengthen Domestic Industries

The rationale behind the tariffs is to revitalize the American steel and aluminum industries. By making imported materials more expensive, the tariffs encourage domestic production and create jobs.

- Reducing Import Dependency:

Tariffs aim to lessen the U.S.’s reliance on foreign steel and aluminum, reducing vulnerability to global supply chain disruptions. - Boosting Domestic Production:

Higher tariffs make U.S. steel and aluminum more competitive, incentivizing investment in domestic mills and smelters. - Protecting National Security:

Ensuring a stable domestic supply of steel and aluminum is vital for national defense and critical infrastructure projects.

However, the tariffs have also sparked concerns about increased costs for industries that rely on these materials, potentially leading to higher consumer prices.

Looking Ahead: Diversification and Domestic Production

As global trade dynamics evolve, the U.S. is likely to further diversify its sources of steel and aluminum. Geopolitical tensions, tariffs, and supply chain disruptions have prompted policymakers to explore domestic production expansion and partnerships with new trading partners.

For example:

- India is emerging as a potential supplier of specialty steel and aluminum products.

- Investments in modernizing U.S. steel mills and aluminum smelters are also underway to reduce reliance on imports.

These strategies aim to enhance the resilience of U.S. supply chains while meeting sustainability goals.

What Lies Ahead?

The long-term success of Trump’s tariffs will depend on whether they achieve their intended goals of boosting domestic production and reducing reliance on imports. However, the immediate impact is clear: higher costs for downstream industries, potential job losses, and strained trade relationships.

Negotiations will play a crucial role in determining how the tariffs affect international trade dynamics. Countries that secure exemptions or quotas may escape the worst of the economic fallout, while those left out could retaliate, further escalating trade tensions.

Ultimately, the tariffs underscore the complex interplay between domestic economic policy and global trade. While they may provide short-term benefits for American steel and aluminum producers, the broader economic consequences—including higher prices for consumers, job losses in downstream industries, and potential trade wars—highlight the risks of protectionist policies in an interconnected global economy.

For industries reliant on steel and aluminum, including construction, automotive, and aerospace, the path forward will require careful navigation of these challenges. Meanwhile, trade partners will continue to push for exemptions, negotiate quotas, and explore alternative markets to mitigate the impact of these sweeping tariffs.

As the March 12 implementation date approaches, all eyes will be on the United States and its trading partners to see how this latest chapter in global trade unfolds.

Lux Metal: Your Trusted Partner for Steel and Aluminum Solutions

At Lux Metal, we understand the growing demand for high-quality steel and aluminum across industries. As a leading manufacturer in Malaysia, we specialize in providing customized metal solutions that cater to diverse needs.

- Comprehensive Metal Fabrication: Our services include precision laser cutting, sheet bending, welding, and more.

- Advanced Machinery: We utilize state-of-the-art equipment to ensure the highest level of accuracy and quality.

- Sustainable Practices: Our commitment to sustainability ensures that we deliver environmentally friendly solutions without compromising on performance.

Whether you need steel for construction projects or aluminum for lightweight applications, Lux Metal has the expertise and resources to deliver top-notch products tailored to your specifications.

Explore our full range of services at Lux Metal and discover how we can support your projects with precision and reliability.